It is no secret that the electric vehicle (EV) industry has been booming in recent years. With climate change and sustainability becoming more of a focus, sales of EVs have soared. In 2020, global EV sales rose by 43%¹ to 3.2 million, despite the fact that overall car sales declined by 16% due to the coronavirus pandemic.

For investors, there could be a long-term opportunity here. Realistically, the electric vehicle industry is still in its infancy. According to the International Energy Agency (IEA), by 2030, there could be up to 230 million² electric vehicles on our roads, up from around 10 million at the end of last year. Meanwhile, according to Allied Market Research, the global EV market is set to be worth around $800 billion by 2027, up from $160 billion in 2019³. This industry growth is likely to generate many lucrative investment opportunities in the years ahead.

Choosing the best electric vehicle stocks to buy for the long term is not an easy process, however. In this industry, competition levels are intense. Out of the world’s top 20 vehicle manufacturers — which together accounted for around 90% of new car registrations in 2020 — 18 have recently announced plans to rapidly scale up production of electric vehicles⁴. In other words, right now, the entire auto industry is undergoing a shift toward electric vehicles. So, gaining broad exposure to the industry through a thematic product could be a sensible approach to investing.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Tesla is leading the electric vehicle race

Today, Tesla is the clear leader in the electric vehicle space. Last year, it delivered 499,950 EVs in total, a 36% increase on the number of vehicles it delivered in 2019 and far more than any of its rivals.

Tesla — which is led by visionary Elon Musk — has a number of things going for it. Firstly, it has a first-mover advantage. A pioneer in the EV space, it was one of the first companies to produce electric vehicles at scale. As a result, it currently has a large market share.

Secondly, its battery technology is best-in-class. Last year, analysts at UBS compared batteries from seven major EV manufacturers and Tesla came out on top by most measures⁵.

Thirdly, Tesla has a dominant position in China, which is the world’s largest EV market. In 2020, Tesla delivered around 150,000 cars⁶ in China (representing about 20% of its total sales⁷) and its ‘Model 3’ was the best-selling EV in the country⁸. With electric vehicle sales in China set to reach six million units by 2025⁹, Tesla looks well placed for long-term growth.

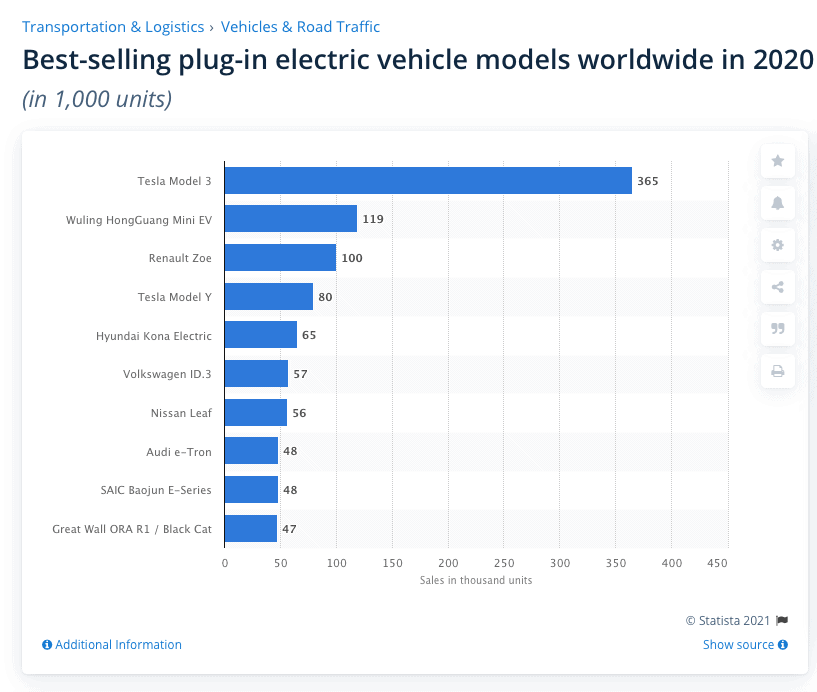

The best-selling electric vehicles globally in 2020

Source:https://www.statista.com/statistics/960121/sales-of-all-electric-vehicles-worldwide-by-model/

Competition is heating up

However, a number of major auto manufacturers are now taking on Tesla.

One such company is Volkswagen, which is taking the electric vehicle race very seriously. Recently, the German company told investors that by 2030, it expects 70% of its cars sold in Europe to be fully electric. To achieve this, it is planning to open six ‘gigafactories’ in Europe by the end of the decade. These will help it ramp up battery production. It also advised that it is targeting an EV market share of over 50% in China and the US by the end of the decade.

Last year, Volkswagen delivered 231,600 EVs (and 9.3 million cars in total). So, it is still currently miles behind Tesla. However, the company appears to be closing the gap rapidly. “We are stepping up the pace. In the coming years, we will change Volkswagen as never before,” said Volkswagen CEO Ralf Brandstätter at the company’s strategy update in March 2021.

Other traditional auto manufacturers in Europe are also ramping up their EV production. Volvo, for example, has said that it is committed to becoming a leader in the ‘premium’ electric car market and plans to become a fully electric car company by 2030. Volvo launched its first fully electric car, the ‘XC40 Recharge’ last year. In the years ahead, it plans to roll out several additional electric models.

Meanwhile, Daimler — which owns Mercedes-Benz — recently unveiled the electric version of its flagship Mercedes-Benz ‘S-Class’ luxury sedan, the ‘EQS’. The EQS is the first in a family of Mercedes-Benz cars built on a dedicated EV platform from the ground up. It will go on sale in August this year in Europe and the US, and in early 2022 in China. Analysts at Deutsche Bank have called the EQS — which has a range of 770 kilometres and a display screen that covers almost the entire dashboard — “Mercedes’ Tesla fighter” and said that the car “will likely set the benchmark in terms of technical features, as well as design and quality” in the industry.

Porsche — which is owned by Volkswagen AG — is another European company worth a mention here. It recently launched its ‘Taycan’ electric sedan and this model is proving to be very popular. Indeed, in the first quarter of 2021, Porsche delivered 9,072 Taycan vehicles, just 61 less than the number of ‘911s’ it delivered.

US manufacturers are getting serious about sustainability

In the US, it’s a similar story with traditional auto manufacturers racing to ramp up their EV production in order to capture market share.

General Motors (GM), for example, recently announced that between now and 2025, it will spend nearly $30 billion on electric (and autonomous) car development, while launching 30 electric car models globally. GM is moving directly to battery electric vehicles (BEVs), bypassing hybrid vehicles completely. By 2035, the company — which recently revamped its logo to reflect the drive towards an all-electric future¹⁰ — will only sell EVs¹¹. “We want to lead in this space. We don’t just want to participate, we want to lead,” said Doug Parks, GM Executive Vice President of Global Product Development in late 2020.

Ford, meanwhile, announced in February that every car it sells in Europe will be “zero-emission capable” (i.e., at least plug-in hybrid) by 2026 and pure electric by 2030. Ford recently launched its ‘Mustang Mach-E,’ and this has proven to be popular so far. In the first quarter of 2021, it was the fourth best-selling EV in the US, stealing market share from Tesla¹².

Tesla has competition in China

In China, the competition is also intense. The largest player here in the EV space is SAIC Motor, which has partnerships with Volkswagen and General Motors. Its budget electric vehicle, the ‘Hong Guang Mini EV,’ is outselling Tesla’s more upmarket cars in the country. In January, sales of this model — which has been marketed as ‘the people’s communing tool’ — were around double Tesla’s sales in China¹³. SAIC has advised that it plans to have nearly 100 ‘new energy’ models with its partners by 2025. New energy vehicles include battery electric vehicles as well as plug-in hybrid and hydrogen fuel cell vehicles.

Then, of course, there’s NIO, which is sometimes called the ‘Tesla of China.’ NIO — which describes itself as ‘the next generation car company’ — develops premium smart electric cars that feature advanced technologies such as artificial intelligence. Like Tesla, it is seen as a trendy brand. In 2020, NIO delivered a total of 43,728 EVs, an increase of 113% year-on-year. Analysts at Mizuho expect the company to roughly double that this year¹⁴, despite the global semiconductor shortage.

Other EV players in China include XPeng, Li Auto, and Warren Buffett-backed BYD Company.

Electric vehicle start-ups

Finally, it is worth mentioning that a number of smaller, niche players are shortly about to enter the market.

One example is Fisker. Its flagship model, the ‘Ocean,’ was designed by Danish automotive designer Henrik Fisker, who also designed Aston Martin’s ‘DB9.’ Fisker plans to start production next year.

Another example is Lucid Motors. It describes its flagship model, the ‘Lucid Air,’ as ‘the quickest, longest-range, fastest-charging luxury electric car in the world.’ This model is expected to be available in 2022.

Rivian is also worth mentioning here. It is developing a range of slick all-electric adventure vehicles. The company has said that Its R1T model is set to be delivered to customers in the US in June 2021.

All of these companies are looking to take on Tesla with their premium electric vehicles.

A better way to invest in electric vehicle stocks

Given the high level of competition in the EV space, those interested in investing in electric vehicle stocks may want to take a diversified approach. Instead of backing just one or two companies, consider spreading capital over a range of EV stocks. This approach will help minimise stock-specific risk and potentially improve your chances of capitalising on the growth of the industry.

One of the easiest and most cost-effective ways to get broad exposure to the EV industry is to invest in eToro’s car-focused Smart Portfolios. One portfolio to consider is the Driverless strategy, which offers access to many major players in the EV space, including Tesla, Volkswagen, General Motors, BMW, Volvo, and NIO, despite the fact it is designed to provide exposure to companies operating in the autonomous vehicle space.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Another option is the ChinaCar portfolio, which provides exposure to Chinese automotive manufacturers. Holdings in this portfolio include NIO, BYD, and XPeng.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

A third option to consider is eToro’s ‘Auto Industry’ Smart Portfolio. This portfolio, which is still in development, but set to be launched in the near future, will include a number of EV manufacturers, since this is the future of the industry.

Through these Smart Portfolios, investors can position their portfolios to capitalise on the long-term growth of the electric vehicle industry, while minimising stock-specific risk.

Source list:

- https://www.theguardian.com/environment/2021/jan/19/global-sales-of-electric-cars-accelerate-fast-in-2020-despite-covid-pandemic

- https://www.iea.org/reports/global-ev-outlook-2021

- https://www.alliedmarketresearch.com/electric-vehicle-market

- https://www.just-auto.com/news/global-electric-car-sales-up-41-in-2020-iea_id201603.aspx

- https://www.businessinsider.com/teslas-batteries-best-cheapest-industry-ahead-competition-ubs-teardown-2020-10?r=US&IR=T

- https://fortune.com/2021/01/28/tesla-2020-profit-china-sales/

- https://www.cnbc.com/2021/02/09/teslas-china-sales-more-than-doubled-in-2020.html

- https://www.cnbc.com/2021/04/22/chinese-electric-car-makers-target-europe-as-competition-heats-up.html

- https://www.spglobal.com/platts/en/market-insights/latest-news/metals/121720-chinas-ev-sales-to-reach-more-than-13-mil-units-in-2020-caam

- https://www.dezeen.com/2021/01/11/general-motors-logo-redesign-2021/

- https://www.nytimes.com/2021/01/28/business/gm-zero-emission-vehicles.html

- https://fordauthority.com/2021/04/ford-mustang-mach-e-was-the-fourth-best-selling-ev-in-the-u-s-in-q1/

- https://www.bbc.co.uk/news/business-56178802

- https://finance.yahoo.com/news/nio-despite-chip-shortage-deliveries-163737076.html