- Who sees the biggest Santa rally? Analysis of 14 major stock markets reveals Hong Kong and UK are best for outsized Christmas gains

- December performance beats average across other months by 1.06 percentage points, equating to 23% of yearly gains

- Hong Kong’s Hang Seng has historically seen the biggest Santa rally, rising 3.1% on average

- UK’s FTSE 100 sees huge outperformance vs rest of year, with December exceeding average monthly performance by 1.93 percentage points

2 December 2024 – Investors in the world’s major stock markets enjoy almost a quarter of their annual returns in December, with the UK and Hong Kong the best places to enjoy outsized Christmas gains, according to analysis from trading and investing platform eToro.

The so-called ‘Santa rally’ – the tendency for markets to outperform in December – is well-known amongst seasoned investors, however the data from eToro emphasises just how pronounced the trend is and therefore how important it is to stay invested through the holiday season.

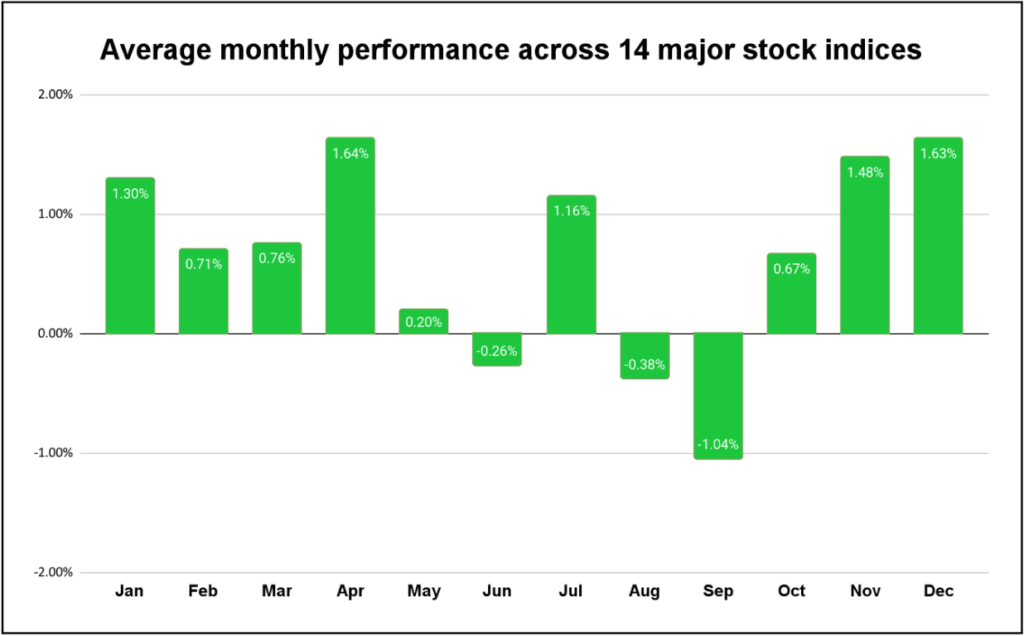

eToro looked at the monthly price returns for 14 of the world’s largest stock indices, from the USA’s S&P 500 to Germany’s DAX 40, going back an average of 50 years. The analysis shows that returns in December average 1.63%, comfortably exceeding the average monthly return from January to November by 1.06%. Thanks to the Santa rally, December has typically accounted for 23% of the total gains these stock markets see across the year.

Chart shows average monthly performance across 14 major global stock indices in eToro’s study

Commenting on the data, eToro Analyst Sam North said: “While past performance is never a guarantee of future returns, December has historically been a standout month for global stock markets, with the so-called Santa rally consistently delivering the goods.

“Our analysis reveals that December accounts for nearly a quarter of annual returns on average, a statistic that underscores the importance of staying invested. While the reasons behind this seasonal boost can vary – from optimism around the new year to increased trading activity – it’s clear that missing out on this period could be costly for retail investors.”

According to the data, based purely on the size of returns, the best hunting ground for Santa rally investors in past years has been Hong Kong’s Hang Seng Index, which since 1965 (when records begin) has risen by an average of 3.1% in December. This is 2.15 percentage points more than the average monthly return for this index across the rest of the year and accounts for 23% of the stock market’s average annual performance.

Another festive season titan is the UK’s FTSE 100. Since its formation in 1984, December has outperformed other months by 1.93 percentage points, returning an average 2.29% and accounting for 36% of its yearly performance. Japan’s premier index, the Nikkei 225, is not far behind, with December delivering outsized gains of 1.98%, outperforming monthly returns from January to November by 1.59 percentage points, whilst accounting for 32% of annual performance.

Across all 14 indices eToro analysed, the only Christmas Grinch spoiling the party is Spain’s IBEX 35, with December underperforming the average returns from January to November by 0.14 percentage points. Meanwhile the December performance of Australia’s ASX 200 (+1.36%) proves that the Santa rally is just as prominent in the Southern Hemisphere’s sunny climes.

Sam North adds: “What’s clear from the data is that the Santa rally is far more generous in some parts of the world, with Hong Kong and the UK having seen phenomenal December performance over recent decades, whilst Spain’s IBEX 35 appears to be on the naughty list. These regional quirks are a reminder that there isn’t a one-size-fits-all approach to global markets and savvy investors should keep an eye on local dynamics to make the most of the season.”

Table shows December performance of stock markets included in eToro analysis

| Stock Index | Average December performance | Average December outperformance vs rest of year (percentage points) | December performance as % of yearly return |

| Hang Seng (Hong Kong) | 3.09% | 2.15% | 23% |

| FTSE 100 (UK) | 2.29% | 1.93% | 36% |

| Nikkei 225 (Japan) | 1.98% | 1.59% | 32% |

| TSX (Canada) | 1.84% | 1.34% | 25% |

| ASX 200 (Australia) | 1.78% | 1.36% | 29% |

| KOSPI (Korea) | 1.75% | 0.98% | 17% |

| STOXX 600 (Europe) | 1.71% | 1.32% | 29% |

| Nasdaq (US) | 1.53% | 0.48% | 12% |

| SIX (Switzerland) | 1.42% | 0.92% | 20% |

| DAX 40 (Germany) | 1.32% | 0.71% | 17% |

| S&P 500 (US) | 1.28% | 0.63% | 16% |

| FTSE MIB (Italy) | 1.26% | 1.05% | 39% |

| CAC 40 (France) | 1.19% | 0.58% | 15% |

| IBEX 35 (Spain) | 0.42% | -0.14% | 7% |

*Past performance is not an indication of future results.

ENDS

Notes to editors

About this data

Calculated using Refinitv price data as far back as available until the end of October 2024 for 14 of the world’s largest stock indices: S&P 500 (data since 1964), NASDAQ (1980), Stoxx 600 (1987), TSX (1950), FTSE 100 (1984), DAX (1965), CAC 40 (1970), SMI (1998), FTSE MIB (1998), IBEX (1970), Hang Seng (1965), Nikkei 225 (1970), KOSPI (1975), ASX (1992). Average is a simple weight of all 15.

Media contacts

pr@etoro.com

About eToro

eToro is the trading and investing platform that empowers you to invest, share and learn. We were founded in 2007 with the vision of a world where everyone can trade and invest in a simple and transparent way. Today we have over 38 million registered users from 75 countries. We believe there is power in shared knowledge and that we can become more successful by investing together. So we’ve created a collaborative investment community designed to provide you with the tools you need to grow your knowledge and wealth. On eToro, you can hold a range of traditional and innovative assets and choose how you invest: trade directly, invest in a portfolio, or copy other investors. You can visit our media centre here for our latest news.

Disclaimers:

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

eToro is authorised and regulated by the Financial Conduct Authority in the UK, in Cyprus by the Cyprus Securities and Exchange Commission, by the Australian Securities and Investments Commission in Australia and licensed by the Financial Services Authority in the Seychelles.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

Regulation and License numbers

UK

eToro (UK) Ltd, is authorised and regulated by the Financial Conduct Authority (“FCA”). Firm Reference Number: 583263. Registered in England under Company No. 07973792

Europe

eToro (Europe) Ltd, is authorised and regulated by the Cyprus Securities Exchange Commission (CySEC) under licence number 109/10. Registered in Cyprus under Company No. HE 200585.

Australia

eToro AUS Capital Limited(“eToro Australia”) is regulated by the Australian Securities & Investments Commission (“ASIC”) for the provision of financial services and products. Australian Financial Services Licence number: 491139.

Seychelles

eToro (Seychelles) Ltd. is licenced by the Financial Services Authority Seychelles (“FSAS”) to provide broker-dealer services under the Securities Act 2007 License number: SD076