- 67% of retail investors feel positive or ambivalent about the year-long bear market

- Many are loading up on defensive assets, like healthcare and utilities, whilst cash allocation jumped 50%

- Confidence rebounded in the last quarter as perceived threat of inflation falls

Wednesday 18th January – The majority of retail investors are shrugging off the downturn that has gripped financial markets for more than a year, according to the latest ‘Retail Investor Beat’ from social investing network, eToro.

When asked what impact the bear market has had on their mindset, two thirds (67%) are either positive or ambivalent, while the remainder (33%) say their investing appetite has been dented to some extent.

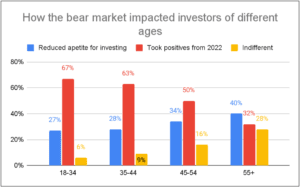

2022 will have been the first major bear market for many less experienced retail investors, yet the data shows that it is older investors with shorter retirement time horizons who are feeling the strain the most.

Three in four (76%) 18-34-year-olds feel positive or indifferent about the downturn, whilst this drops to 60% amongst over-55s (see chart). Across all age groups, the younger the investor, the more upbeat they are about the 2022 bear market – challenging the perception that younger investors are more short-term driven.

Commenting on the trend, Ben Laidler, Global Markets Strategist at eToro, said: “The fact that two thirds of retail investors feel indifferent, or even more positive, after the worst year for markets in a generation might seem odd. But the majority of this cohort think in years and decades. For those with longer time horizons, the back end of 2022 has offered a chance to buy companies at lower valuations, improving the outlook for long term returns.”

There has also been an uplift in sentiment, with 69% feeling confident about their portfolios. Whilst still a relatively low figure compared to past Retail Investor Beats, it is a five percentage point quarter-on-quarter increase, while confidence in other areas of life such as income and job security also improved.

One explanation for this is that the perceived threat of inflation – considered the biggest investment risk in six of the last seven quarterly surveys – is gradually falling. At the end of Q3, 24% saw inflation as the single biggest threat to their portfolio over a three-month period, with this dropping to 22% at the end of Q4. When asked about the biggest risk across the whole of 2023, those citing inflation dropped to 19%, with more (22%) seeing a global recession as the main threat.

In preparation for this recession risk, many are adjusting their portfolios defensively whilst also preparing for future opportunities. The proportion holding cash assets (e.g. savings account) jumped from 46% in Q3 to 69% at the end of Q4 – a 50% increase. Meanwhile two traditional defensive sectors – healthcare and utilities – both saw a 4 percentage point rise in those invested in them, while other defensive plays in the current climate – staple consumer goods and energy – saw a 3 percentage point rise.

“Investors endured a torrid 2022 but sentiment has turned upwards with many feeling more reassured by the inflation signals they’re receiving”, adds Laidler.

“However they will also be well aware that most experts are predicting at least a mild global recession, and many are repositioning accordingly, with more looking into defensive stocks. There was also a significant dash for cash in the final quarter as banks around the world continued to pass on better rates to savers, albeit slowly, and investors kept some powder dry for market opportunities ahead.”

You can read the full Retail Investor Beat report here.

ENDS

Notes to editors

About this report

The Q4 Retail Investor Beat was based on a survey of 10,000 retail investors across 13 countries and 3 continents. The following countries had 1,000 respondents: UK, US, Germany, France, Australia, Italy and Spain. The following countries had 500 respondents: Netherlands, Denmark, Norway, Poland, Romania, and the Czech Republic.

The survey was conducted from 14th – 24th December 2022 and carried out by research company Appinio. Prior to Q2, previous waves of this survey were conducted quarterly in conjunction with Opinium.

Retail investors were defined as self-directed or advised and had to hold at least one investment product including shares, bonds, funds, investment ISAs or equivalent. They did not need to be eToro users.

Media contacts

About eToro

eToro is a social investment network that empowers people to grow their knowledge and wealth as part of a global community of investors. eToro was founded in 2007 with the vision of opening up the global markets so that everyone can trade and invest in a simple and transparent way. Today, eToro is a global community of more than 30 million registered users who share their investment strategies; and anyone can follow the approaches of those who have been the most successful. Due to the simplicity of the platform users can easily buy, hold and sell assets, monitor their portfolio in real time, and transact whenever they want.

UK / EU DISCLAIMER

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

eToro is regulated in Europe by the Cyprus Securities and Exchange Commission, authorised and regulated by the Financial Conduct Authority in the UK and by the Australian Securities and Investments Commission in Australia.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

AUS DISCLAIMER

eToro AUS Capital Limited is authorised by the Australian Securities and Investments Commission (ASIC) to provide financial services under Australian Financial Services Licence 491139. Stocks are offered via eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS. Zero commission does not apply to short or leveraged positions. Zero commission means that no broker fee has been charged when opening or closing the position. Limited stock exchanges only.

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

US DISCLAIMER

Securities trading is offered by eToro USA Securities Inc., member of FINRA and SIPC, a self-directed broker-dealer that does not provide recommendations or investment advice. Content, research, tools, and stock symbols on eToro’s website are for educational purposes only and do not imply a recommendation or solicitation to engage in any specific investment strategy. All investments involve risk, losses may exceed the amount of principal invested, and past performance does not guarantee future results. Cryptotrading is offered by eToro USA LLC. Cryptocurrency holdings are not FDIC or SIPC insured. Visit our Disclosure Library for additional important disclosures. FINRA Brokercheck © 2022.