- One in five (22%) see recession as main investment risk, while 13% cite inflation as top concern

- Retail investor confidence grows, 78% feel upbeat about markets versus 71% in June

- One in three (33%) plan to increase investment contributions in Q4, whilst 7% will scale back

Wednesday 27 September 2023 – The prospect of a recession has jumped above inflation as the chief concern for retail investors around the world, according to data from the latest Retail Investor Beat (RIB) from trading and investment platform eToro.

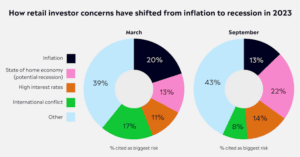

In the study of 10,000 retail investors across 13 countries, more than a fifth (22%) said they regard the state of the economy and a potential recession as the biggest risk to their investments, whilst 13% see inflation as the top risk. This is a significant reversal from six months ago, when inflation was the number one worry (20%), with recession fears lower down the list (13%).

The RIB data also shows that, while a potential recession is now the biggest perceived threat to investment portfolios, it is not weighing down on investor sentiment in the way that out-of-control inflation did six months ago. When retail investors were asked how confident they feel across different aspects of life during the last three months, every single confidence metric rose. Those confident about their investment portfolio jumped from 71% in June to 78% today, whilst those upbeat about income and living standards rose from 65% to 70% over the same period.

Whilst confidence in investments uniformly rose across every country, Dutch retail investors are the most optimistic (91%) whilst the Spanish score lowest on this metric (71%).

Commenting on the data, eToro Global Markets Strategist Ben Laidler, said: “Retail investors are no longer laser-focused on inflation and are clearly feeling optimistic about central banks’ ability to tame price rises without many more interest rate hikes. Whilst concerns have now shifted towards the recession that these interest rate hikes might cause, this is not weighing down sentiment to the same degree that inflation was.

“In fact retail investors are feeling a lot rosier about their investments than they were three months ago, they are generally quite bullish about the remainder of 2023, and the consensus amongst this group is still for a sustained bull market in the first half of next year. This would extend the 23% global stocks rally we have already seen since the October 2022 low.”

The jump in confidence related to investments is resulting in a more bullish approach when it comes to the size of investment contributions. According to the data, a third (33%) plan to increase the size of their regular contributions in the next three months, with this group outnumbering those who plan to scale back investment contributions (7%) by more than four to one.

The industry most likely to benefit from this upturn in sentiment is technology, with investors more likely to up investment in this sector over any other sector during Q4. Financial services – an industry that historically performs well with high interest rates – was the second favourite amongst respondents for the remainder of 2023, followed by the real estate and energy sectors. The sectors least attractive to retail investors in Q4 are discretionary consumer goods and industrials.

Laidler adds: “Tech has come back with a vengeance in 2023 and is once again in focus for retail investors as the strongest performing sector of the year, with AI stocks doing a lot of the heavy lifting. Unsurprisingly, given the recession risks, consumer discretionary goods come bottom of the list for investors at the moment. But they are not afraid of being contrarian, with a significant focus on real estate and utilities sectors, recent underperformers that would do well with any early cutting of interest rates.”

ENDS

Notes to editors

About this report

The latest Retail Investor Beat was based on a survey of 10,000 retail investors across 13 countries and 3 continents. The following countries had 1,000 respondents: UK, US, Germany, France, Australia, Italy and Spain. The following countries had 500 respondents: Netherlands, Denmark, Norway, Poland, Romania, and the Czech Republic.

The survey was conducted from 18th August – 29th August 2023 and carried out by research company Opinium. Retail investors were defined as self-directed or advised and had to hold at least one investment product including shares, bonds, funds, investment ISAs or equivalent. They did not need to be eToro users.

Media contacts

pr@etoro.com

About eToro

eToro is the trading and investing platform that empowers you to invest, share and learn. We were founded in 2007 with the vision of a world where everyone can trade and invest in a simple and transparent way. Today we have over 32 million registered users from more than 100 countries. We believe there is power in shared knowledge and that we can become more successful by investing together. So we’ve created a collaborative investment community designed to provide you with the tools you need to grow your knowledge and wealth. On eToro, you can hold a range of traditional and innovative assets and choose how you invest: trade directly, invest in a portfolio, or copy other investors. You can visit our media centre here for our latest news.

Disclaimers:

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

eToro is authorised and regulated by the Financial Conduct Authority in the UK, in Cyprus by the Cyprus Securities and Exchange Commission, by the Australian Securities and Investments Commission in Australia and licensed by the Financial Services Authority in the Seychelles.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

Regulation and License numbers

UK

eToro (UK) Ltd, is authorised and regulated by the Financial Conduct Authority (“FCA”). Firm Reference Number: 583263. Registered in England under Company No. 07973792

Europe

eToro (Europe) Ltd, is authorised and regulated by the Cyprus Securities Exchange Commission (CySEC) under licence number 109/10. Registered in Cyprus under Company No. HE 200585.

Australia

eToro AUS Capital Limited(“eToro Australia”) is regulated by the Australian Securities & Investments Commission (“ASIC”) for the provision of financial services and products. Australian Financial Services Licence number: 491139.