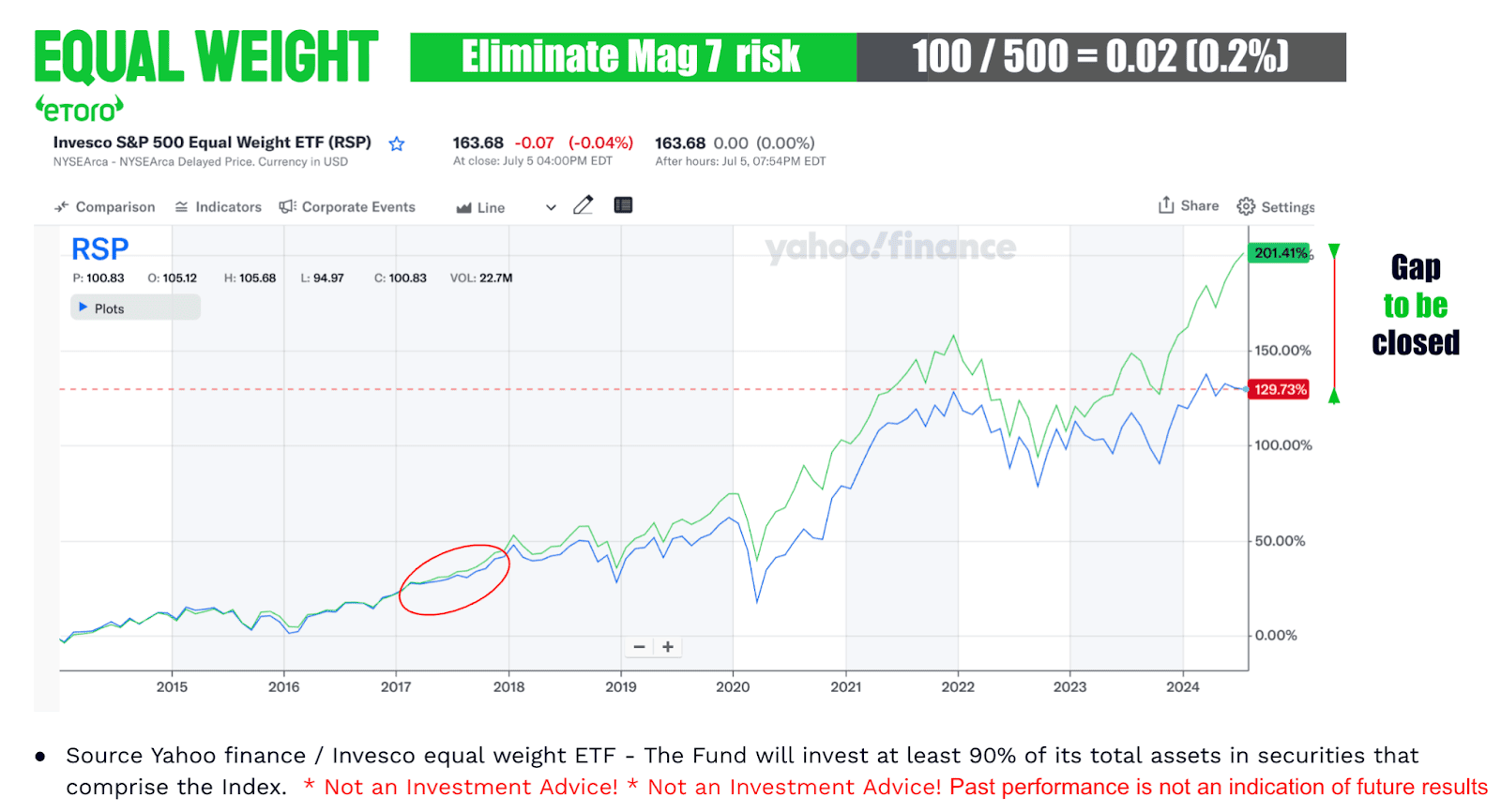

When considering an investment in the S&P 500, most people think of the traditional market-cap-weighted index (SPY), where the largest companies dominate the performance of the index (AMZN, NVDA, AAPL for example). However, an alternative approach that’s gaining attention is the S&P 500 Equal Weight Index (RSP), which gives each of the 500 companies the same weight in the index (100/500 = 0.2%). This method presents several potential advantages that could make it an attractive option for investors, especially in the current market environment.

Why Consider an Equal Weight S&P 500 ETF?

- Enhanced Diversification: In the market-cap weighted S&P 500, a handful of mega-cap stocks, often from the tech sector, can significantly influence the index’s performance. This concentration risk can expose investors to large swings based on the fortunes of just a few companies. An equal-weight ETF, on the other hand, distributes exposure more evenly across all 500 companies, resulting in a more diversified portfolio. This diversification can lead to more balanced performance across various sectors, reducing the risk of overexposure to any single industry or company.

- Potential for Higher Returns: Historically, smaller companies within the S&P 500 have outperformed their larger counterparts over long periods. An equal-weight index naturally gives more emphasis to these smaller and mid-cap stocks, which might result in higher returns, particularly in market conditions where these stocks are favored. As the market continues to evolve, especially with potential rotations away from the tech-heavy leadership, an equal-weight approach could capture growth in other sectors that have been overlooked.

- Reduced Sector Dominance Risk: In recent years, the technology sector has dominated the traditional S&P 500 due to the immense growth of companies like Apple, Microsoft, and Google. While this has been beneficial during tech rallies, it also increases risk should the sector face a downturn. An equal weight index reduces this dominance, spreading exposure more evenly across sectors. This can help mitigate the impact of any one sector’s underperformance on the overall portfolio.

- Rebalancing Advantage: Equal-weight funds are regularly rebalanced to maintain equal allocation across all companies. This process involves selling shares of companies that have appreciated in value and buying more of those that have underperformed. This disciplined approach can help investors “buy low and sell high,” potentially enhancing returns over time. The regular rebalancing also ensures that the portfolio remains aligned with its equal weight strategy, maintaining broad exposure to all sectors.

- Mitigation of Large-Cap Volatility: Large-cap stocks, while generally more stable, can experience significant volatility, especially during periods of market uncertainty. By balancing the influence of large caps with mid and smaller-cap companies, an equal-weight index may offer a smoother ride through volatile markets, reducing the portfolio’s overall risk.

- Opportunity in Market Rotation: As interest rates evolve and the economic landscape shifts, there is often a rotation in market leadership. Historically, after periods of heavy concentration in specific sectors, like technology, markets tend to rotate into undervalued or underappreciated areas. Equal-weight ETFs are well-positioned to capture gains from these rotations, particularly if smaller companies and less dominant sectors start to outperform.

The Case for Now

Back in July, the S&P 500 Equal Weight Index relative to the traditional S&P 500 was at its lowest level since the 2008 Financial Crisis, suggesting that the equal-weighted approach could be undervalued and primed for a potential upswing. With the broader market showing signs of rotation, and sectors like utilities, industrials, and energy—often underrepresented in the market-cap weighted index—being highlighted by strategists for their long-term prospects, now could be an opportune time for investors to consider an equal-weight ETF.

Given that the “Magnificent 7” tech giants have been the primary drivers behind the SPY performance in recent years, some investors are increasingly concerned about their high valuations, which have created a significant disparity between these seven companies and the other 493 in the index as you can see below. In response to these concerns, some investors are considering an equal-weight strategy to mitigate the risks associated with the heavy concentration in these tech giants. Additionally, as interest rates potentially decline, undervalued stocks in other sectors may become more appealing, further enhancing the case for an equal-weight approach.

Final Thoughts

While the equal-weight S&P 500 ETF offers several potential advantages, including diversification, the possibility of higher returns, and reduced sector risk, it is not without its considerations. Higher costs, increased turnover, and performance variability depending on market conditions are factors that investors need to weigh. However, as part of a diversified portfolio, an equal-weight approach could be a smart choice for those looking to balance growth potential with risk, especially in an environment where market dynamics appear to be shifting.