Donald Trump’s victory in the U.S. presidential election has sent ripples through global markets. Investors have begun pricing in reduced regulation, fewer interest rate cuts, higher tariffs, and a renewed focus on U.S. manufacturing. However, even across the Atlantic, one industry stands to clearly benefit from Trump’s presidency, and it has been on a tear these past weeks.

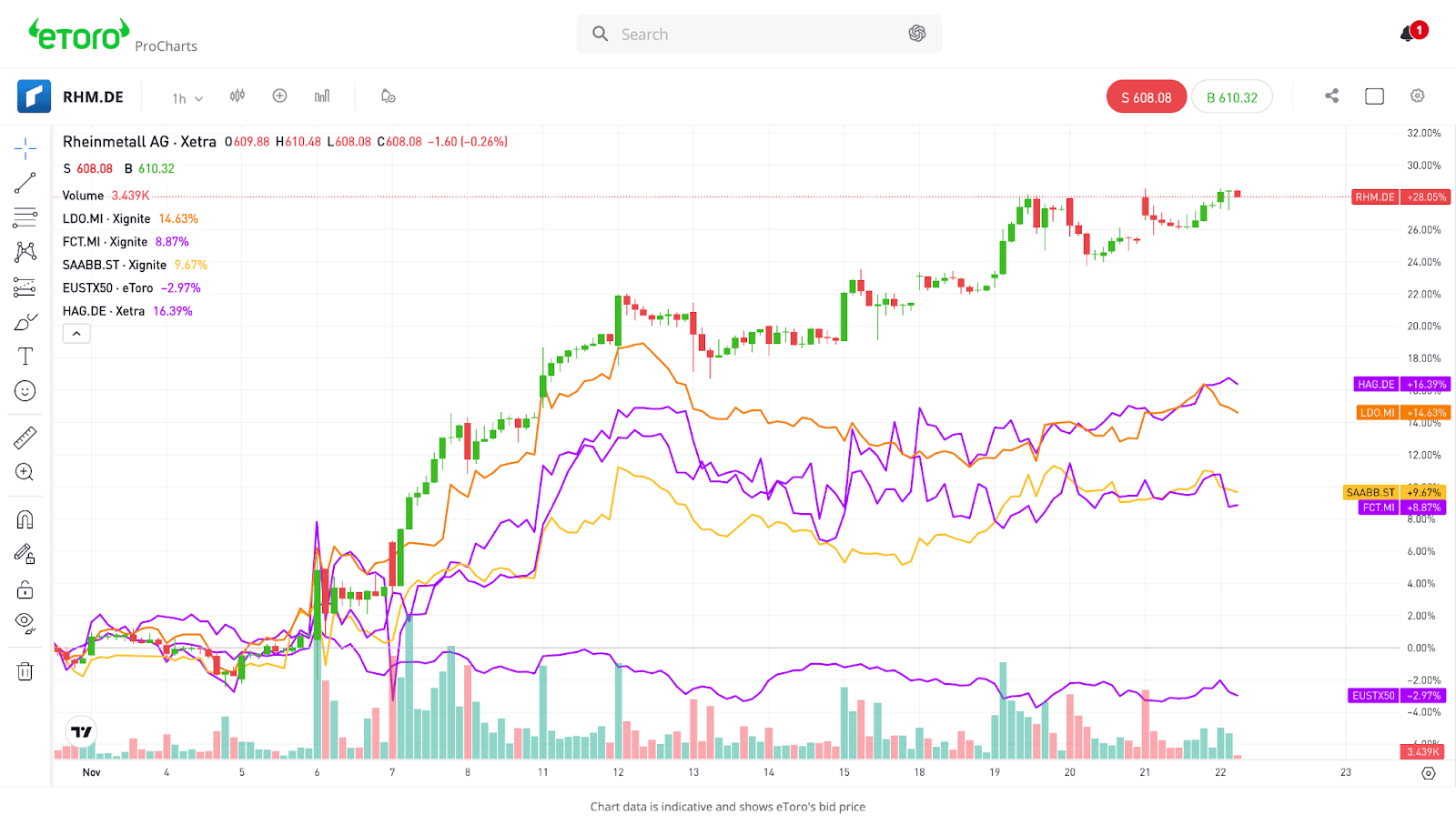

We’re talking about defense. In November alone, Stocks of Europe’s defense leaders have surged by up to 28%, far outpacing the EU Stoxx 50 ($EUSTX50) index. Defense has become the second-best performing sector in Europe this year, delivering a remarkable 29% year-on-year return, trailing only the insurance industry.

Source: eToro

NATO spending commitments serve as a catalyst

A key driver of this trend is the increased urgency surrounding defense spending within NATO member states. Donald Trump’s critical stance on European allies’ defense contributions has reinforced the need for higher military expenditures. His message is clear: you can’t get the peace dividend without investing. Early this year, Trump stated that if NATO member states fail to meet NATO’s defense spending target of 2% of GDP, they may risk losing U.S. military support. Analysts further speculate that Trump might push for an increase to 3% of GDP.

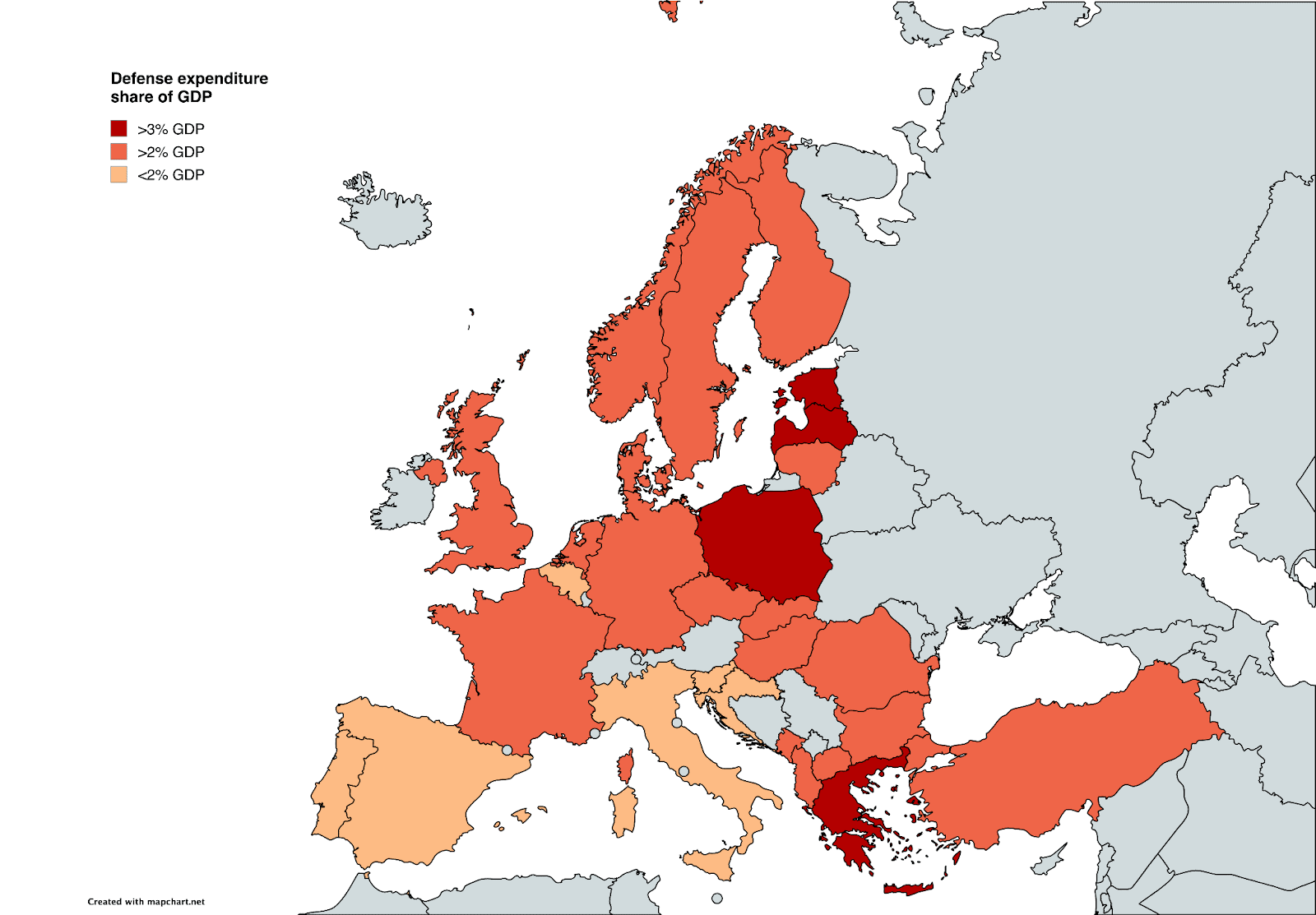

NATO allies have already taken action, spurred initially by the conflict in Ukraine. By the end of 2024, 23 of NATO’s 32 members plan to meet the 2% GDP target, up from just 10 in 2023. Poland (4.12%), Estonia (3.43%), and the U.S. (3.38%) lead the way, while Spain, Slovenia, and Luxembourg remain among the lowest contributors. Even so, if we take the US out of the equation, NATO’s allies collectively spend just 2.02% of GDP on defense—approximately $430 billion. The U.S. is spending almost twice as much alone. Additionally, some EU countries are likely to miss their spending targets. Regardless, defense spending is becoming a major objective for European governments.

Source: mapchart.net, NATO

European defense manufacturers step up to the task

With geopolitical tensions rising, one thing is clear: NATO’s European allies will have to arm up, and they should do it sooner rather than later. While more than two thirds of European defense budgets are spent on US-made equipment, smaller regional players are reaping the rewards as well, particularly in areas where the US is lacking.

One notable example is ammunition production. The conflict in Ukraine has highlighted critical shortages in artillery shells and ammunition stockpiles among NATO allies. In response, German defense giant Rheinmetall ($RHM.DE) has increased capacity, recently establishing a new ammunition factory in Ukraine.

The broader European defense sector has experienced a surge in investor interest, with stock prices climbing between 20% and 130% year-to-date. These gains are supported by strong revenue growth, expanding margins, and a growing sense of urgency among NATO member states to bolster their defense capabilities.

Impact on the U.S. defense industry

But while European defense manufacturers are soaring on heightened demand, shares of their U.S. counterparts—such as Lockheed Martin ($LMT), Raytheon ($RTX), and Northrop Grumman ($NOC)—have seen a muted impact. Despite European demand increasing by over 10% in some cases, it still represents a small proportion of these companies’ total revenues. Therefore, investors aren’t as optimistic about its impact on the top and bottom lines. Furthermore, potential tariffs could shift spending plans in favor of European suppliers. If a trade war were to break out, European nations would likely prioritize local manufacturers where possible.

Are expectations overstated?

However, the strong performance of the industry is raising questions about valuations. For instance, Rheinmetall’s ($RHM.DE) price-to-earnings (P/E) ratio has more than doubled over the past two years, in line with a broader trend of multiple expansion among European defense manufacturers. High valuations leave less room for error, and with much uncertainty around the current geopolitical situation, any unexpected developments could rattle investors. Despite the positive business outlook, they also might leave limited room for further upside.

While it remains to be seen how the geopolitical situation will develop, allies are likely to increase their defense spending regardless, especially with Trump pushing for higher spending. However, with some of these stocks trading at P/E ratios comparable to high-flying tech names, careful analysis is recommended.