Please see this week’s market overview from eToro’s global analyst team, which includes the latest market data and the house investment view.

Equity markets show resilience, volatility is back

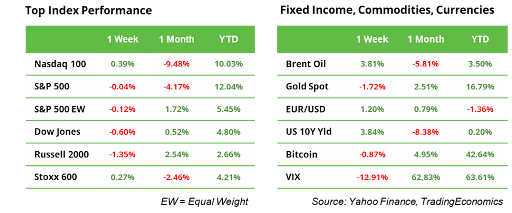

If you look at last week’s index performances (see the table), it seems as if nothing happened, but the reality is quite the opposite. On Monday, the S&P 500 Index had its worst day since September 2022, losing over 3%. The Nasdaq also dropped 3%, and Japan’s Nikkei 225 shed a staggering 12%. This turmoil was triggered by a combination of factors: a sudden rate hike by the Bank of Japan, which led to capital flows back into the yen (carry trade reversal), massively disappointing Intel earnings, and weak U.S. labor market data, which reignited recession fears.

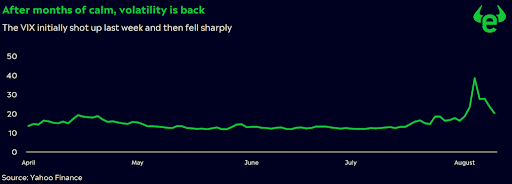

However, for the rest of the week, equity markets showed resilience, buoyed by solid company earnings and lower-than-expected jobless claims. The S&P 500 ended the week almost unchanged, down just 0.04%. Nevertheless, volatility has returned after months of calm, and we wouldn’t be surprised if it remains elevated for some time. August is light on data, markets are traditionally weak in Q3, and the U.S. elections are on the horizon.

This week, the focus shifts from the labor market to inflation. Controlled inflation will strengthen the belief that the Fed is ready to cut interest rates at its next meeting in September. U.S. retail sales data for July will be released on Thursday. On the retail front, earnings reports from Tencent, Alibaba, and JD.com will provide investors with new insights into Chinese consumer behavior.

Will fresh inflation data pave strengthen the belief that the Fed is ready to cut?

The markets are firmly pricing in a Fed interest rate cut in September, with the only question remaining being the size of the cut. Currently, the odds are evenly split between a 25 or 50 basis point reduction. This week, inflation reports on producer prices (Tuesday) and consumer prices (Wednesday) could significantly influence the direction of monetary policy. For consumer price inflation, the consensus expects a slight decline from 3.0% to 2.9%. A lower-than-expected figure could act as a catalyst for equities.

Recession fear explained

After experiencing strong equity markets in the first seven months of 2024, it’s surprising that just one week of volatility has reignited recession fears. The trigger for concern is the U.S. unemployment rate rising by more than 0.5%, marking its fourth consecutive monthly increase, from 3.8% to 4.3%. This measure, known as the Sahm Rule, has been tracked by the St. Louis Fed since 1949.

This century, the Sahm Rule has alerted markets three times: in 2001, when the Nasdaq bubble burst; in 2008, with the onset of the global financial crisis; and in 2020, at the start of the pandemic. In those instances, unemployment rose rapidly to 6%, 10%, and 15%, respectively. Will it be different this time?

In 2001, technology stocks were overinflated without corresponding profits, leading to severe job losses, particularly in that sector. In 2008, widespread redundancies were triggered by excessive leverage in the financial system. And in 2020, lockdowns led to a sharp spike in unemployment. In today’s market, the technology boom is supported by strong earnings growth, leverage is limited by regulatory measures, and no new health crisis appears imminent. The biggest risk may be an unproductive overinvestment in AI, which is why NVIDIA‘s upcoming earnings report on August 28 will be watched as closely as if it were a macroeconomic event.

Volatility index: a single indicator is not enough

The VIX also has its weaknesses, which can distort the perception of market risks. Between January and October 2022, the S&P 500 fell by 28%, but the VIX peaked at 38.94 at the beginning of the decline in January. This was because the market did not collapse in a panic, but moved downwards in a controlled manner over a period of months. In contrast, the VIX shot up to 85.47 during the COVID-19 crisis, when the markets fell dramatically within a few weeks. Investors should therefore not blindly rely on a single indicator.

Earnings and events

Tuesday, August 13: Home Depot, Tencent

Wednesday, August 14: UBS, Cisco, E.ON, RWE, due date for Berkshire Hathaway 13-F filing

Thursday, August 15: Walmart, Alibaba, Applied Materials, Deere, JD.com