Please see this week’s market overview from eToro’s global analyst team, which includes the latest market data and the house investment view.

Risky assets slip, US government bonds in the spotlight as safe haven

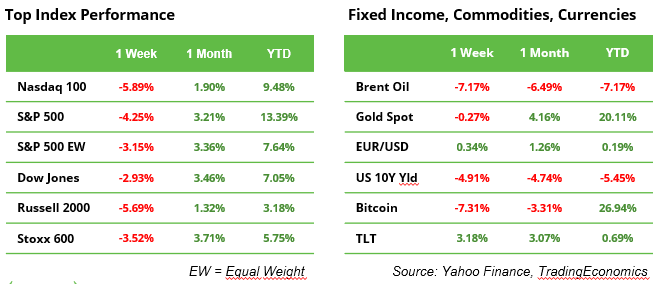

Last week was tough for risky assets. Major equities in the US, Europe, and Japan fell between 3% and 6% (see table on the next page), following weak macroeconomic data. Oil and Bitcoin both dropped by 7%, while gold remained nearly flat at -0.3%. US Treasuries turned out to be a rare safe haven. The benchmark TLT bond ETF (20-year+) gained 3%. Details on US sector performance are provided in a separate section below.

Investors are concerned that the Fed may act too slowly to prevent a significant economic slowdown. On Friday, traders were divided, causing the odds of a 0.25% or 0.50% rate cut to fluctuate several times before settling at a 70% chance of the smaller cut. On September 18, the Fed will not only announce its decision but also update the controversial dot plot, providing an outlook for future rate cuts. In June, Fed members projected the policy interest rate would be around 5% by the end of 2024, 4% by the end of 2025, and 3% by the end of 2026.

This upcoming week is set to be eventful, with several key events: Apple’s iPhone 16 release on Monday (with several Chinese competitors trying to steal its thunder), the ABC debate between Trump and Harris on Tuesday, and the ECB rate decision on Thursday.

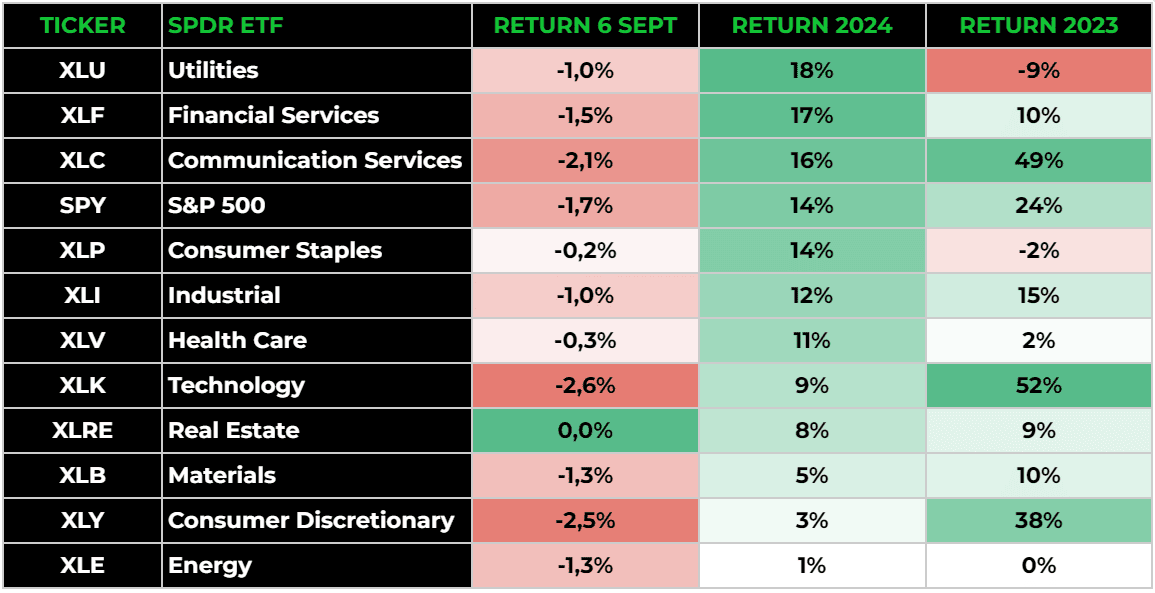

S&P 500 sector performance: Utilities from last to first

Year-to-date, Utilities is the best-performing sector of the S&P 500, after being the laggard in 2023 (see table). The sector reported the highest Q2 earnings growth among all sectors, with a 21% increase year over year, benefiting from the trend to “electrify everything.” The runner-up is Financial Services (17% earnings growth), while two of last year’s top performers, Technology and Consumer Discretionary (luxury goods), are now underperforming the broader S&P 500 Index. Despite lofty buyback programs, the Energy sector has delivered just a 1% price return over the last twenty months.

The table also shows that on a risk-off day like Friday, September 6, three rate-sensitive sectors—Real Estate, Consumer Staples, and Healthcare—held up relatively well. Last year’s top performers—Technology, Consumer Discretionary, and Communication Services—experienced the biggest declines due to valuation concerns.

It’s Christine Lagarde’s turn: will the ECB provide more guidance?

The ECB is expected to cut rates by 25 basis points on September 12—anything else would come as a surprise. The focus will be on the subsequent press conference, as Christine Lagarde is under pressure to address the future interest rate path. With inflation easing and the economy showing signs of recovery, Lagarde may be forced to shift her tone. A small rate cut, along with the prospect of continued dovish monetary policy in the coming months, could weigh on the euro, while the DAX and STOXX Europe 600 may benefit from broader market strength.

Will US inflation drop to a 3,5 year low?

The US CPI report on Wednesday is the last significant macroeconomic update before next week’s Fed meeting. Headline inflation for August is expected to drop to 2.6% from 2.9% in July, partly due to base effects. If the number comes in at 2.6%, it would mark the lowest inflation rate since March 2021. The biggest risk comes from the strong services sector, which could hinder further progress in curbing inflation. Although the Fed has shifted its primary focus from inflation to the labor market, a surprising CPI figure in either direction will undoubtedly influence policy decisions.

Earnings and events

AI Devices. Notable events include Apple’s iPhone 16 release (Sept. 9) and Microsoft’s CoPilot update (Sept. 16), both of which will emphasize AI assistant applications. Huawei has also scheduled an event directly after Apple’s, potentially surprising investors.

Politics. US presidential candidates Donald Trump and Kamala Harris will debate for the first time in the ABC News studio on September 10.

Macroeconomic Releases. China’s trade balance (Sept. 10), UK unemployment and GDP (Sept. 10-11), US CPI (Sept. 11), ECB rate decision (Sept. 12), US PPI (Sept. 12), and China’s industrial production and retail sales (Sept. 14).

Corporate Earnings and Activity: Oracle (Sept. 9), GameStop (Sept. 10), and Adobe (Sept. 12) are set to report earnings this week. Investors will also be monitoring increased activity in Dell and Palantir stocks, as they are set to replace Etsy and American Airlines in the S&P 500 Index on September 20.