A Pillar for Building Modern Wealth

Introduction

As Bitcoin ($BTC) continues to garner mainstream adoption from both retail and institutional investors, its usage and utility have become increasingly evident. Many can now recite the essence of Bitcoin in their sleep – digital currency, a store of value, digital gold 2.0, decentralised and a hedge against inflation. With a staggering increase of almost 1800% in value since pandemic lows, Bitcoin has shifted from a speculative asset to a viable financial instrument. This remarkable growth is not just a testament to its resilience but also a signal of its acceptance as legal tender in a few countries, marking a pivotal moment in the evolution of money.

As someone who has Bitcoin as my top investment, this analysis delves deeper into the narrative behind the king of crypto, exploring its true potential and my vision for a future where Bitcoin seamlessly integrates into mainstream finance.

The Evolution of Money

From prehistoric times to the 21st century, money has transformed from barter systems using goods like shells, livestock and services to commodities such as silver and gold, and now, fiat currency. Each phase has reflected the changing needs of society. It would be short-sighted to believe that the evolution of money halts at cash – the rise of digital assets signals a new era. It’s increasingly clear that the current financial system – flawed and outdated – will struggle to sustain itself in the long term.

This evolution aligns seamlessly with our advancing technological landscape as we transition into a more digital world. Technology has become a catalyst for change, continuously reshaping how we think, transact and connect. While traditional systems are starting to adapt to the world of crypto, their pace is often hindered not by the complexities of integrating blockchain with mainstream finance, but by government regulations and policy challenges. The potential for a seamless financial ecosystem is there – we simply must navigate these obstacles to fully realise it.

New Beginnings

When I was running my managed services IT business from 2004 to 2014, I first heard about Bitcoin in 2011 while passing by a group of technicians huddled around a few computer screens. Curious about their distraction, I asked what they were up to, assuming it wasn’t work. They replied, “We’re checking out Bitcoin.” Naturally, I wanted to know more and one of them described it as a form of digital currency. I nodded with slight confusion and my busy schedule that day left me with neither the energy nor the brainpower to ask further questions.

While life is meant to be about having no regrets, I sometimes find myself wishing I had invested in Bitcoin the moment I heard about it when it was just $1, peaking at almost $30 within that year. However, with my limited investing knowledge at the time, I might have sold early, which would have been an even harder pill to swallow. Fortunately, a couple of years later, I began to pay more attention to Bitcoin and the crypto scene. My passion for technology drove me to recognise Bitcoin’s potential and I dove deep into the world of cryptocurrency – never looking back.

Since its debut in 2009, Bitcoin has proven its resilience, climbing from $0.01 to above $70,000 today. Despite various crises, regulatory hurdles and steep competition, it continues to hold the #1 position with a market cap close to $1.5 trillion. What was once viewed as a speculative and almost fictional asset has now become a legitimate investment. With only 21 million bitcoins ever to exist, the last one is expected to be mined by 2140. This scarcity enhances its value and establishes a system resistant to inflation – no more ‘printing’ or mining

Environmental Concerns and Solutions

Bitcoin’s environmental impact mainly stems from its energy-hungry mining process, which emits around 22 million metric tons of CO2 each year. However, the industry is pivoting toward sustainability by harnessing renewable energy sources like solar and wind, along with adopting more efficient mining technologies. With initiatives focused on carbon offsets and regulatory support, there’s a growing movement to make Bitcoin greener without stifling its innovative edge.

A Revolution

Bitcoin has the power to dismantle financial barriers, providing individuals in underdeveloped regions access to money and resources they may not have had before, thereby paving the way for greater financial equality. It allows those without access to traditional banking services to participate in the financial system, making it especially valuable in regions where banking infrastructure is lacking. Additionally, Bitcoin enables innovative financial solutions like micro-lending, allowing individuals to access small loans for entrepreneurship and other needs, which can be particularly transformative in underdeveloped areas.

Since adopting Bitcoin as legal tender in September 2021, El Salvador has embarked on an exciting journey of financial innovation and inclusion. This bold move aims to empower the 70% of the population that was previously unbanked, granting them access to essential financial services. While only about 20% of citizens currently use Bitcoin, the government remains optimistic about its potential to reduce remittance costs and open up new economic opportunities. With approximately 5,746 BTC in its holdings, El Salvador is committed to harnessing Bitcoin for growth. Initiatives like the Chivo Wallet are designed to drive adoption and educate the public on the benefits of digital currency, while also protecting against inflation in a volatile economy.

Other countries, like Venezuela, showcase Bitcoin’s power in action, where citizens have turned to it as a stable alternative in the face of hyperinflation and political instability. Similarly, in Nigeria, a country with a significant unbanked population, Bitcoin has provided a means for many to save, transact and access micro-lending opportunities, enabling greater financial participation.

Sure, there are bumps along the road as every innovation has its growing pains, but that’s all part of the process. Integrating Bitcoin into mainstream finance is a work in progress, and with all great things in life, someone needs to take that leap of faith. As Bitcoin continues to gain traction, it holds the promise of transforming financial landscapes and empowering individuals across the globe.

Key Catalysts

As the cryptocurrency market has experienced a downward trend for some time, many analysts, including myself, believe the bear market has effectively ended, giving way to a prolonged consolidation phase. This period of stability is essential, from a technical standpoint, it creates solid support levels that can lead to a powerful bull cycle.

Macro factors significantly influence Bitcoin’s future value. Recent trends of cooling inflation, anticipated interest rate cuts and improving economic data signal a stabilising economy. Lower interest rates enhance market liquidity, facilitating increased investment in Bitcoin, while better employment rates can boost consumer confidence and spending.

Interestingly, despite Bitcoin trading near its previous all-time high, recent statistics show that search interest on Google has not surged significantly. This observation suggests that while retail interest in Bitcoin hasn’t fully emerged yet, it is likely still to come, as potential investors become more aware of Bitcoin’s value.

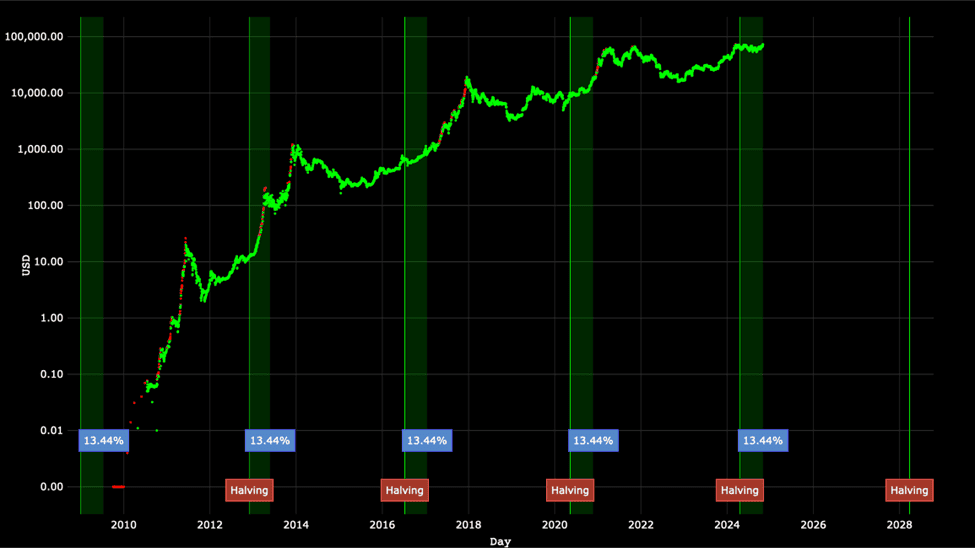

The recent Bitcoin halving occurred on April 20, 2024, reducing the block reward from 6.25 BTC to 3.125 BTC per block. Historically, Bitcoin’s price tends to rise significantly within 6 to 18 months following a halving event due to the reduction in supply coupled with steady or increasing demand. For example, after the 2016 halving, the price increased from approximately $580 to over $19,000 in about 18 months. Following the 2020 halving, Bitcoin surged from roughly $9,000 to its then all-time high of about $64,000 in less than a year. The next halving is expected in 2028, which will further cut the reward to 1.5625 BTC.

Source: charts.bitbo.io

Risks

Investing in Bitcoin ($BTC) comes with a unique set of risks that potential investors should carefully consider. The upcoming U.S. elections could have significant ramifications for the over crypto space. If Kamala Harris were to win, her ambiguous stance on Bitcoin might hinder crypto innovation, while Donald Trump’s pro-crypto advocacy could pave the way for broader adoption. Additionally, a Democratic victory could trigger short-term market pullbacks as investor sentiment fluctuates.

The threat of further regulatory crackdowns remains ever-present, as changing frameworks could stall Bitcoin’s growth and integration into mainstream finance. The cryptocurrency market is inherently volatile, leading to dramatic price swings that can result in both significant gains and steep losses. Additionally, technological vulnerabilities, coupled with competition from emerging cryptocurrencies, could challenge Bitcoin’s dominant position. Investor psychology plays a crucial role as well, with market sentiment often driving erratic behavior. Lastly, the environmental impact of Bitcoin’s energy consumption has come under scrutiny, potentially affecting its acceptance among eco-conscious investors.

What Will the Future Look Like?

Visionaries are those who change the world and Bitcoin falls squarely into that category. It evokes both hope and fear, with the unknown intensifying the latter. The crucial question remains: how can we fully integrate Bitcoin into the current mainstream financial system? This requires exploring the cognitive and behavioural aspects of humanity – how are our perceptions and behaviours shifting in this digital landscape?

As we transition into a more digital world, we are witnessing a massive transfer of wealth from baby boomers to Gen X, Y, and Z, who are more inclined to embrace digital assets. This generational shift signifies that inheritances will likely flow into digital assets, reinforcing Bitcoin’s position as a cornerstone of modern wealth. Inheriting digital assets will become the norm, fundamentally altering how future generations view and interact with money.

Noteworthy are the diverse opinions surrounding Bitcoin. Key players like billionaires Michael Saylor, Paul Tudor Jones and Bill Miller advocate for Bitcoin as a solid investment with long-term growth potential. Conversely, Bill Gates has shifted from scepticism to a more cautious view, acknowledging Bitcoin’s potential while emphasising concerns over its volatility and environmental impact. This change is highlighted by Microsoft’s upcoming shareholders meeting on December 10, 2024, where a proposal to assess investing in Bitcoin will be discussed, indicating a changing tide in institutional sentiment.

In contrast, bears like Warren Buffet and Jamie Dimon continue to express caution, often citing volatility and speculation as significant concerns. However, if sceptics and institutions don’t completely embrace Bitcoin soon, they risk being left behind as younger generations inherit wealth and actively invest in digital assets. The landscape is evolving at breakneck speed and those who fail to adapt may find themselves outpaced by a new wave of digital finance.

Is It Too Late to Invest?

Many investors have felt they missed countless opportunities to invest in Bitcoin ($BTC) particularly when it fell below $3,000 during the pandemic in 2020 and again below $20,000 in 2022. Now, as Bitcoin approaches its all-time-high of over $70,000, a familiar sentiment is creeping in – people may hesitate, thinking the best days are behind it. However, forecasts suggest that Bitcoin could soar to over $200,000 within the next bull cycle and potentially reach millions by 2050.

The lesson is clear: waiting for the “perfect” moment to invest often leads to missed opportunities and could mean jumping in again at the next peak. History has shown us that Bitcoin’s volatility can result in substantial price increases and those who remain on the sidelines may find themselves regretting their decisions later once more. With ongoing institutional interest and growing adoption, now could be a pivotal time to consider entering the market before the next monumental surge – one that could be written into the history books.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.