President Trump’s ‘America First’ approach is shaking up global markets, but the UK stock market isn’t flinching. Sure, there were a few wobbles in the past ten days but the FTSE 100 and FTSE All-Share have stayed resilient. So, what’s driving the recent performance, and can it keep up? Let’s dig in.

The UK market is defying sceptics:

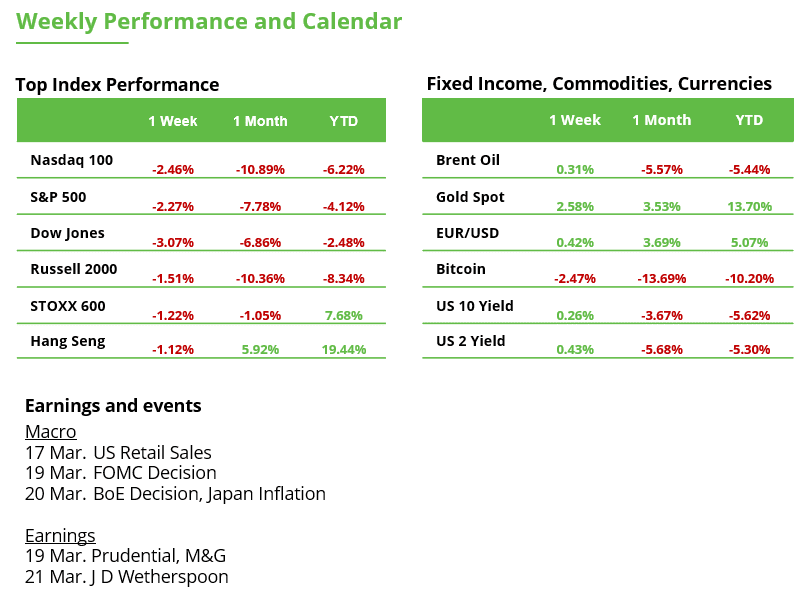

- The FTSE 100 is up 6.6% YTD, beating the S&P 500 (-3.9%) and defying years of underperformance.

- The Euro Stoxx 50 (+10.7%) is even stronger, as global investors rotate into value stocks and away from overpriced US mega-cap tech.

- Meanwhile, the FTSE 250 (UK-focused stocks) isn’t playing along, stuck in mid-cap limbo as the UK economy struggles. But if you’re a long-term investor, some of its unloved stocks might be hidden gems waiting to shine.

FTSE 100 loves its “old economy” stocks:

- Banks, oil, and mining stocks are holding firm – thanks to high rates, pricey crude, and value-hunting investors.

- Lloyds and Standard Chartered popped as investors piled into financials, while BP and Shell stayed strong, shrugging off energy price swings.

Not-so-hot sectors, now:

- Consumer stocks are struggling. Cost-of-living pressures mean UK shoppers aren’t splurging on luxury sneakers.

- Real estate took a hit. Higher-for-longer rates = tough times for property stocks. Savills a notable case and recently dropped after failing to present a clear turnaround plan.

Stocks in the spotlight:

- NatWest fell as the UK government sold more shares. Investors don’t love “forced” selling, but this is a step toward full privatization.

- Assura (healthcare property business) jumped on takeover buzz. Private equity loves cheap UK assets – expect more M&A moves.

- Gold miners shined as gold hit an all-time high. Tariff fears + safe-haven demand = investors rushing into precious metals.

The macro setup is key – watch the BoE.

- The Bank of England meets on March 20. Will they hold rates at 4.5% or hint at cuts? Inflation ticked up to 3%, which could delay rate cuts.

- If the BoE eases later in 2025, rate-sensitive stocks (real estate, consumer) could rebound.

Bottomline: Value Play or Value Trap?

- Cheap, but for how long?

- The FTSE 100 trades at ~12x forward earnings – below its long-term average (14x) and cheaper than both the S&P 500 (21x) and Europe (15x). While it may not be a deep bargain, its relative discount suggests room for a re-rating as global investors take notice.

- Private equity and foreign investors are already snapping up undervalued UK assets.

- Dividends still rule.

- The FTSE 100’s 3.8% dividend yield dwarfs the S&P 500’s 1.4% – offering steady income even if growth takes time.

- Patience pays.

- Warren Buffett’s warning: Markets struggle when they forget the fundamentals—earnings have historically grown ~7% per year, on average. When markets overshoot this pace, they’re essentially borrowing returns from the future. The US has front-loaded years of gains, while the UK has quietly stuck to its long-term pace. That may make UK a better risk-reward bet for long-term investors.

Tariffs as a Boomerang? Trump’s Trade War Weighs on U.S. Corporate Profits

Concerns are rising, but panic remains absent: More S&P 500 companies are mentioning “tariffs” in their earnings calls than at any time in the last 10 years. This highlights how much trade uncertainties threaten corporate profits and market stability. At the same time, the number of companies mentioning “recession” has dropped to its lowest level in over 5 years, signaling that fears of an economic downturn remain low.

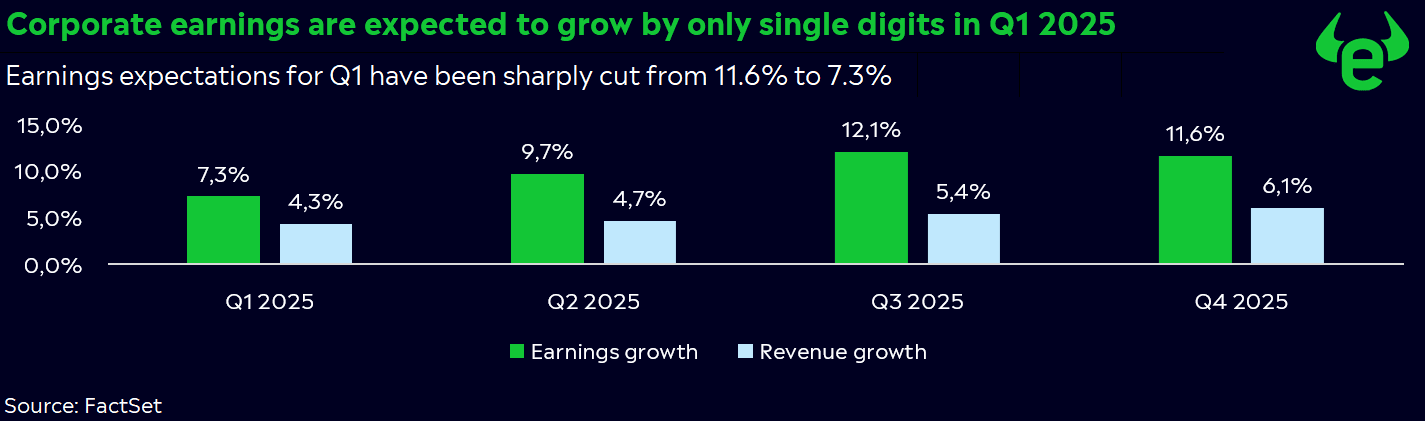

Tariff uncertainty clouds the outlook: S&P 500 companies are expected to report 7.3% YoY earnings growth in Q1 2025 (see chart), a sharp revision down from 11.6% projected at the end of 2024. Revenue growth is estimated at 4.3% YoY. Trump and uncertainty over new tariffs are weighing on expectations, but the market has already partially priced in these risks. Tariffs alone won’t crash the economy, but they could accelerate the slowdown in the U.S.

Four sectors hit hardest: The four sectors with the highest mentions of “tariffs” in Q4 earnings calls—Materials, Industrials, Consumer Discretionary, and Consumer Staples—are also the ones that have seen the largest cuts in earnings expectations for Q1 2025. This indicates that tariffs are not just a talking point but are directly impacting corporate earnings.

Earnings growth doesn’t always mean stock gains: Eight of the eleven S&P 500 sectors are expected to report earnings growth in Q1 2025, led by Health Care and Information Technology. However, higher profits don’t automatically translate to rising stock prices—valuations and market trends play a crucial role. While Health Care has gained 4.5% YTD, Information Technology is down 10.0%, reflecting a market shift toward defensive and cyclical sectors. Health Care, Energy, Utilities and Real Estate have been the strongest performers this year.

Bottomline: Whether the four-week losing streak is an overreaction or if the correction continues will become clear in the coming days. Historically, corrections occur almost every year, often creating new opportunities. However, investors remain in the dark regarding Trump’s trade policies and are seeking clarity. Let’s see whether the Fed can calm the markets somewhat on Wednesday – or trigger new turbulence.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.