Equity markets rebounded, but oil and gold evidence economic worries over not over

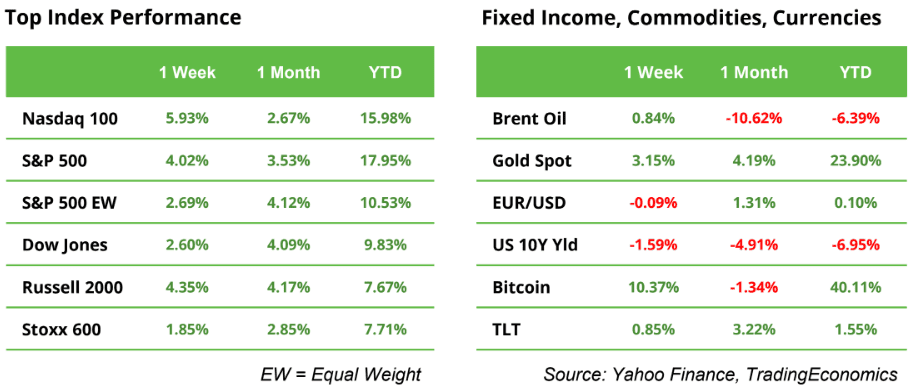

Last week, we witnessed remarkable resilience in the equity markets once again. The S&P 500 Index rose by 4%, while the Nasdaq 100 Index increased by 6%, recovering the losses from the previous week. For U.S. large-cap equities, it was the best week of 2024, leaving both the S&P 500 and Dow Jones just 1% below their all-time highs.

In Europe, the STOXX 600 Index regained only half of its losses due to concerns over economic growth, particularly in Germany. The European Central Bank (ECB) cut the policy interest rate by 0.25%, from 3.75% to 3.50%, as expected. Meanwhile, Bitcoin gained 10%, but Brent and WTI oil briefly hit new local lows at $69 and $65, respectively. Additionally, gold reached a new all-time high of $2,586, signaling that concerns about a global economic slowdown persist.

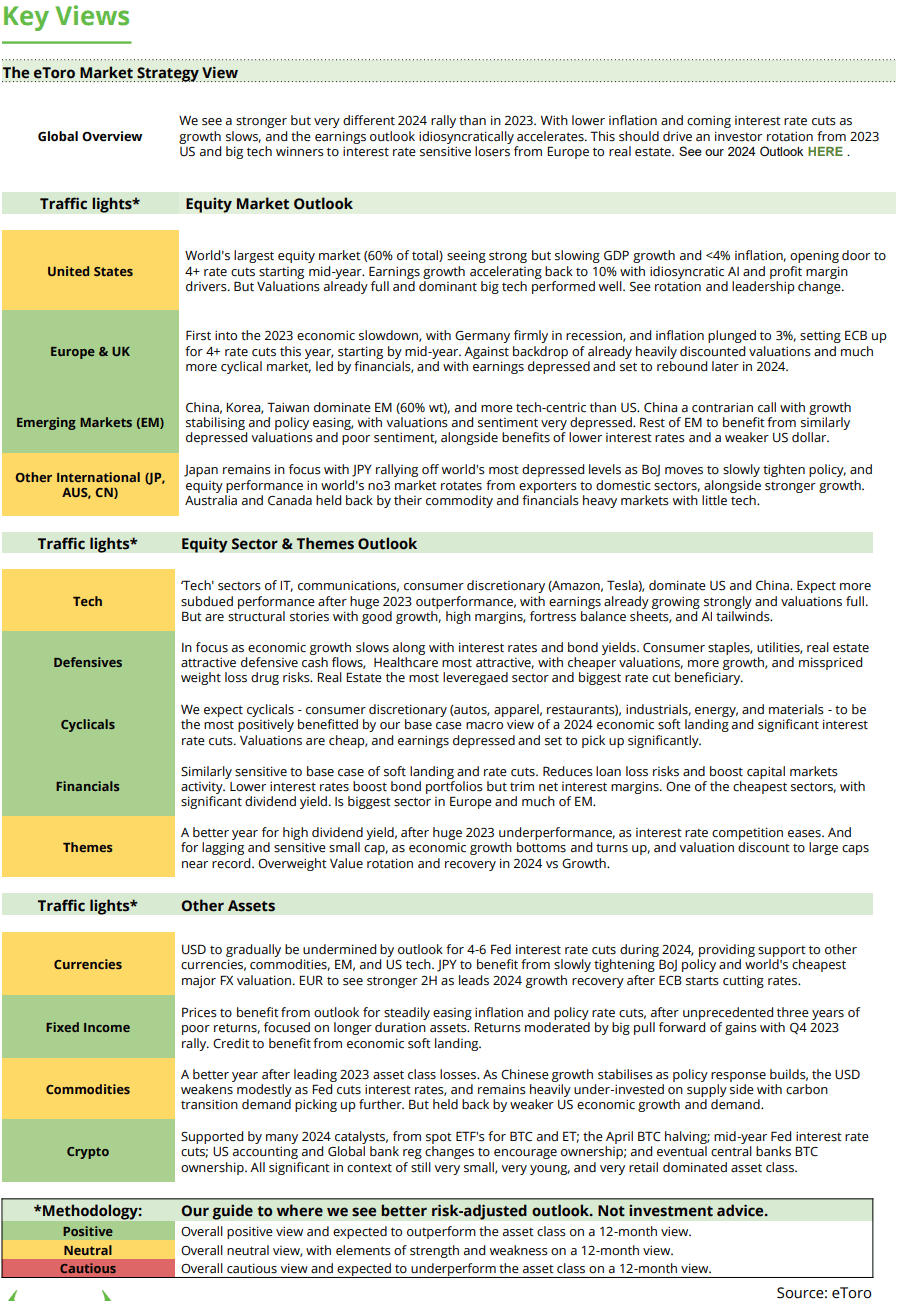

This week’s focus is on interest rates, with the U.S. Federal Reserve, Bank of England, and Bank of Japan all set to make key decisions. The Fed is expected to cut rates by at least 0.25% (see below), while the BoE and BoJ are anticipated to pause after previous cuts. Market participants are also closely monitoring China, where the ongoing property crisis is contributing to lower retail sales, overcapacity in manufacturing, falling commodity prices, and slowing economic growth.

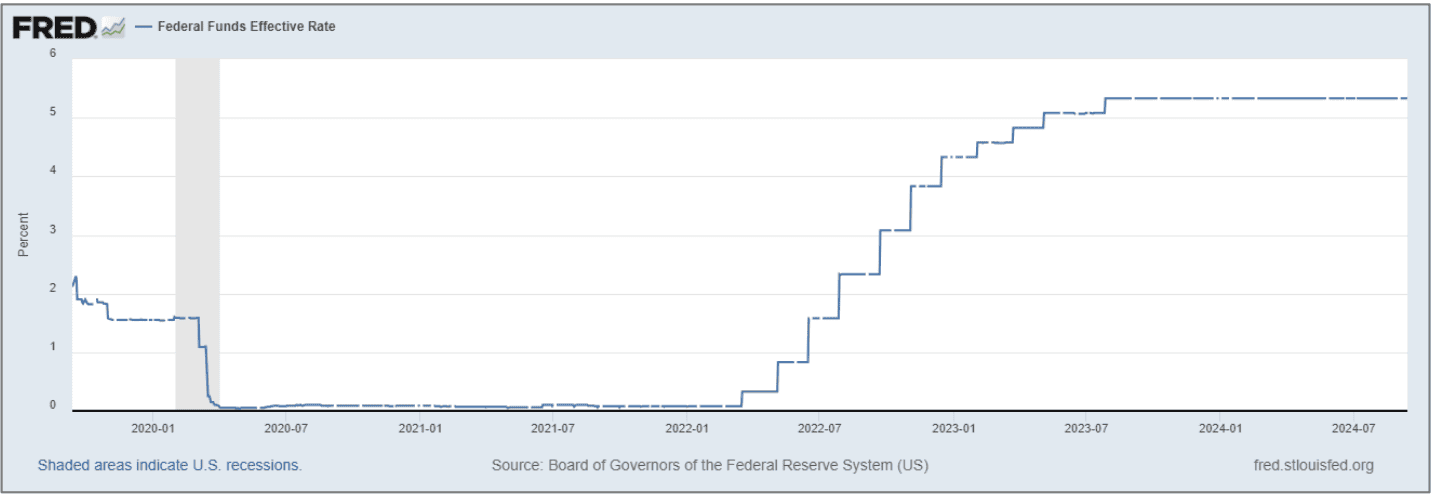

The Fed to cut 0.25% or 0.50%, that’s the question

At the close of markets on Friday, the likelihood of either a 0.25% or 0.50% interest rate cut by the Federal Reserve on Wednesday remained evenly split. In any case, investors will see the long-awaited first rate cut since the Fed paused its hikes in July 2023. Economists are predicting three quarter-point cuts this year: 0.25% after each of the remaining policy meetings on September 18, November 7, and December 18, 2024. If this forecast holds true, the Fed will claim success, as three cuts in 2024 align exactly with what Fed Chair Jerome Powell indicated in December 2023.However, investors are concerned that economic growth is slowing more sharply than anticipated, and many are hoping for a full percentage point cut before Christmas. We’ll have more clarity on Wednesday at 8 p.m. CET, particularly since the updated ‘dot plot,’ which outlines interest rate projections for 2025 and 2026, will also be released.

Source: fred.stlouisfed.org

Focus of Week: Chips Are The New Oil and Orange Juice jumps

Chips are the new oil

“I went to dinner with Elon Musk and Jensen Huang, and I’d describe the dinner as me and Elon begging Jensen for GPUs,” Oracle CEO Larry Ellison admitted in an interview. Oracle recently announced plans to build a massive AI supercomputer with 131,000 NVIDIA Blackwell GPUs to train Musk’s xAI language models. Meanwhile, Oracle stock hit an all-time high after last week’s earnings report.

Saudi Arabia also expects access to NVIDIA’s high performance chips within the next year, potentially linked to oil trades aimed at replenishing the U.S. strategic petroleum reserve, which was heavily tapped after Russia’s invasion of Ukraine. NVIDIA’s advanced chips are crucial for national security, spurring interest from various countries. It makes one think about China’s aggressive actions in the South China Sea, home to Taiwan, where tensions have escalated after a Chinese ship damaged a Philippine vessel (a U.S. ally) a month ago.

Geopolitical tensions, while low-probability, can have high-impact risks that are often too complex for investor models. An easier risk to monitor is potential global supply chain delays, which could slow down economic growth, as seen during the 2020 pandemic.

After cocoa, now orange juice prices reach new highs due to weather conditions

The price of orange juice has soared to record levels due to several factors, including poor weather conditions, citrus diseases like “citrus greening,” and reduced harvests, particularly in Florida. These disruptions have led to a drop in supply, driving up prices globally. Additionally, increasing production costs and inflation have contributed to the rising cost of orange juice. This situation highlights broader challenges in agricultural production and supply chains.

Earnings and events

Key macroeconomic events this week include interest rate decisions from the U.S. Federal Reserve (Sept. 18), the Bank of England (Sept. 19), and the Bank of Japan (Sept. 20). In the U.S., we’ll also receive August Retail Sales data. After the unexpectedly high 1% month-over month growth in July, the market now anticipates a more modest 0.2% increase for August.

Earnings reports from transportation giant FedEx and the second-largest U.S. homebuilder Lennar, both due on Thursday, will provide further insight into the state of the U.S. economy.