Please see this week’s market overview from eToro’s global analyst team, which includes the latest market data and the house investment view.

Powell announces a first rate cut, unemployment data will determine the size

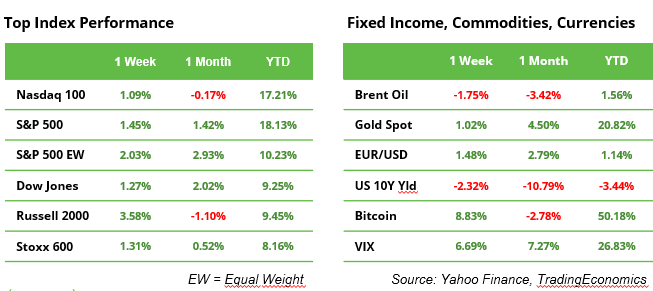

Last week, the “The time has come for policy to adjust,” were the famous words of Jay Powell during his speech at the annual Jackson Hole Symposium in Wyoming. After the Federal Reserve raised its policy interest rate 11 times between March 2022 and July 2023, reaching 5.5%, the Chair now signaled that rate cuts are on the horizon. On Friday, the Nasdaq, S&P 500, and Dow Jones indices all rose by 1.1-1.2%, while the small-cap Russell 2000 Index outperformed with a 3.2% gain. The 2-year Treasury bond yield fell to 3.97%, the 10-year yield to 3.8%, and the EUR/USD strengthened to 1.12, its highest level in 2024 so far.

As of now, the Fed’s policy focus will shift from inflation to unemployment as the key factor in determining rate cuts. While all labour market data will be closely monitored, the August Unemployment Rate, to be released on September 6th, will be particularly significant. A rate exceeding 4.4% could prompt a 50 basis point cut at Fed meeting on September 18th, rather than the expected 25 basis point cut. Inflation data will get updated this Friday when the PCE report is released. However, this event may be overshadowed by NVIDIA’s quarterly earnings report, due on Wednesday after U.S. markets close.

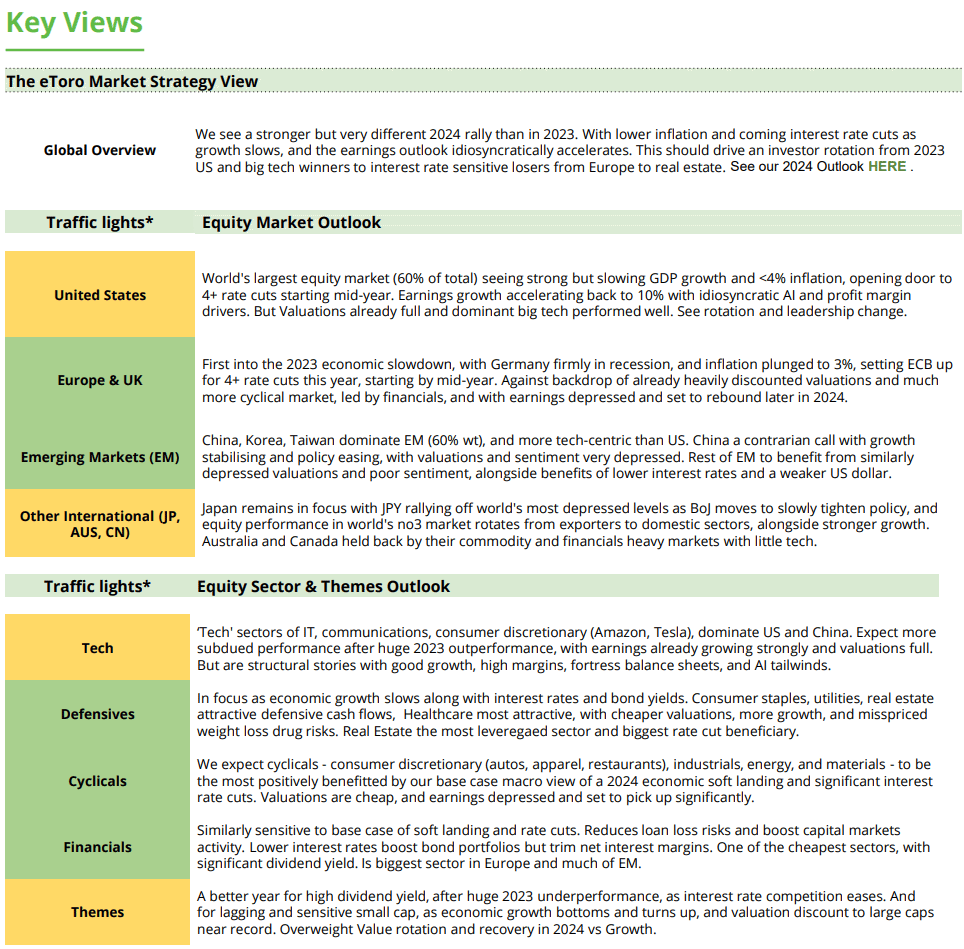

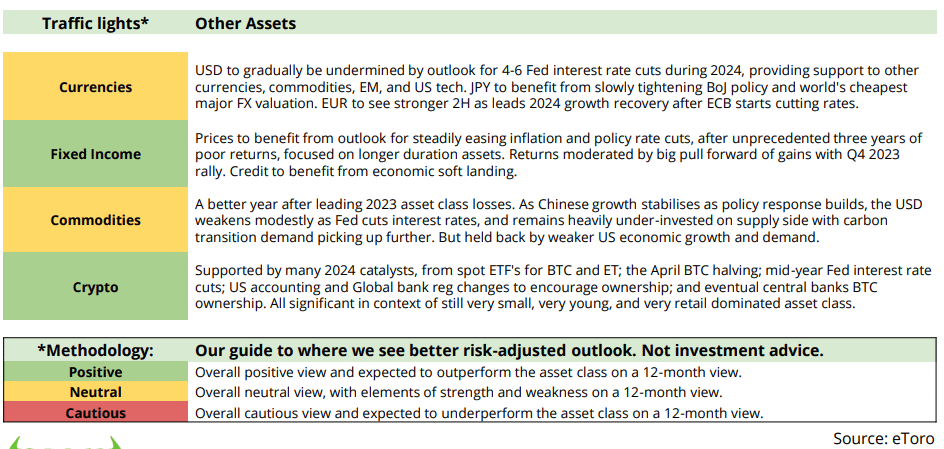

The reason for a rate cut is more important than the timing

Since the beginning of the year, market focus has largely centered on when and how often the Fed will cut interest rates. However, the key question is “why.” The rationale behind a rate cut makes all the difference. If the Fed lowers rates amid a strong economy, it signals strength and control—a positive sign for a bull market. Conversely, a cut due to economic weakness may reignite recession fear. Crucially, inflation needs to continue easing. Attention on Friday will be on the US PCE rate, with expectations that inflation remained steady at 2.5% in July.

Copper as a barometer for the global economy, prices stabilize

Copper is currently as cheap relative to gold (see chart) as it has been since 2020—a sign of weakness in the global industry. Often referred to as a barometer of the world economy, copper could, however, see increased demand soon. Expected interest rate cuts and lower import prices due to a weaker dollar could boost copper demand. In addition, an increasing supply deficit is forecast in the coming years, which could further support prices. Last week, copper closed at $4.25 per pound, stabilizing above July’s lows. In May, the metal briefly reached $5.30.

Will NVIDIA do it again? Key factors to watch on Wednesday

“Get the popcorn out,” Wedbush tech analyst Dan Ives remarked when asked about the upcoming NVIDIA earnings. However, with such a bullish outlook, there’s a risk that even strong numbers might fall short of expectations. Here are the key factors to watch in the company’s report:

- Earnings. Forecast: revenue of $28.54 bn YoY and earnings per share of $0.64.

- Outlook. More important than the past quarter’s performance is the future outlook. Do they see new orders coming in at the same, massive pace going forward?

- Delays. Rumors had it that NVIDIA may face delays up to three months on the delivery of the new Blackwell chips. Will the company make a statement?

- China. The effects of US sanctions on China on Nvidia’s growth and necessary strategic adjustments.

Be prepared for possible price swings due to the high valuation (forward P/E ratio of 48 times) and the stock’s sensitivity to quarterly results.

Beware of a possible “September effect”

The “September Effect” is a well-known market phenomenon where stock markets, particularly in the U.S., tend to decline during September, historically one of the weakest months for equities. This trend may be driven by seasonal behavioral patterns like portfolio rebalancing after summer, tax considerations, and portfolio clean-up before the fiscal year-end. However, it’s not a guaranteed outcome. The effect can also become a self-fulfilling prophecy, where expectations of a downturn lead to increased selling, contributing to the decline.

Earnings and events

On Wednesday August 28th not only NVIDIA, but also electrical car manufacturer BYD, software maker Salesforce, and cybersecurity firm CrowdStrike will report earnings. On Thursday August 29th investors will get fresh numbers from the new Berkshire Hathaway holding Ulta Beauty, besides technology stocks Dell and Marvell.