Hi Everyone,

Donald Trump is watching the financial markets very closely. For him, it seems to be an indicator of how far he can push his trade war agenda. When markets are doing well, he seems to feel free to take bigger risks and when markets fall, he seems to think he can always fix everything with a single tweet.

Investors are also watching Donald Trump very closely. They know that if they sell their stocks and markets go down, Trump will probably try to fix everything with a single tweet and send stocks back up. So they are wary of selling in the first place.

Donald Trump, seeing a supportive Fed and unwavering markets, feels free to take even greater risks by pushing his trade war agenda ever further.

Today’s Highlights

- Sudden Change of Plans

- Was it a Whale?!

Traditional Markets

US Stock markets skyrocketed after Jerome Powell’s speech yesterday, seeing their biggest gains since January 4th.

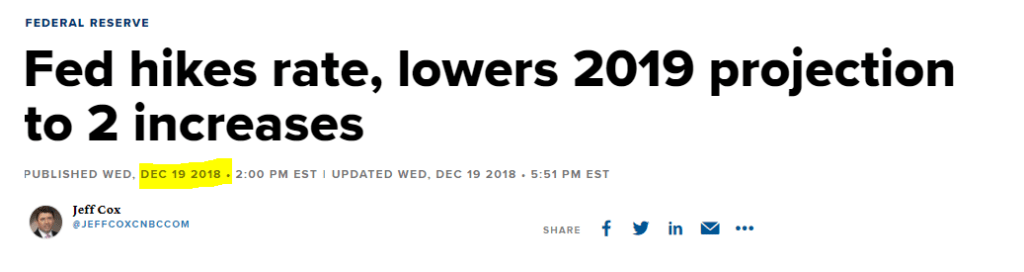

To be clear, this is likely the quickest shift in global economic policy the world has ever seen. The Fed went from considering two or three rate hikes in 2019 in December to now laying the groundwork to cut interest rates within the next few months.

So, from this (December 19th, 2018)…

Tomorrow, we’ll hear from three more central bank bosses. Bank of Japan Governor Kuroda, Bank of England Governor Carney, and the ECB’s Mario Draghi.

Now, the European Central Bank is deploying negative interest rates so it’s very unlikely that they’re going to be cutting. But what they could do and what some analysts expect…

Crypto Whale Watching

It’s no secret that in the low liquidity environment of bitcoin and the crypto markets, whales have the potential to make waves.

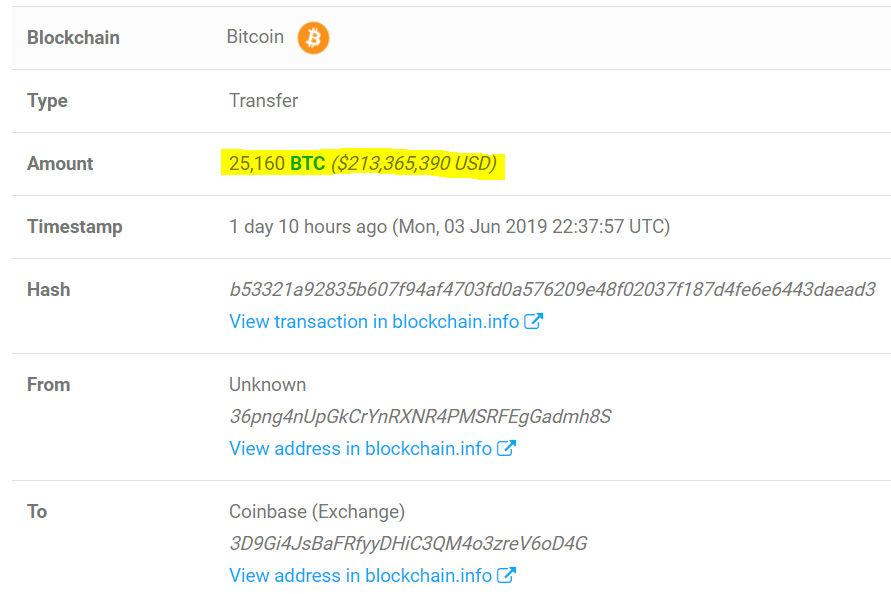

So when the price of bitcoin fell 8.3% in under an hour on Monday night, many were out looking for a scapegoat. It seems that one turned up rather quickly and several clients have pointed me to this link showing a rather large transaction going from an unknown wallet to a well known Coinbase wallet.

So the theory goes that someone transferred about $250 million worth of bitcoin onto the exchange, sold the coins off, causing the price to crash, then bought them back at a lower price and moved them back into cold storage.

Would be a killer trade if they could pull it off.

Some quick calculations however, will show us that this is simply not possible. As highlighted in this piece, a $200 million order is a pretty tall order and it would be difficult to fill on any exchange. Coinbase Pro’s reported volume for the time of the selloff was just 2,000 BTC.

The Woes of Spring

No matter the conclusion, this is an excellent argument to be having at the moment and is a true sign that the crypto markets are now in Spring.

Spring is really the best time too. Winter was brutal this past cycle but I’m not so sure we should be looking forward to summer either.

A break above $9,000 at the moment would no doubt spark further attention and further price surges. However, those surges could very well be unrealistic and solely based on hype. Or in other words, what we want is sustainable value creation, not short-term momentum-driven surges.

Summer is hot and people get burned. Last crypto summer was arguably harsher than any winter. Bitcoin’s mempool got flooded, transaction times and fees went through the roof. Not to mention that many exchange sites crashed due to heavy traffic and several of them even had to close their doors to new customers.

It was a very tense time and even though bitcoin’s price doubled in 17 days, those gains were eventually given back and anyone who bought in during those two and a half weeks was left with a very bitter taste.

No, springtime is the best by far. So enjoy the peaks and valleys and take things as they come.

Have an amazing day ahead!

Best regards,

Mati Greenspan

Senior Market Analyst

Connect with me on….

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/

LinkedIn: https://www.

Your Social Investment Network – www.eToro.com

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.