Please see this week’s market overview from eToro’s global analyst team, which includes the latest market data and the house investment view.

Dow Jones and DAX set new all-time highs, September sees rate cuts coming

Equity markets once again demonstrated resilience in August. The Nasdaq (+4.1%), S&P 500 (+3.9%), Dow Jones (+2.0%), and the European STOXX 600 (+2.1%) all ended the month in positive territory, despite an initial drop of 5% to 10% in response to a string of perceived negative news. A stronger-than-expected Q2 earnings season and more positive macro-economic data from the U.S. helped restore sentiment. As we enter September, markets seem to have stabilized, as indicated by the VIX Index.

Last week, NVIDIA‘s earnings came in solid but didn’t impress investors as much as before. Value stocks did well on average in both the US and Europe, with Dow Jones and DAX indices reaching new all-time highs. Warren Buffett’s Berkshire Hathaway reached a remarkable milestone of a market cap over $1T, the first American company to do so outside the technology sector. Soft inflation numbers in the US (PCE 2.5%) and EU (2.2%) paved the way for central bank monetary action in the coming weeks.

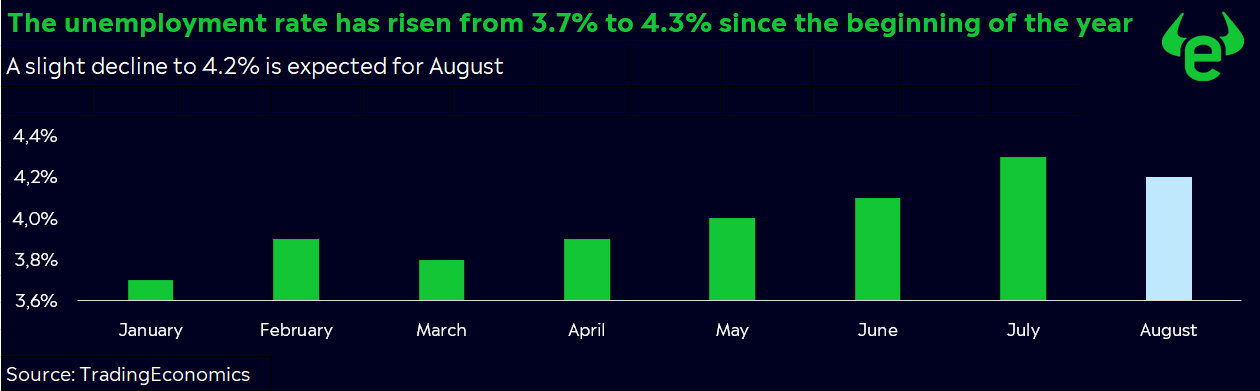

September is often viewed with caution in financial markets, as the historical long-term average for equities is slightly negative. Major upcoming events include the rate decisions by the ECB on September 12 and the Fed on September 18, with rate cuts of at least 0.25% anticipated. Leading up to these dates, investors will focus on U.S. non-farm payrolls and the unemployment rate this Friday, as these figures contributed to the ‘Black Monday 2024’ event on August 5.

US labour market: further cooling in unwelcome

Investors are increasingly focused on the unemployment rate, as it tends to rise rapidly at the onset of a recession (as per the Sahm Rule). In July, the unemployment rate climbed to 4.3%, its highest level since October 2021 and the fourth consecutive monthly increase. In March, it was at 3.8%. For August, a slight decline to 4.2% is expected (see chart). However, an unexpected increase to 4.4% or 4.5% would significantly heighten concerns about economic stability and could reignite speculation about a substantial 50 basis point rate cut. Additionally, 163,000 new jobs and a 0.3% increase in wages compared to the previous month are anticipated.

Market recovery: Dow Jones Industrial Average Index takes the lead

Last week, the Dow Jones became the first major U.S. index to reach a new all-time high. Although the index rose by 8% from its low a few weeks ago—less than the gains seen in the S&P 500 and Nasdaq—it also experienced less selling pressure beforehand. Defensive stocks such as American Express and Procter & Gamble reached new record highs. Among the ‘Magnificent 7,’ Meta briefly surpassed its previous record high two weeks ago, but this resulted in a false breakout on the weekly chart. The stock has since recovered by 18%, as have Amazon and Tesla. Nvidia outperformed them all, with a gain of 32%.

Investors must distinguish between volatility and risk

Volatility represents temporary fluctuations that don’t necessarily impact the fundamental value of a long-term investment, while risk involves a permanent loss of asset value. In the U.S., a cooling labor market is increasing recession risks. However, declining inflation is creating room for rate cuts—markets are pricing in a 100-basis-point reduction by the end of 2024, with another 100 basis points expected in 2025. The Fed is anticipated to follow the ECB’s lead on September 18 and initiate a shift in interest rates. Another reason for optimism is that S&P 500 companies are projected to achieve 15.5% earnings growth in Q4 compared to the previous year.

Earnings and events

Key focus will be on U.S. non-farm payrolls and the unemployment rate this Friday, as these figures contributed to the ‘Black Monday 2024’ event on August 5. Besides, there will be fresh PMI data in both the US and China.

On the list of companies reporting earnings, chip stock Broadcom stands out. AI-focused investors will try to get more info on the progression of TPU sales to Google and others. Cybersecurity company Zscaler and Chinese car manufacturer NIO will also open the books.