Please see this week’s market overview from eToro’s global analyst team, which includes the latest market data and the house investment view.

Markets taking a pause after the ‘Trump rally’

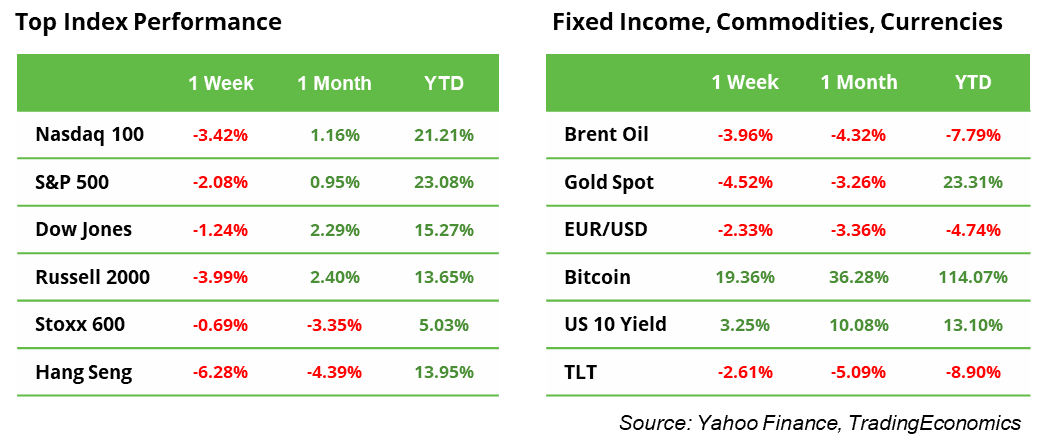

Last week, equity markets saw the end of the Trump rally, at least for now. The S&P 500 Index closed above 6,000 for the first time ever on Monday, but finished the week 2.1% lower (see table). Similarly, the Dow Jones reached 44,000 before ending down 1.2%. The Nasdaq 100 peaked above 21,000 but fell 3.4% from the close on 8 November. US equity indices surged after Trump’s election victory, driven by promises of lower taxes and less regulation, which were expected to boost entrepreneurship and profits among the country’s largest companies.

With the exception of cryptocurrencies, most other financial markets were weighed down by the prospect of more tariffs in the coming months. The European STOXX 600 lost 0.7%, the Japanese Nikkei 225 dropped 2.2%, and the China-focused Hang Seng Index fell 6.3%. The US dollar strengthened further to 1.05, bolstered by Jerome Powell’s statement that ‘the Fed is not in a hurry to lower interest rates’ amid stable macroeconomic data and the expectation of potentially higher inflation if the new Trump administration adopts more expansive policies. The strong dollar also negatively impacted emerging markets (-3.8%), gold (-4.5%), and oil (-4%).

Crypto markets, however, responded positively when Trump announced the creation of a new Department of Government Efficiency, which can be abbreviated to DoGE. This led Bitcoin to a new all-time high, closing above $90,000. The small size of the crypto market means it remains highly volatile, especially when even modest amounts of capital move between asset classes.

The week ahead

Looking ahead, all eyes will be on NVIDIA’s quarterly earnings report, due on 20 November after the close. Other companies set to report include retailers Walmart and Target, cybersecurity specialist Palo Alto Networks, and US-listed Chinese firms Baidu, PDD, NIO, and Xpeng. On 22 November, several countries will release their flash PMI figures for November.

With the US Q3 earnings season nearly complete (93% of S&P 500 companies have already reported) and just six full trading weeks left until the year-end, investors will also be turning their attention to the potential for a ‘Santa rally’ and to Outlook 2025 presentations.

Blackwell chips and datacenters: NVIDIA’s outlook is key to reach new record highs

NVIDIA’s success story seems almost too perfect to be true, and therein lies the risk. Even the smallest disappointments could trigger a strong reaction from investors. However, if NVIDIA delivers as expected, a new record high may only be a matter of time. Despite high expectations, the chip giant managed to avoid significant profit-taking last week, and the stock remains near its record high.

The anticipation ahead of the quarterly earnings report is palpable. Investors are looking for answers to key questions: the availability of the highly sought-after Blackwell chips, growth in the datacenter division, and possibly the next upward revision of the company’s outlook. Forecasts suggest an 85% year-over-year increase in earnings per share to $0.74 and an 82% year-over-year jump in revenue to $33.1 billion. Since the start of the year, the stock has risen by an impressive 196.9%, or eight times the performance of the S&P 500.

Yen devaluation puts the Bank of Japan in the spotlight again

As an example of what’s happening in currency markets, the yen continued to lose ground last week. The USDJPY pair rose by 1.8% to over 155 – its highest level since July. This is a direct result of Trump’s victory, which significantly boosted the US dollar and drove US bond yields higher. Traders are pricing in the promised higher US import tariffs, which are fueling inflation expectations while making rate cuts less likely.

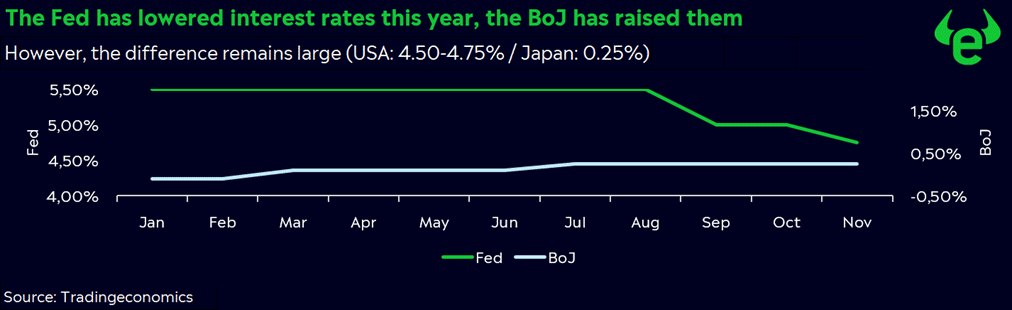

The US dollar received additional support from the rebound in US inflation, which rose to 2.6% in October. The existing interest rate differential between Japan and the US continues to make carry trades attractive, even as the monetary policies of the Fed and the Bank of Japan converge. While the BoJ is raising rates, the Fed is cutting them (see chart).

The situation could become particularly critical if USDJPY continues its upward trajectory unchecked. The BoJ may be forced to raise rates earlier or more aggressively. Attention is also focused on whether Japan will need to intervene in the currency market again to stop the yen’s depreciation. This year, Japan has already spent a record $63 billion on interventions. Japan’s inflation data on Friday will be key in assessing the BoJ’s next steps.

Earnings and events

Earnings releases:

19 Nov. Walmart, Xpeng

20 Nov. NVIDIA, Palo Alto Networks, Target, TJX, NIO

21 Nov. Baidu, PDD, Deere