- Rheinmetall’s sales have soared on the back of increased NATO spending

- The company is facing multiple risks that could endanger growth

- Valuations are sky-high, leaving little room for error

Geopolitical tensions and defense spending are soaring in Europe, propelling Rheinmetall’s shares to new heights. Germany’s largest defense manufacturer has seen its stock surge over 100% this year, with an additional 27% gain following Donald Trump’s return to the White House. The company continues to set new records in sales, profits, and order backlogs, driven by rising military budgets across NATO allies. But with high expectations and geopolitical uncertainties, investors are left wondering if Rheinmetall has more room to grow.

Rheinmetall Q3 results: Another Record Quarter

Rheinmetall’s third-quarter results showed increasing demand. Sales grew 40% year-over-year, reaching €2.6 billion, while EPS climbed 30% to €6.32. The company also expanded its operating margin by 1% to 12.3%, driven by continued demand, especially in the Vehicle Systems and Weapon and Ammunition segments. Rheinmetall’s order backlog also continued to grow, reaching $52 billion, or almost 5x the guided sales for 2024.

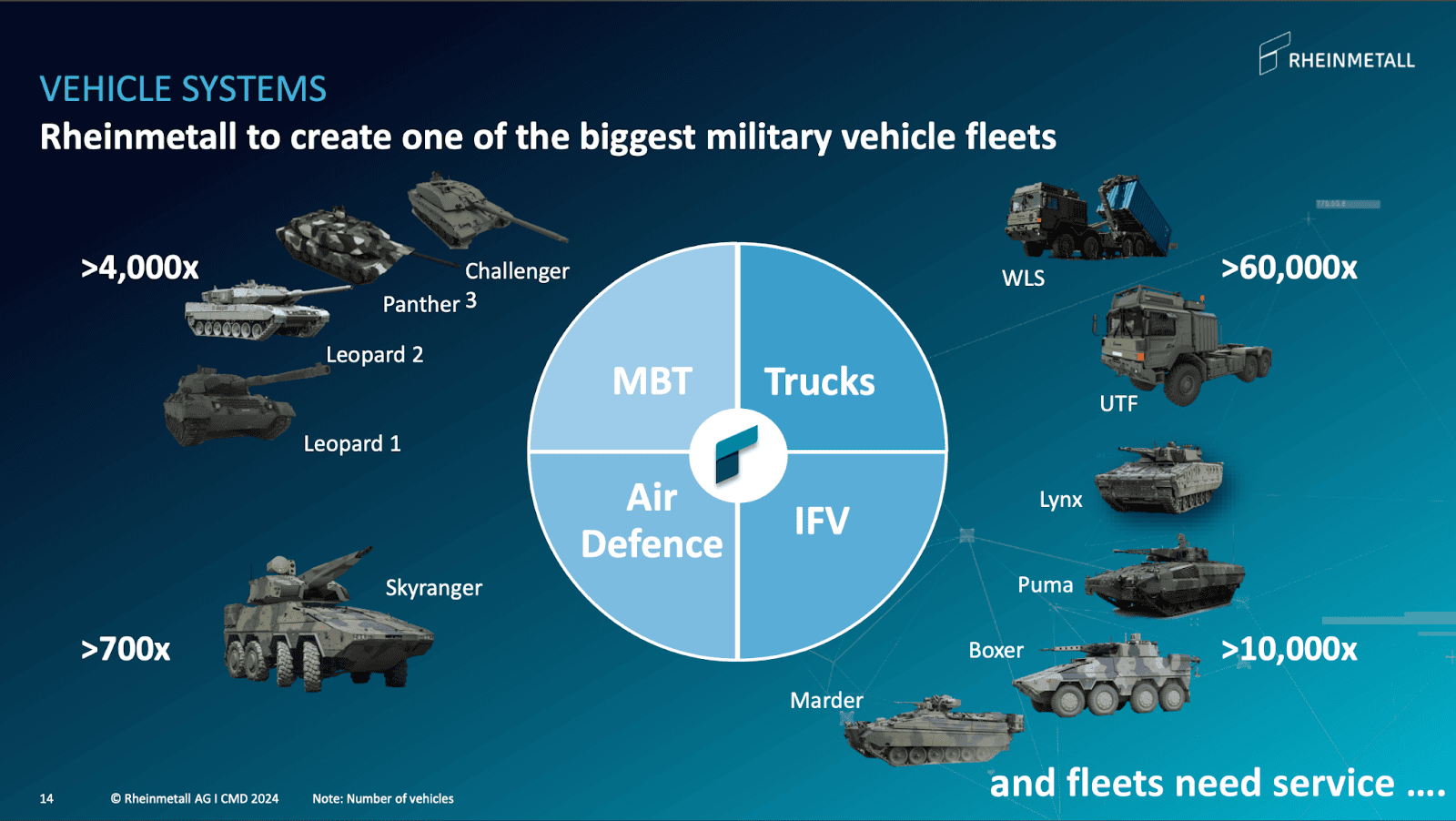

Vehicle Systems: The Backbone of Rheinmetall

Rheinmetall’s Vehicle Systems division accounted for over 50% of sales in Q3, generating €1.23 billion, representing 87.6% YoY growth. The division secured significant contracts during the quarter, including:

- €2.9 billion for 6,500 military trucks for the German Army

- €151 million for Leopard tanks for the Czech Republic

- €280 million for armored vehicles for Algeria

Demand in this segment is very robust, which is why Rheinmetall is expanding its global footprint and offerings through heavy investments. Collaborations like the joint venture with Leonardo and the acquisition of Loc Performance in the U.S. expand its manufacturing footprint and product capabilities.

Source: Rheinmetall Investor Relations

Growth catalysts for the segment include not only battlefield digitization, which is becoming a key part of Rheinmetall’s strategy, but also increasing interest from NATO members in replacing outdated, Soviet-era equipment.

Rheinmetall expects Vehicle Systems sales to grow at a pace of ~35% annually through 2027 while operating margin is also expected to increase to 13 – 15%.

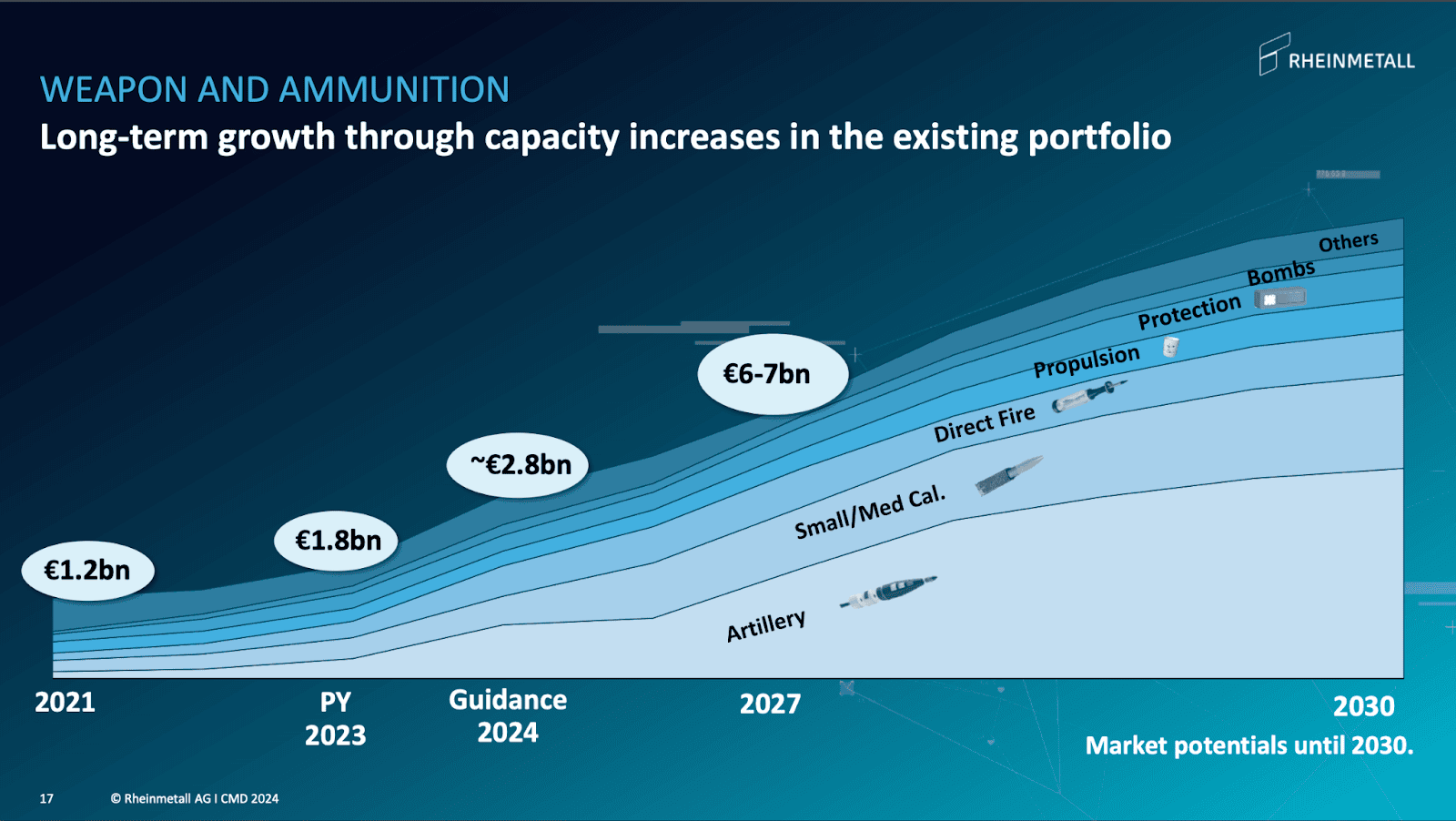

Weapons & Ammunition: Expanding Capacity to Meet Demand

The Weapons & Ammunition division, responsible for 20% of sales, has seen massive demand since the start of the Ukraine conflict. Allies are rushing to replace and expand their ammunition stockpiles, with Ukraine alone firing tens of thousands of artillery shells each month. Rheinmetall has responded with aggressive capacity expansion:

- A new ammunition plant is being built in Unterlüß, Germany, and it is expected to produce 200,000 artillery shells annually.

- An upcoming plant in Ukraine is set to open in 13–14 months, and it already has over €100 million in pre-orders.

- The acquisition of Spanish ammunition maker Expal contributed €352 million (around 26%) in sales in the first nine months of 2024.

Source: Rheinmetall Investor Relations

These investments cement Rheinmetall’s position as a key supplier of NATO-compliant munitions, but they also come with risks. Overbuilding capacity could strain margins if demand normalizes post-conflict. These capital-intensive investments force Rheinmetall to carefully assess the long-term viability of these projects.

Risks Facing Rheinmetall: Political and Geopolitical Uncertainty

While Rheinmetall’s growth is compelling, defense is a hard-to-predict industry. One of the most significant challenges is the reliance on heightened geopolitical tensions to drive demand. Here are three key risks to consider:

1. End of the conflict in Ukraine

The Ukraine conflict has been a major catalyst for Rheinmetall’s recent growth. If the conflict were to be resolved, as we all hope it will, the urgency driving current demand may diminish, and Rheinmetall could face both a slowdown in demand and decreasing investor appetite. This is especially important due to its high valuation, which we’ll discuss later.

2. Political Shifts in Germany

In November, Germany’s coalition government collapsed following Chancellor Olaf Scholz’s dismissal of Finance Minister Christian Lindner. Early elections are expected in 2025, and leadership changes could delay defense spending decisions.

On the earnings call, CEO Armin Papperger reassured investors: “We see absolutely no big impacts,” adding that in the worst case, Rheinmetall may face delays of “ maybe four, six or eight weeks in some of the order intakes.”

Direct impact is also limited because Rheinmetall’s capacity for 2025 is already fully booked.

3. Overcapacity Concerns

Rheinmetall’s aggressive acquisitions and capacity expansions could become a liability if demand doesn’t meet expectations. Overbuilding could erode margins and leave the company with excess capacity, especially as the current elevated demand is tied to ongoing conflicts.

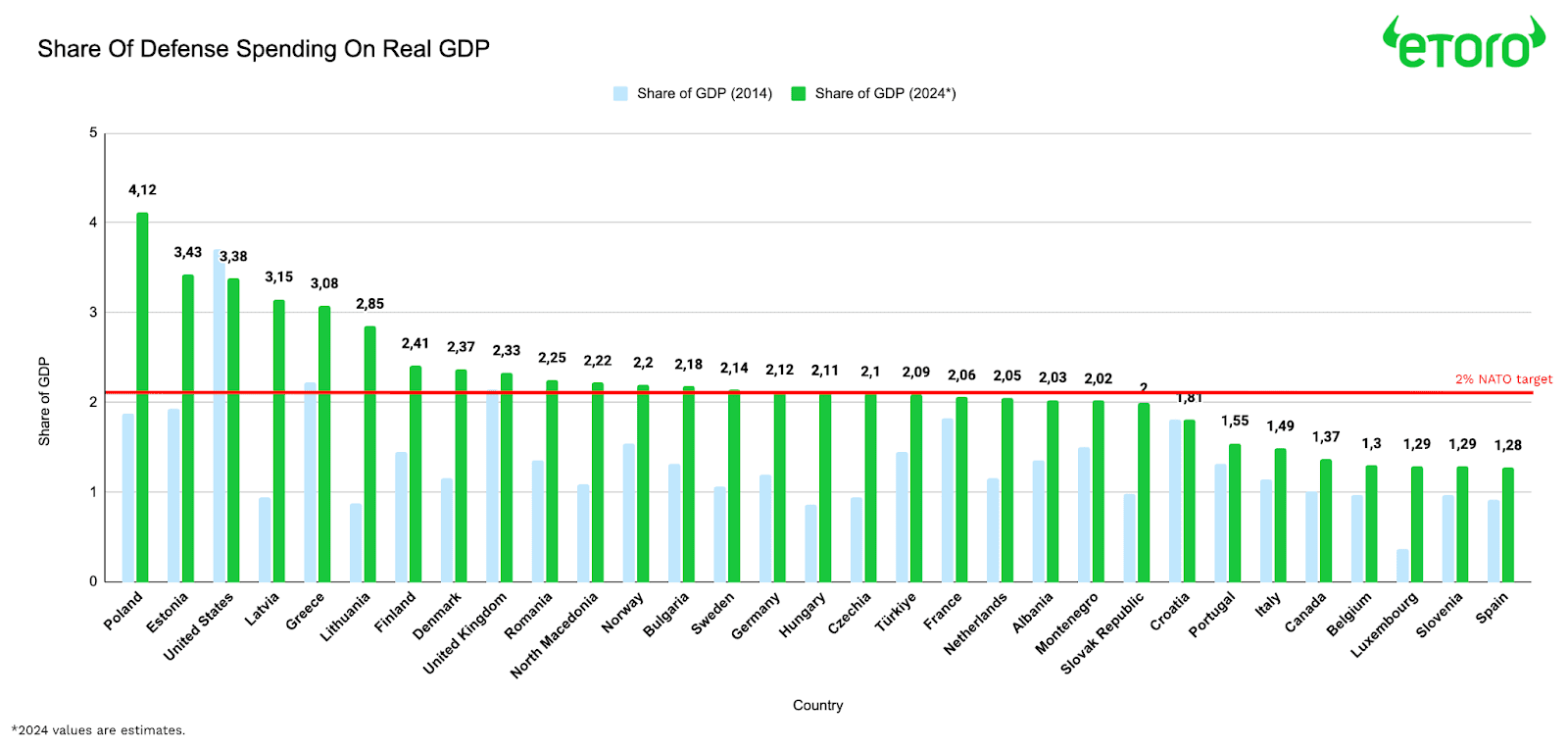

NATO Spending: The Long-Term Growth Driver

Rheinmetall has directly benefited from NATO’s renewed focus on defense spending. The conflict in Ukraine showed that allied countries were not well prepared for active warfare, and stockpiles quickly ran out. As a result, NATO’s 2% spending goal, long ignored by European allies, has become a key political objective.

Source: NATO

Germany’s decision to create a €100 billion special defense fund in 2022 set the tone for the region. Rheinmetall has been a major recipient of this spending, securing contracts for military vehicles, tanks, and ammunition. Other nations, including Poland, Hungary, and Romania, are also ramping up budgets to modernize their forces with NATO-standard equipment.

Additionally, with Donald Trump being elected as president of the United States, CEO Armin Papperger expects the US to increase pressure on NATO allies to spend more than the current goal of 2% of GDP, saying: “At the end of the day, there will be big pressure and this pressure helps us to get budget.”

Rheinmetall is well aware of the significant opportunities before it. “We are experiencing growth like we have never seen before in the Group. We have entered into pioneering collaborations and have promising projects in many countries – for example, in the USA, Great Britain, Italy, and Ukraine,” said CEO Armin Papperger on the Q3 earnings call.

This shift in NATO spending is likely to remain a long-term growth driver for Rheinmetall, providing it with reliable and predictable revenue streams. However, it depends on continued political support for defense spending, which could fade if geopolitical tensions ease.

Rheinmetall’s Finances: A Look Under The Hood

As demand surged and Rheinmetall’s CapEx and acquisitions expanded, it’s important to examine its financial health.

A quick look at the balance sheet tells us that as of Q3, Rheinmetall had a healthy net debt-to-equity ratio of 0,5. In absolute terms, net debt stood at 1,33 billion euros. However, Rheinmetall has more than 2 billion € in credit capacity that it can use for further expansion, such as the acquisition of Loc Performance. Rheinmetall’s debt looks sustainable.

However, investors must remember that as an asset-heavy business with an ROA of just 4,7%, Rheinmetall needs to sustain its investments to grow – something that might prove challenging if geopolitical conditions stabilize. It also puts a cap on growth, which brings us to the last part of this article.

Rheinmetall’s Valuation: Are Expectations Too High?

Rheinmetall’s forward P/E ratio has climbed from 15 to 22 over the past year, reflecting high investor expectations.

However, a forward P/E of 22 places Rheinmetall at par with industries such as tech and luxury goods. A premium in the defense industry. We can agree that the growth dynamics in this sector are much different. While the defense sector enjoys a favorable environment, Rheinmetall’s reliance on geopolitical tensions introduces significant uncertainty. At such a lofty valuation, even minor headwinds could trigger a sharp decline in the stock price.

Source: gurufocus.com

Compared to its European peers, such as BAE Systems, Leonardo, and Thales, or American defense giants like Raytheon, Lockheed Martin, and Northrop Grumman, we can see that Rheinmetall is the most expensive defense stock. Such a premium valuation raises questions about its sustainability.

Rheinmetall’s shares are far from a bargain. The key question for investors is whether you believe demand will remain strong and predictable enough to justify categorizing the stock as a long-term growth play. Without reliable demand or continued tailwinds, the premium valuation could become a vulnerability rather than a strength.