Strong start to the second half of 2024

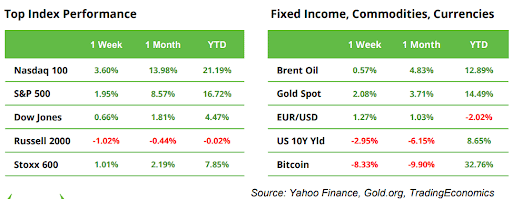

Last week, the S&P 500 (+2%) and Nasdaq (+3.6%) had a strong start to the year’s second half, driven by labour market data that supports the case for the Fed to cut interest rates. Tesla stock rose 27% on the back of higher-than-expected delivery numbers and growth in energy storage. In Asia, stock market indices in Japan and Taiwan reached all-time highs.

Soft macro data caused bond yields to go down, as well as the US dollar. Sterling traded higher after the Labour landslide win in the UK elections. Crypto markets took a beating when the trustees of the failed exchange Mt. Gox moved $2.7 billion worth of Bitcoin to a new wallet. In France, contrary to expectations, the far-left rather than the far-right won the elections, but without an absolute majority, raising worry about an ungovernable country for the coming years.

The main focus this week will be on US CPI, the start of the Q2 earnings season (both detailed below), and the European market’s response to the UK and French elections.

The bar for the upcoming US earnings season is set high

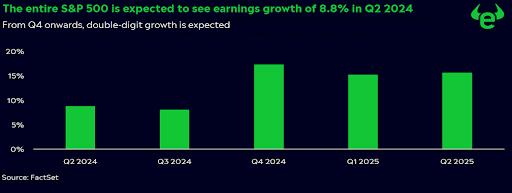

With Wall Street and earnings expectations at record levels, it is becoming increasingly difficult to meet expectations and continue the rally. The banks will kick things off: BlackRock, Citigroup, JPMorgan, and Wells Fargo will report on Friday, followed by Goldman Sachs on Monday and Bank of America and Morgan Stanley on Tuesday. Their quarterly results will reveal how the banks have fared in an environment of high interest rates and slower growth. Financial companies are expected to rank seventh out of eleven sectors in the S&P 500, with anticipated earnings growth of 4.2% for the second quarter. The entire S&P 500 is expected to see earnings growth of over twice that rate at 8.8%, accelerating to double-digits for Q4 onwards (see chart).

European corporate earnings set to move back into positive territory

In comparison, for the European STOXX 600 earnings growth is projected at 1.4% for Q2 (if true, as first positive reading since 2023 Q1), and 10.1% for Q3, although both numbers have recently been revised down from 3.1% resp. 11.9% due to political uncertainty.

Inflation remains the most important number for investors

This week is inflation week! US consumer prices (CPI) fell to 3.3% year-on-year in May. This is still too high for the Fed to justify a turnaround in interest rates. For June, the market consensus forecasts a fall to 3.1%. The two biggest drivers of inflation recently have been Transport Services (10.28%) and Shelter (4.56%). Energy came in at just 3.41%. Used cars and trucks (-8.64%) contributed the most to easing price pressures.

Gold is almost keeping pace with the S&P 500 this year (14% vs 16%)

A decline in inflation is important not only to keep Wall Street’s rally alive, but also for commodities, especially gold. Increasing expectations of interest rate cuts would put pressure on bond yields and weaken the dollar. Falling bond yields make gold more attractive as a safe haven and a weaker dollar makes it cheaper. The precious metal is trading 4% below its record high of $2,450 an ounce.

China: CPI on Wednesday, trade data on Saturday

Unlike in the US or Europe, inflation in China is not too high but rather too low. The CPI shows an increase of only 0.3% year-on-year. The risk of deflation has not been completely shaken off despite the support provided to the economy so far. More stimulus from Beijing is necessary. The ongoing real estate crisis continues to weigh heavily, and domestic demand remains weak. For the past two months, exports have exceeded imports again. This is driven by increasing global demand but also influenced by a lower base effect, making the numbers appear better than they truly are compared to the low levels of the previous year.

Earnings and events

Besides some of the largest US banks, we will see earnings data from Delta Air Lines and Pepsico on Thursday. Looking over the weekend, next week investors will get a first impression on earnings growth in the technology sector when chip stocks ASML and TSMC open the books, as well as Netflix.