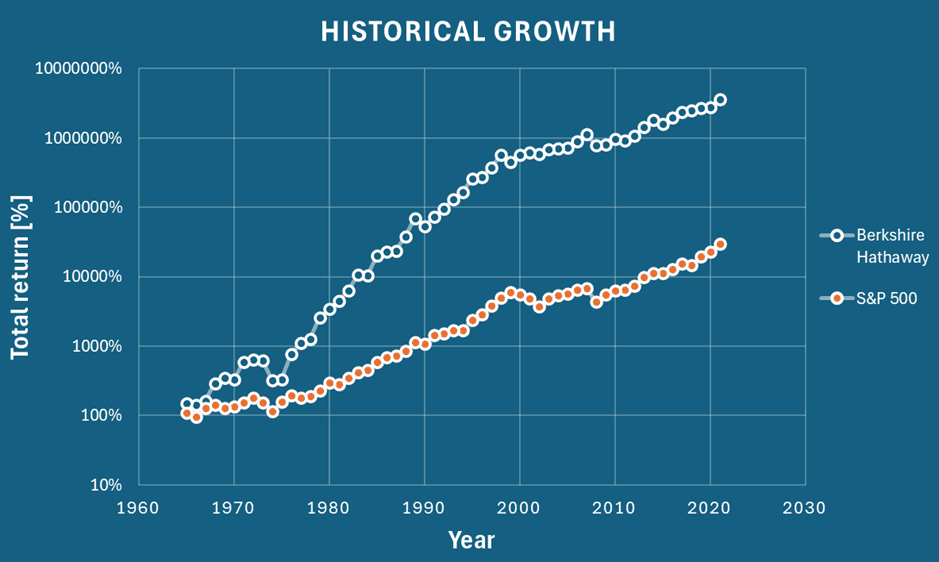

Did you know that Berkshire Hathaway ($BRK.B) has consistently outperformed the S&P 500 for decades? Imagine the financial freedom and peace of mind that comes from investing in a company with such a proven track-record. Since 1965, BRK has beaten the market in 39 out of 58 years.

The historical growth of BRK vs S&P 500 is shown in the figure below, note that for comparative purposes the total return is shown on a log scale. For the period between 1964 and 2021 BRK outperformed the S&P 500 with an overall gain of 3 641 613% while the S&P 500 achieved a mere 30 209%. A remarkable track-record indeed.

Data source: https://berkshirehathaway.com/letters/2022ltr.pdf?mod=article_inline

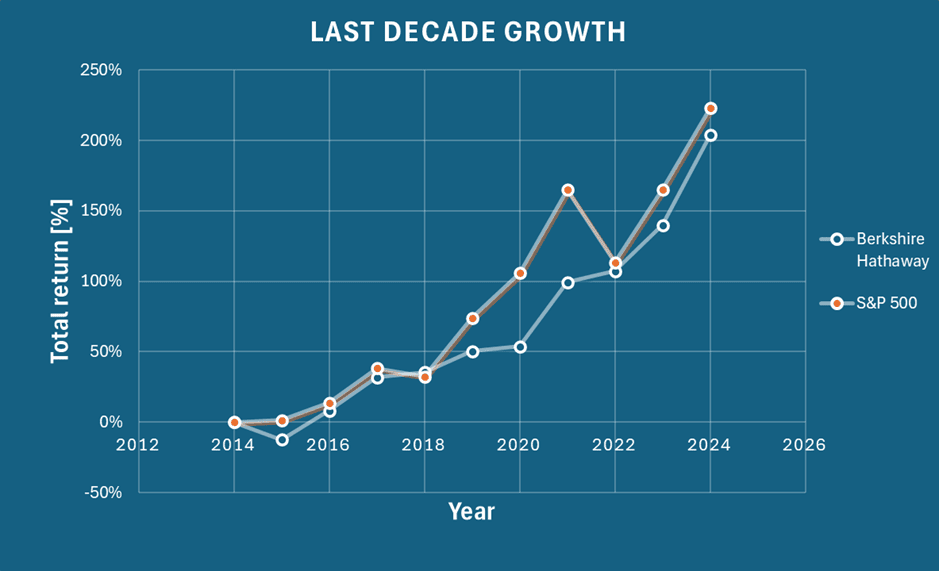

The market cap of $BRK.B increased from $345.19 billion in Oct 2014 to $985.8 billion USD in Oct 2024, making it the 9th most valuable company in the world today. Concerns were raised as to whether Warren Buffet could sustain the historical performance given the size of the conglomerate. The last decade of performance vs the S&P 500 gives some insight to the question. The S&P 500 outperformed BRK by 19% over this period.

It should be noted that this is not the first time that the S&P 500 outperformed BRK for an extended period. From 1970 to 1975, the S&P 500 outperformed BRK by 27%. Fast forward just 1 year to 1976, BRK outperformed the S&P 500 by 68%, following a gain of 129.3% by BRK (S&P 500 gained only 23.6%). This is not surprising, as value investing requires the market to realise the true value of an undervalued company, which could take years.

Taking another look at the performance over the last decade, it is evident that during COVID, the S&P 500 outperformed BRK significantly, however, during the 2022 bear market, BRK experienced growth while the S&P 500 retracted by 20%. This is testament to the risk adverse strategy incorporated by BRK. Warren Buffett is a firm believer that avoiding large capital losses, is key to long-term growth.

Data source: https://www.macrotrends.net/stocks/charts/BRK.B/berkshire-hathaway/revenue

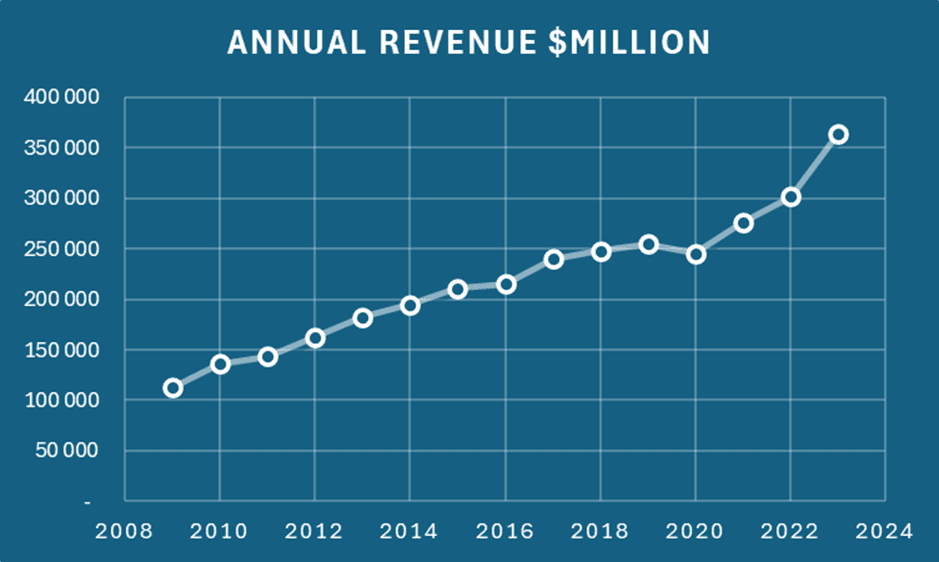

BRK’s Earning Power

As shown in the figure below, the annual revenue has shown consistent growth since the 2008 recession. The revenue is only one part of the story, we should shift our focus to the earnings stemming from the revenue growth. The net income can be a good indicator; however, it makes more sense to look at the operating income to assess the real returns generated by the company.

Data source: https://www.macrotrends.net/stocks/charts/BRK.B/berkshire-hathaway/revenue

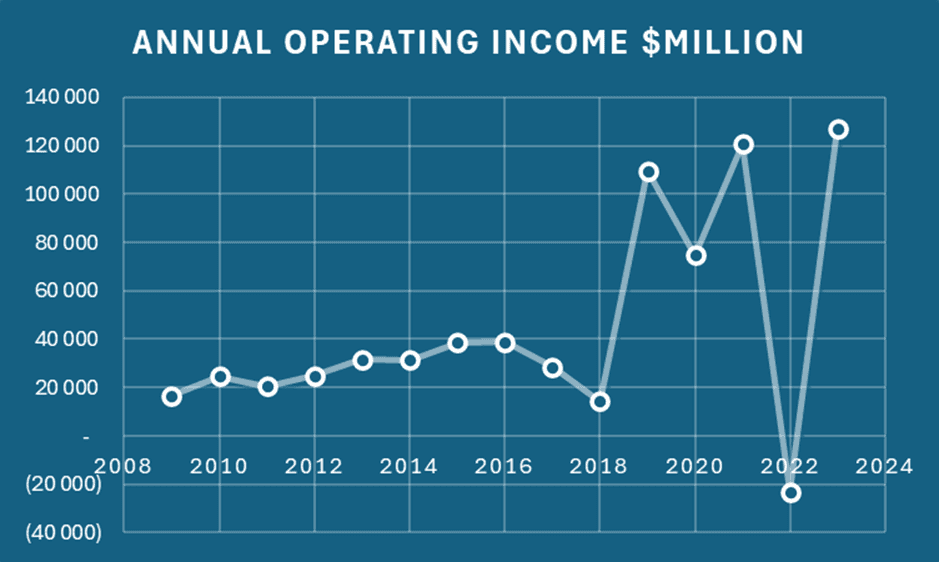

As demonstrated in the chart below, BRK’s operating earnings have exhibited a remarkable upward trend over the past decade. This sustained growth is a testament to the company’s ability to generate consistent returns for its investors. Increased earnings often lead to higher dividends and potential stock price appreciation, making BRK an attractive investment for those seeking long-term capital growth.

Data source: https://www.macrotrends.net/stocks/charts/BRK.B/berkshire-hathaway/revenue

A Deep Dive into the success of BRK

Under the leadership of Warren Buffett, one of the most respected investors of all time, BRK has consistently delivered exceptional returns. The company’s focus on acquiring businesses with enduring economic value and holding them for the long term has proven to be a winning strategy. For example, BRK’s investment in Apple has yielded an impressive 845.7% return over the past 8 years.

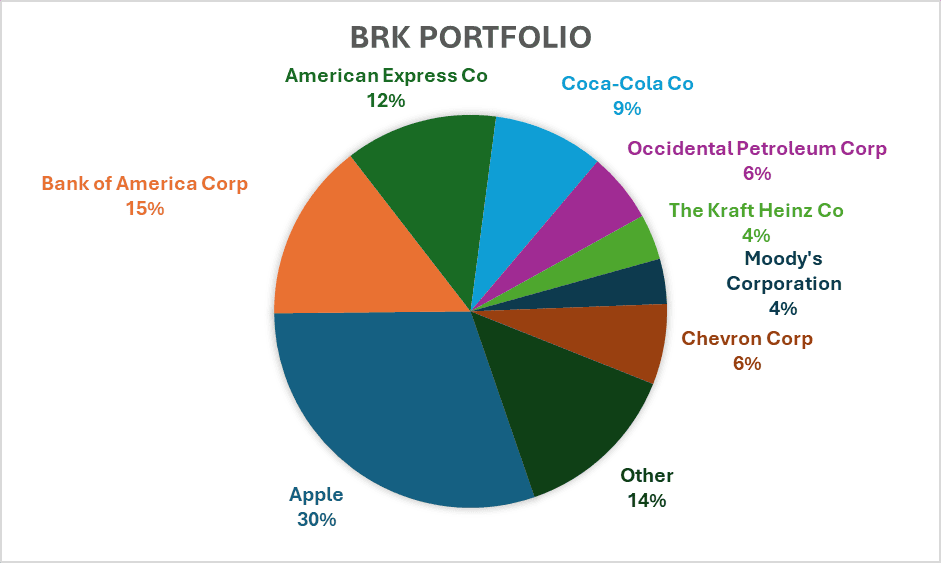

While investing in a single company can carry risks, BRK’s diversified portfolio, which includes stakes in major holdings like Apple, Coca-Cola, Bank of America, and Kraft Heinz, helps to mitigate these risks. By entrusting your savings to BRK, you are not just investing in a company; you’re investing in a proven investment philosophy and a team of experienced managers.

Below is the current composition of BRK’s portfolio. The chart does not include the treasury bills held by BRK or their cash reserves.

Data source: https://www.gurufocus.com/guru/warren%2Bbuffett/current-portfolio/portfolio?view=table

Strategy in action

BRK’s investment strategy is exemplified by its holdings in Apple and Coca-Cola. Apple was acquired in 2016, trading at $26.90 per share at year end. Today, the stock market is trading at $227.50, delivering a total return of 845.7%, excluding dividends. Similarly, the investment in Coca-Cola in 1988, trading at $2.69 per share at end of year, resulted in a 2 586% return, with the stock price now at $29.57 after holding it for 36 years. Additionally, Coca-Cola paid dividends throughout the period. As you can see, both investments have significantly outperformed the market, demonstrating the effectiveness of BRK’s long-term approach.

Risks

The inherent risk of BRK is managed with diverse investments across multiple industries in businesses delivering returns. The current portfolio includes a mix of US and international companies, further mitigating risk through diversification. The logic is to pick a limited number of good stocks and avoid new stocks which could dilute the overall return. On top of the stock portfolio, they are also invested in the insurance business.

BRK is exposed to market risk, and in anticipation of potential downward changes, redirected investment from stocks to treasury bills. The large amount of cash and treasury bills are therefore a strategy to mitigate the risk of a bear market, but also be ready to seize attractive opportunities that arise from a potential bear market. BRK is potentially expecting a significant market drawback, akin to the 2000 dotcom bubble bursting.

Another risk speculated about in the market is what the future will hold if CEO, Warren Buffet, now 93 years old is no longer there. Good CEO that he is, planned for succession and earmarked Greg Abel who runs BRK’s non-insurance operations. Abel is a certified public accountant and has been with BRK since 2000, when the energy company he ran was bought by BRK. Abel is a dealmaker and led the way in some of BRK’s biggest and most successful acquisitions.

Buffet is of the opinion that the share price will increase on his passing, because of an attempted value-enhancing conglomerate breakup.

The question is still whether his successors will be able to sustain his track-record. Only time will tell.

Value of the business

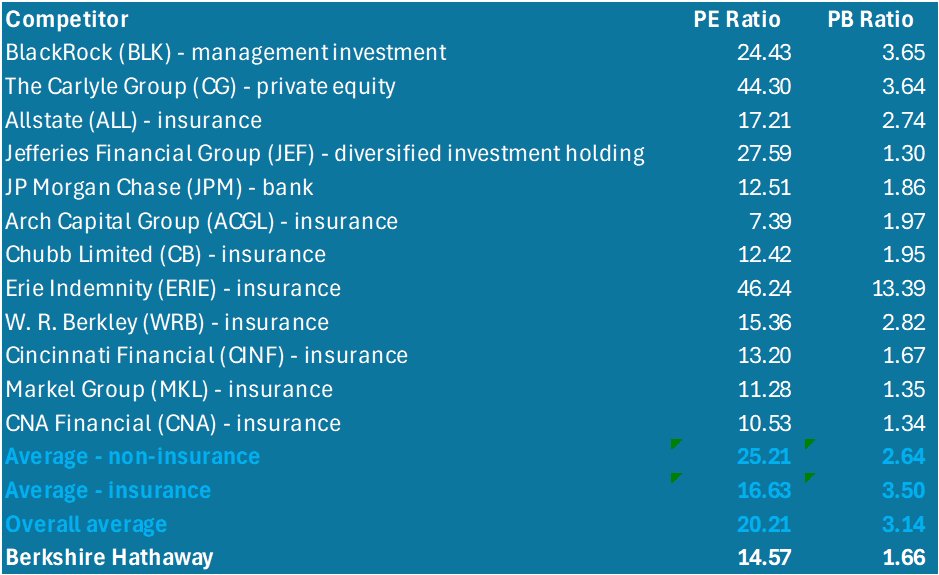

BRK is a conglomerate with investment in insurance, finance and consumer goods and it difficult to match with similar businesses due to the diversification into multiple industries. Below is a comparison to some competitors:

BRK’s PE (price-to-earnings) ratio is currently 14.57, making it reasonably priced compared to its competitors in the market. Similarly, is the PB (price-to-book) ratio lower than the average. All things being equal, it is better to buy a company with a lower PE ratio, because you are getting more earnings for your investment.

Warren Buffet indicated that moderate growth is expected and based on the PE ratio, there is not exceptional growth in earning expectations. Given the historical operating profits and the focus on improving them, BRK is likely to exceed market expectations. This is supported by rising earnings estimates and the consequent rating upgrade that implies improvement in the company’s underlying business.

The Discounted Cash Flow (DCF) valuation of BRK, based on a WACC of 7% and a 3.5% growth rate, is $462.47 per share. Compared to the current price of $454.01 it has an upside of 1.9%, which is an indication that the intrinsic value of the company is higher than what the market price it at. As of June 30, 2024, BRK’s book value was $607.97 billion. Currently, BRK’s market value is $985.8 billion. As mentioned before, BRK trades at a lower premium (PB ratio) than its competitors.

Based on the company’s historical earnings, rising estimates, its minimal risk, consistent growth strategy, and strong financial position, BRK appears to be an attractive investment option for those seeking steady returns and limited risk.

Closing remarks

In conclusion, BRK presents a compelling investment opportunity for investors seeking excellent long-term returns, with limited risk. The company has an excellent track-record spanning decades, is well diversified, and has a strong financial position, making it an attractive investment option.