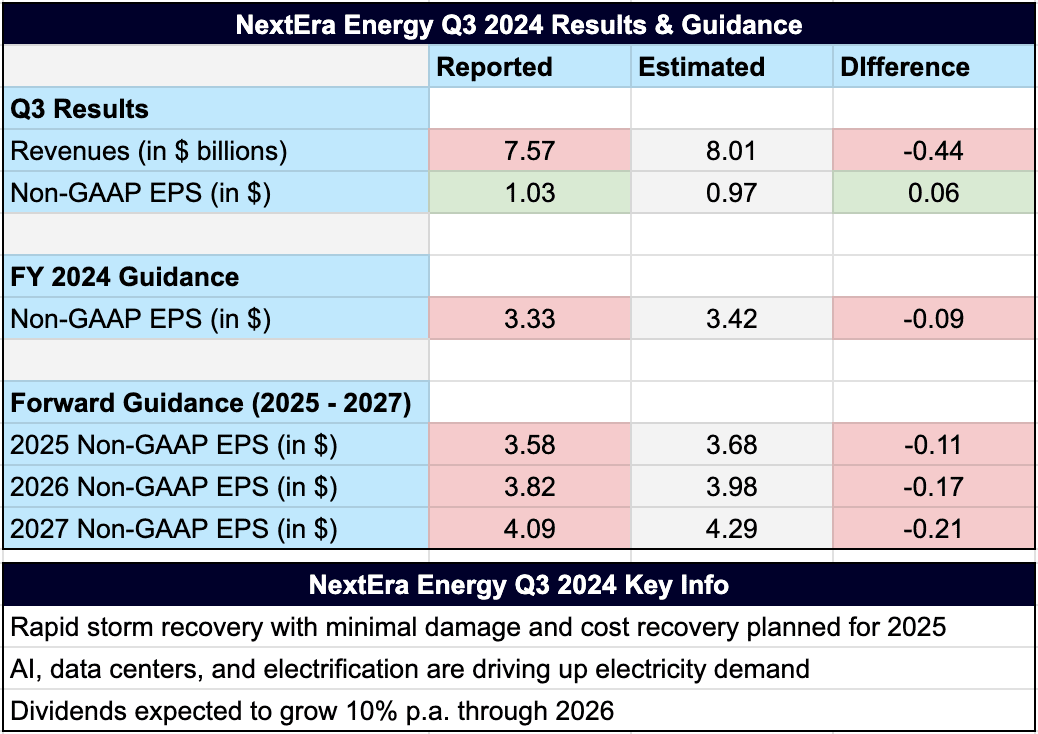

- Earnings beat: Adjusted EPS of $1.03 (up 9.6%) beats expectations despite revenue miss.

- Hurricane recovery: Rapid storm recovery from Hurricanes Helene and Milton, with minimal damage and cost recovery planned for 2025.

- Rising demand: Demand for clean energy is enjoying multiple tailwinds across industries, positioning NextEra for long-term growth in renewable energy.

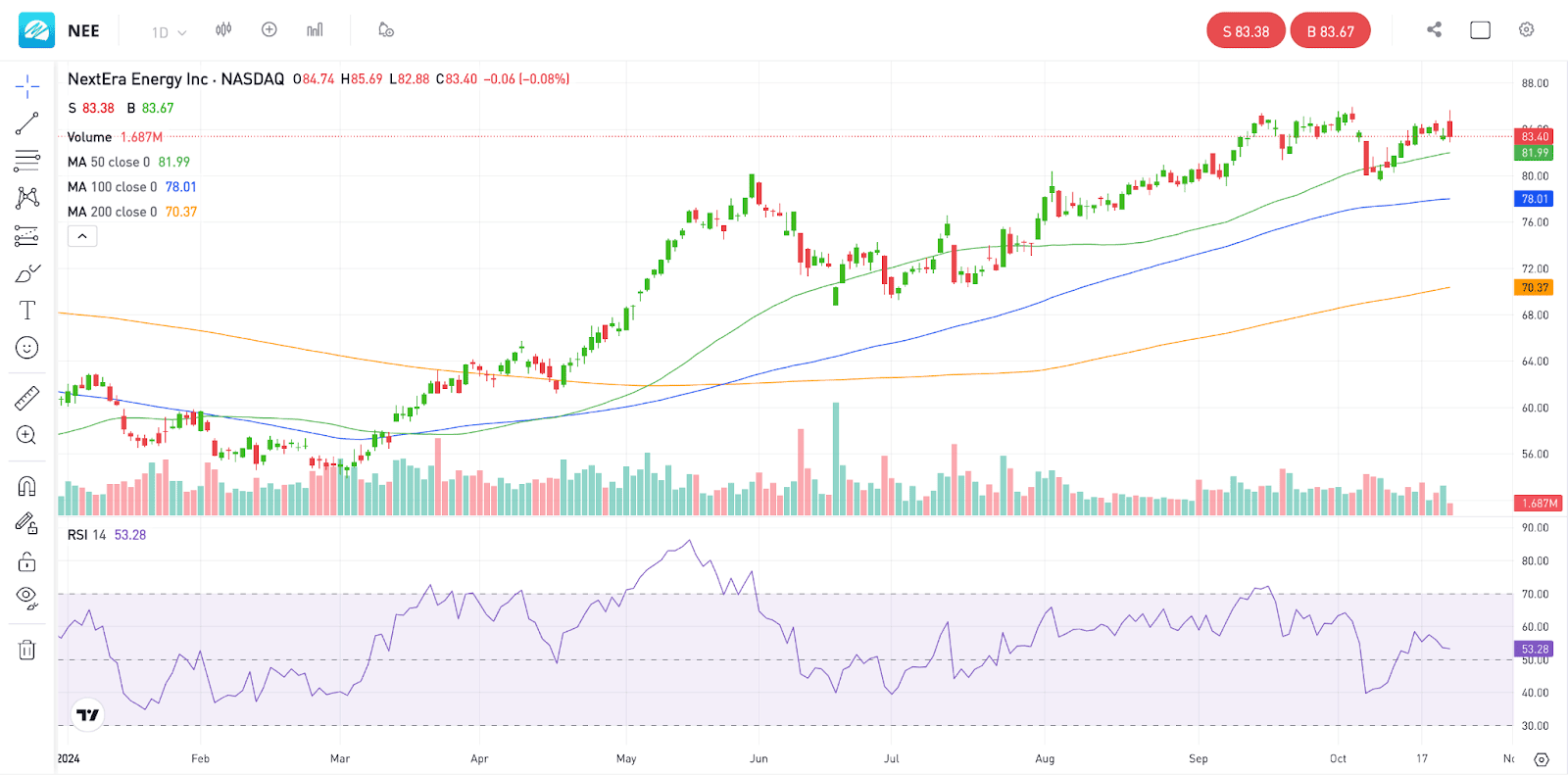

NextEra Energy (NEE) shares have been on a tear this year, with the stock climbing nearly 38% year-to-date, outpacing the S&P 500, which has risen approximately 23%. The company enjoys multiple tailwinds, such as increased electricity demand, higher prices and positive market sentiment. But how bright are NextEra’s future prospects? Let’s dive in.

– NextEra’s shares are on a tear this year, source: eToro

Meet the world leader in renewable energy

For those of you unfamiliar with the company, NextEra Energy is the largest renewable energy provider by market capitalization. It primarily generates electricity from wind and solar, with smaller operations in natural gas and nuclear energy.

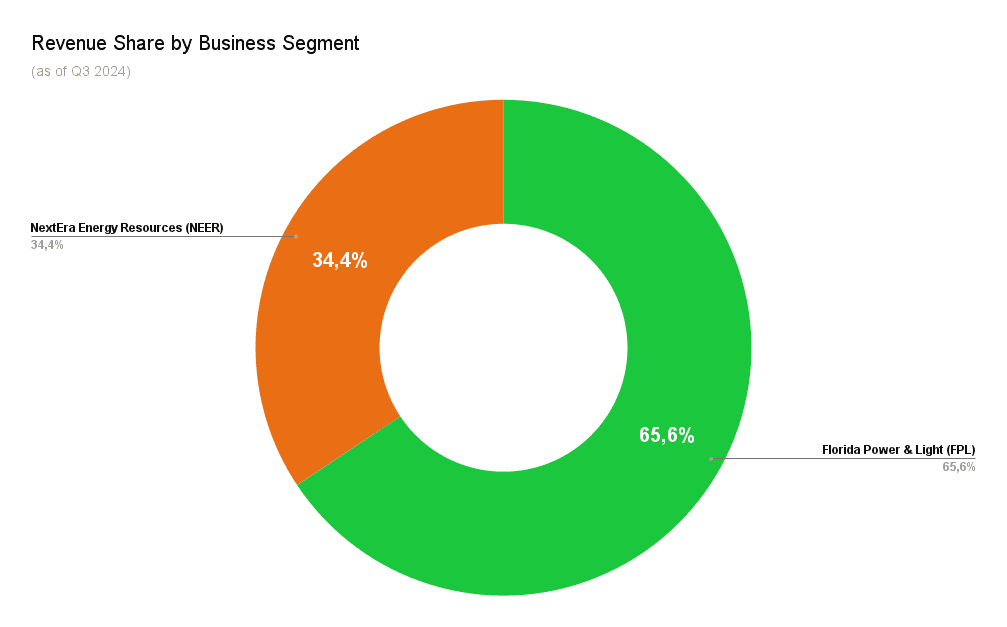

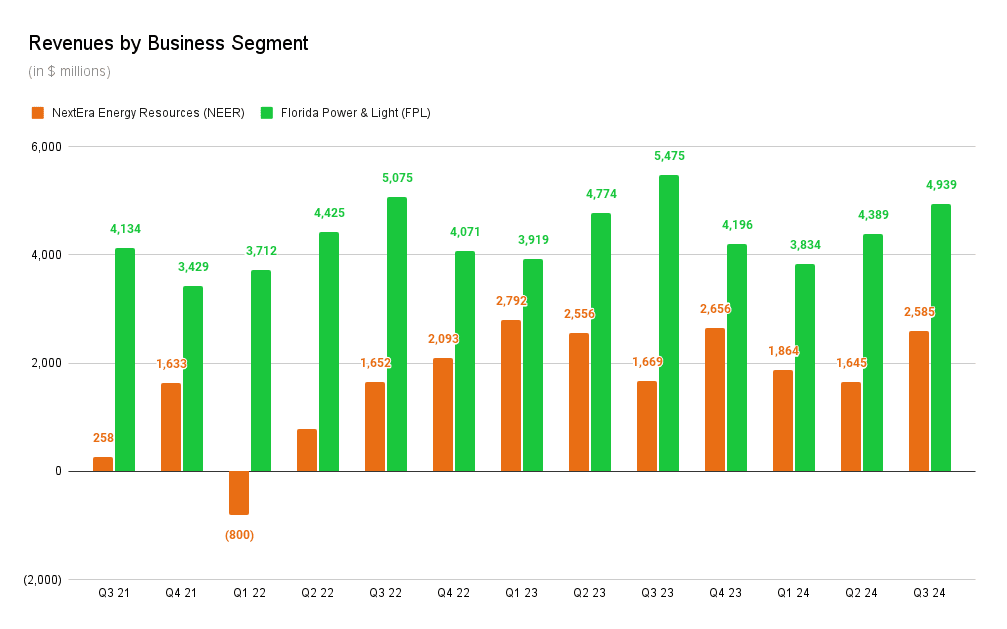

NextEra operates through two key subsidiaries:

- Florida Power & Light (FPL): Florida’s largest renewable energy provider, serving over 12 million people.

- NextEra Energy Resources (NEER): Oversees operations in the U.S. and Canada, focusing on renewable energy projects.

– FPL earns the lion’s share of NextEra’s revenue, source: NextEra Energy 10-Q statement

After posting its Q3 results before the bell on Wednesday, it seems that the sun is still shining on this stock. Despite missing revenue expectations, NextEra beat EPS estimates by 4%, posting adjusted EPS of $1.03, representing a 9.6% increase compared to last year on revenues of $7.57 billion (up 5.4% from Q3 ‘23), underscoring the company’s operational strength and growth trajectory.

NextEra delivers another bright quarter

NextEra’s growth continues to be driven by increasing electricity demand and a strong construction pipeline.

- FPL generated $0.63 per share in net income (up from $0.58 last year) thanks to increased capital investments. Regulatory capital employed rose 9.5% YoY, with total capital investments expected to be $8-8.8 billion this year. Already, FPL has the largest utility-owned solar portfolio in the US.

- NEER earnings reached $0.47 per share (up from $0.43). During Q3, NEER added 3 GW to its backlog, bringing the LTM total to 11 GW—equivalent to 9 million households. Most additions were in solar (1.4 GW) and storage (1.4 GW), with 0.2 GW of wind projects.

– NextEra shows continued growth, source: NextEra Energy 10-Q statement

– NextEra shows continued growth, source: NextEra Energy 10-Q statement

Hurricane impact causes no significant storm

The recent hurricanes Helene (Category 4) and Milton (Category 3) threw a wrench in the works. Helene left 680,000 FPL customers without power, while Milton caused outages for nearly 2 million.

Fortunately, FPL was able to restore power to 95% of customers within four days, thanks to investments in storm hardening, including burying power lines and upgrading infrastructure. While 75% of NextEra’s generation facilities in Florida were hit by storms, they reported “no significant damage.”

The storm recovery is expected to cost $1.2 billion, including $150 million to replenish storm reserves. Fortunately, these costs will be recovered through a surcharge on customer bills in 2025, pending regulatory approval.

Data centers provide multiple incremental tailwinds

The increasing computing power needed for AI is leading to growing data center energy consumption, as well as an increase in overall data center demand. These are both increasing the demand for electricity, especially from renewable sources. Studies project electricity demand will grow 600% over the next 20 years compared to the last 20.

NextEra anticipates benefiting from this growth. On the earnings call, CEO John Ketchum noted, “We face a period of unprecedented growth in power demand,” adding that this demand growth is “driven in large part by 7/24 loads from data centers,” but also due to the reshoring of manufacturing facilities because of rising geopolitical risks and the rapid electrification of industries.

“U.S. data center demand alone is projected to grow at a 22% compound annual growth rate from 2023 to 2030, potentially driving the need for 150 gigawatts of new renewables and storage.” – CEO John Ketchum

NextEra is focusing on expanding low-cost solar and battery storage facilities, which are scalable and efficient. Forecasts suggest renewable growth could triple in the next seven years compared to the past seven.

But data centers affect electricity demand in more ways than one.

They compress the renewable energy supply, stimulating further demand from other industries needing to lock up renewable power and driving up electricity prices. This creates additional demand and premium pricing for utilities like NextEra, providing another tailwind for the company.

“…all ships are rising with the tide here, so to speak.” – CEO John Ketchum

However, while AI and data centers are increasing electricity demand, the effect on NextEra’s bottom line is expected to be incremental rather than monumental. Given the company’s extensive and diversified utility portfolio, data center demand is a promising, but ultimately supplementary growth factor for the company.

Balancing Cost, Capacity, and Speed is key to growth

NextEra believes that sustainable renewables growth depends on three key pillars: cost, capacity, and speed.

Nuclear energy has high capacity but is slow and expensive to build. Even if 100% of existing nuclear plants are repowered, it would only address 1% of expected 2030 demand.

Natural gas, another commonly used alternative, remains costly. In contrast, NextEra advocates for a mix of wind, solar, and storage solutions, which are significantly cheaper and faster to deploy than gas-fired plants. New wind and solar projects are 60% and 40% cheaper, respectively, and easier to integrate into the grid.

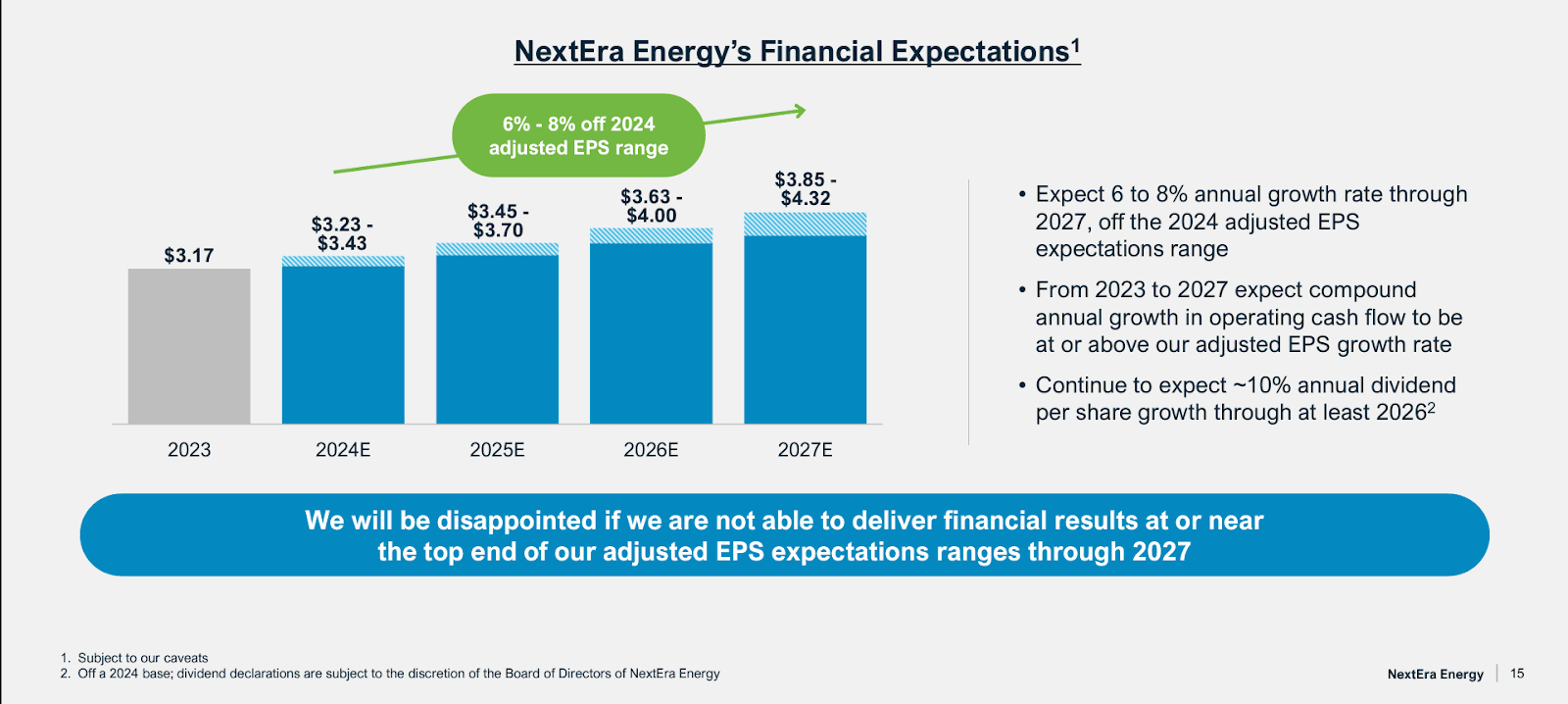

Long-term outlook remains on track

NextEra reaffirmed its long-term financial outlook, expressing confidence in delivering results at the top of its EPS expectations through 2027. The company also plans to grow its dividend yield by 10% annually through 2026, providing attractive growth for dividend investors.

“We will be disappointed if we are not able to deliver financial results at or near the top of our adjusted earnings per share expectations ranges each year through 2027, while maintaining our strong balance sheet and credit ratings.” – NextEra Energy Q3 press release

– Long-term financial outlook, source: NextEra Energy Q3 presentation

Conclusion

NextEra has delivered another solid quarter, though some investors may have hoped for a bigger demand boost from data centers. While NextEra enjoys multiple AI-related tailwinds, the impact of AI on its business may be limited.

Rather, the company should benefit from the combined effect of these trends on broader renewables demand. The outlook for the renewable energy industry remains strong, with power demand set to rise sharply.

While the stock trades at a slight premium to historical averages, that’s the price you pay for a stable and reliable utility company. However, with an analyst price target of $88.56, less than 5% above the current price, the upside here may be limited.

Q3 Earnings at a glance