Last week: Investors have continued to sell tech stocks

Markets: The Nasdaq fell by 3% to 18,386 points, experiencing its fourth consecutive week of losses, with declines from its record high reaching 12%. The S&P 500 and the Dow recorded smaller losses (each around 2%), While the Russell 2000 fell by 7% after a 10% rise in July. Gold climbed by 2% due to falling bond yields and approached its record high. Bitcoin dropped by 15% after a three-week rally.

Macro: In July, the US added only 114,000 jobs, and the unemployment rate unexpectedly rose to 4.3%. The probability of a 50-basis-point rate cut in September now stands at 79%. The US ISM Manufacturing PMI fell from 48.5 to 46.8 (expectation: 48.8), suggesting a deeper recession in this sector. Jerome Powell hinted at a possible interest rate cut in September. The European economy grew by 0.6% year-on-year in Q2, while inflation unexpectedly increased in July from 2.5% to 2.6% (expectation: 2.4%).

Stocks: Berkshire Hathaway has reduced its stake in Apple by nearly 50%, with cash reserves reaching a new record high of $276.9 billion. Microsoft’s cloud business grew slower than expected in the second quarter. Meta exceeded revenue forecasts through AI-driven targeted advertising. Amazon’s profit forecast disappointed analysts. Apple exceeded revenue forecasts despite sluggish sales in China.

This week: Q2 figures from Eli Lilly, Walt Disney and Novo Nordisk

The economic calendar offers limited data, with the US ISM Services PMI and inflation data from China being the key highlights. The focus is particularly on the current Q2 reporting season. So far, 75% of S&P 500 companies have reported, with 78% surpassing earnings expectations.

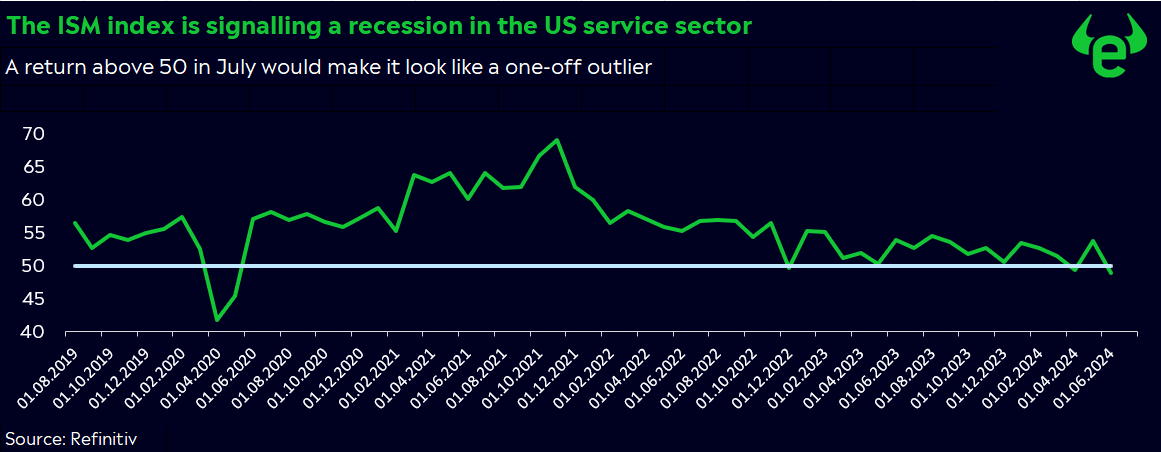

ISM Services PMI: Signs of recession or just a one-off outlier?

Despite high interest rates, the services sector has contributed to the stability of the US economy in recent years. However, the US ISM Services PMI fell from 53.8 to 48.8 in June—the lowest level in four years. The 50-point mark separates expansion from contraction, suggesting that activity in this sector is now contracting. Investors are questioning whether this is a one-off anomaly or if the index will remain in the recessionary range or even decline further. July data, due on Monday, is expected to show an increase to 51.0.

Improved market breadth would give the bull market additional stability

The recent rotation from tech stocks to small caps and economic-sensitive sectors makes sense. Tech stocks are expensive, while other sectors are significantly cheaper. Improved market breadth could offer stability in the medium to long term. Currently, 69% of S&P 500 stocks are above their 200-day moving average. However, tech is not being written off: major companies like Nvidia and Alphabet continue to generate high profits, indicating that we are not in a bubble. Overall, tech has performed well this year, and short-term price fluctuations may be seen by many as buying opportunities.

China has not yet won the battle against deflation

Consumer prices have fallen on a monthly basis over the past two months. Despite a YoY increase, inflation reached only 0.2% in June. Weak consumer spending and a struggling housing market are dampening economic recovery. Two weeks ago, the People’s Bank of China (PBoC) surprised markets with an unexpected rate cut to support growth. CPI data for July, to be released on Friday, may indicate easing deflation risks (expected: 0.4% YoY). The day before, trade data will be published, potentially showing whether the trade surplus has grown for the fourth consecutive time.

Key highlights of upcoming quarterly earnings reports

Monday: Palantir Technologies, Infineon

Tuesday: Caterpillar, Airbnb, SMCI, Uber

Wednesday: Novo Nordisk, Walt Disney, Shopify, Softbank, Honda

Thursday: Eli Lilly, Sony, Siemens, Deutsche Telekom, Allianz

Friday: Constellation Software, Assicurazioni Generali