Last week: US tech shares continued to fall, market rotation in small caps

The big winner was the Russell 2000 – the US stock index for small caps rose by 3%. In contrast, the Nasdaq fell 3%, increasing its losses to 8% from its record high – correction territory is officially reached at 10%. The S&P 500 dropped 1%, breaking on Wednesday the longest streak without a 2% decline since 2007. 5 out of 11 sectors closed in the red, with communication services and information technology the worst performers. Health care and utilities saw the strongest gains.

Gold failed to benefit from the overall market uncertainty, losing 1% in value. Brent crude oil prices fell by 3%, while Bitcoin recovered after a dip. The US economy grew more than expected in the second quarter (2.8% vs. 2.0%), while the core inflation (PCE) remained at 2.6% in June (expected: 2.5%).

Alphabet fell by 6% as its $13.2 billion investments in AI exceeded expectations. Tesla dropped by 8% after a disappointing quarterly profit and the delay of its robotaxi launch. SAP rose by 8% thanks to a 25% increase in cloud revenue driven by strong AI demand. LVMH declined by 2% due to weak revenue growth and cautious Chinese consumers, with sales in Asia (excluding Japan) falling by 14%.

This week: all eyes on four of the Magnificent 7

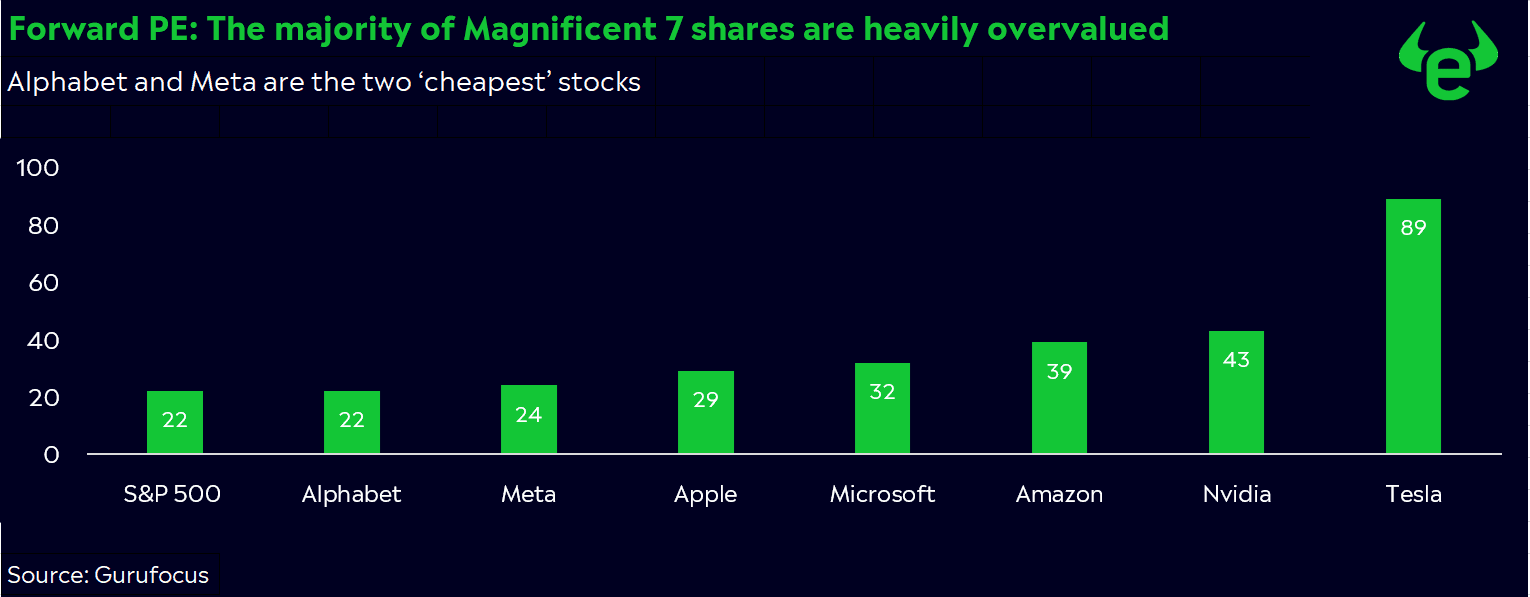

Throughout the week, numerous quarterly reports from the US and Europe are expected. Including four of the Magnificent 7: Microsoft, Meta, Amazon, and Apple.

European investors are hoping for signs of more dynamic growth (GDP data on Tuesday) or progress in combating inflation (CPI data on Wednesday). On Wednesday evening, Fed Chair Jerome Powell might prepare the markets for a rate cut in September. The US ISM Manufacturing PMI on Thursday is expected to continue indicating a recession in the manufacturing sector. In the labor market, markets are hoping for further cooling (Non-Farm Payrolls on Friday), which would make rate cuts more likely.

Powell is likely to prepare the markets for a rate cut in September

On Wednesday evening, the Fed will announce its interest rate decision for July, followed by a press conference with Jerome Powell. In the US, inflation (PCE) remained low in June, and the labor market cooled more than expected in the second quarter. This creates room for potential rate cuts. While inflation is not yet fully defeated, the Fed does not want to miss the opportunity for a soft landing. According to the Fed’s June dot plot, only one rate cut is projected for this year. In contrast, markets currently expect three rate cuts and price in an 86% chance of a first adjustment in September.

Next test for Fed and markets: ISM and NFP data

A further cooling US labor market report would give the Fed solid reasons to cut interest rates multiple times this year. A moderate increase in job growth is expected (185k), while wage growth and the unemployment rate are projected to remain unchanged at 3.9% and 4.1%. The ISM Manufacturing PMI must climb above 50 to signal an end to the recession. For July, a slight increase from 48.5 to 48.8 is anticipated. Since November 2022, the index has surpassed the 50 mark only once, in March of this year.

German economy: beacon of hope or problem child for the EU?

European investors are hoping for an acceleration in economic growth and a further decline in inflation. For the second quarter, a GDP growth of 0.3% QoQ is expected in the Eurozone. Inflation (CPI) is anticipated to have decreased from 2.5% to 2.3% YoY in July. Particularly important are the earlier-released data on the German economy. Why? Germany is the largest economy in Europe and simultaneously the EU’s problem child.

The Q2 earnings season is gaining momentum

Monday: McDonald’s, Heineken

Tuesday: Paypal, Procter & Gamble, Microsoft, Starbucks, Airbus, BP

Wednesday: Boeing, Mastercard, ARM, Meta, UBS, Adidas, HSBC

Thursday: Airbnb, Amazon, Apple, Coinbase, Intel, Ferrari, BMW, Barclays

Friday: Chevron, Exxon Mobil, Linde