Hi Everyone,

Climate change is often a politically charged issue but no matter what your stance, I think we can all agree that it’s better for the environment if we all do our part to keep the globe as clean as possible.

As investors, we play a very unique role in the global ecosystem. Companies with more money have more power collectively, as investors we have considerable influence. In many cases, investing in a company with a noble social or environmental cause can even yield greater profits than their incumbent competitors.

The term impact investing embodies this concept and the search term has been rising steadily over the last decade.

Of course, researching which companies to invest in and building a portfolio on this basis can be extremely time-consuming. So, in order to give our clients an advantage, the eToro team has put together a new Smart Portfolio for @RenewableEnergy.

The 22 stocks were specifically selected based on the companies respective goals to reduce our carbon footprint, their geographic diversity, and already significant market cap. Feel free to review the full prospectus at this link, or invest in just a few clicks on the eToro platform.

eToro, Senior Market Analyst

Today’s Highlights

- Getting Closer Slower

- Turkey Collapsing

- Alt Season Continues

Please note: All data, figures & graphs are valid as of March 28th. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

Though the risks are mostly isolated to the UK and partially Europe, all global investors should probably have one eye on the Brexit at the moment. As we progress, it does seem that any doomsday scenario is getting increasingly less likely, but certainly worth watching out for.

A series of eight votes were held in Parliament yesterday to try and determine what should be done. None of them passed, but two of them did get further than May’s deal, which included the option to stay in the EU customs union, and the very popular option of a second referendum. Overall, it seemed that softer options were more pleasing to UK lawmakers, making a hard Brexit seem less likely.

Additionally, Prime Minister May has given a rather peculiar ultimatum that she will resign if her deal passes. Some were quick to point out the irony that if she wins she has to go, but if she losses she can stay in power. Of course, it’s entirely possible that she’ll never get that option anyway, as Parliament is reluctant to vote on the same deal for the third time.

Meanwhile, a possible trade deal between the US and China does seem to be inching forward. The previous deadline of March 31st is now irrelevant and optimists think it could now happen by May or June.

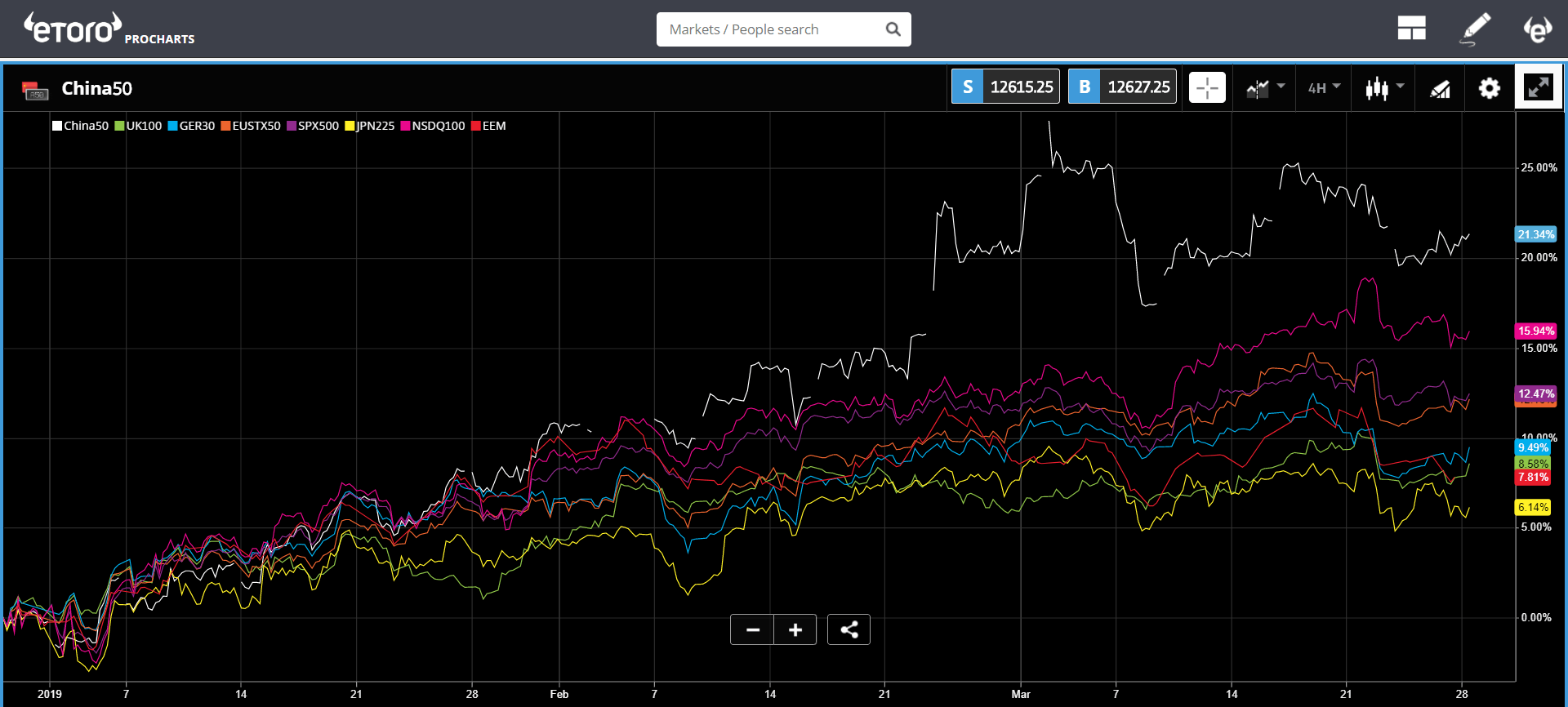

The overall mood in the stock markets is one of consolidation. Here we can see several of the top stock indices from around the world. The most impressive here is the China 50 (white line), which has managed to hold much of it’s early gains.

Turkish Meltdown

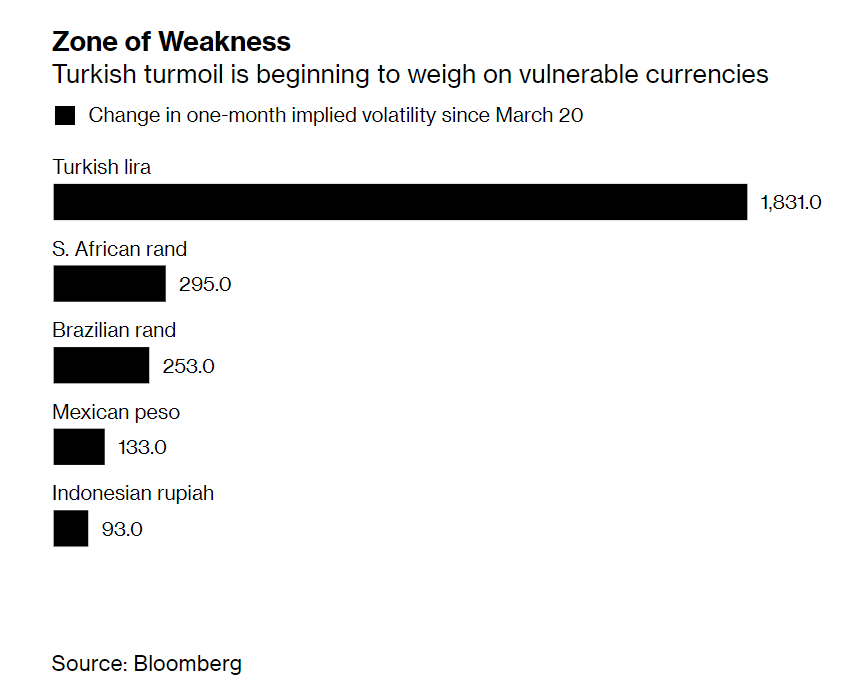

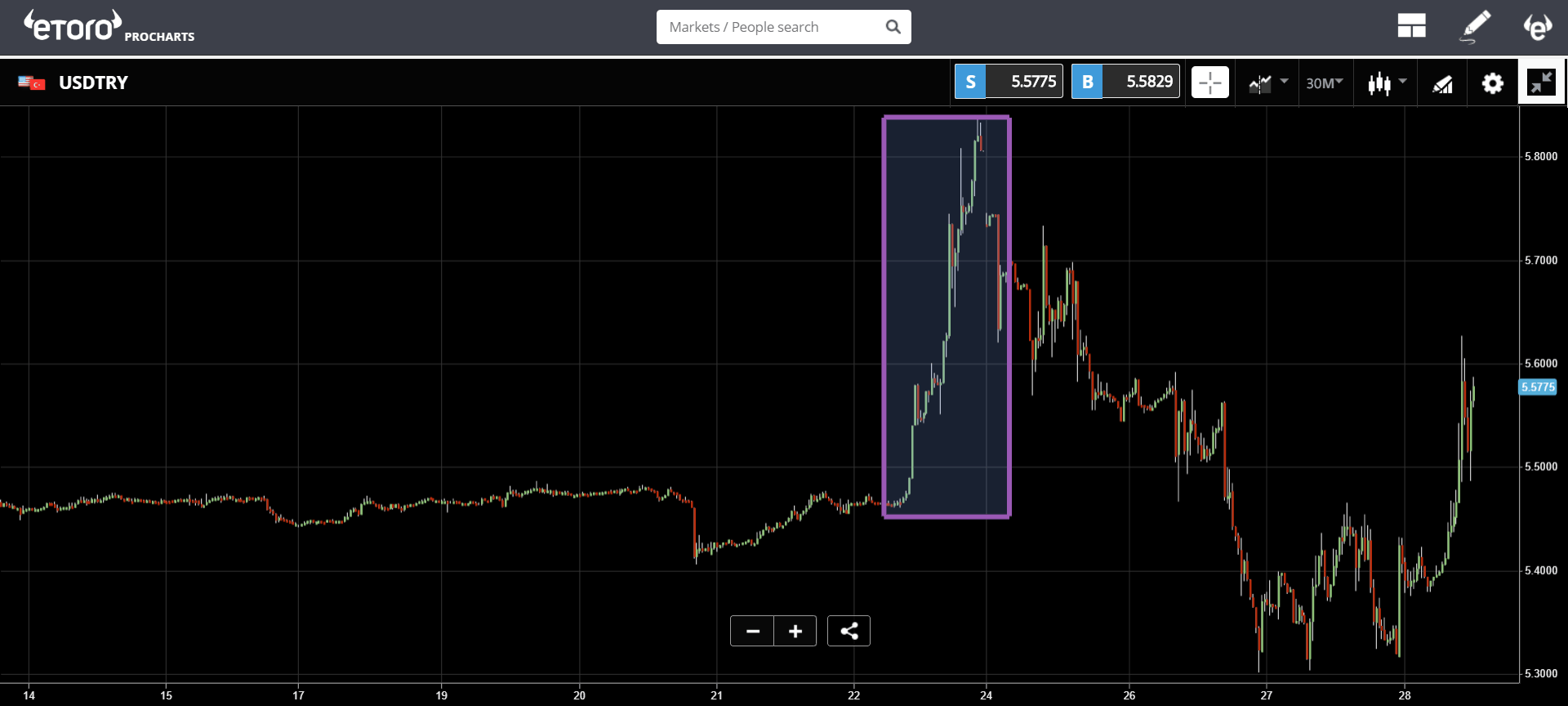

Following a 7% plunge on Friday (purple rectangle), in what was intended as a defensive move, Turkish authorities have allegedly blocked banks from lending Liras to foreigners. The move makes it more difficult for people to short the currency and forces buyers to enter the spot market.

However, strict capital controls only tend to work temporarily, especially in a market that is keen to sell. As we can see, the Lira continues to weaken this morning.

(Pleaes note: the USDTRY shows US Dollar strength against the Lira, so an upward move means the Lira is falling.)

Local elections in Turkey will be held on Sunday, so keep your eyes open.

Alt Season Continues

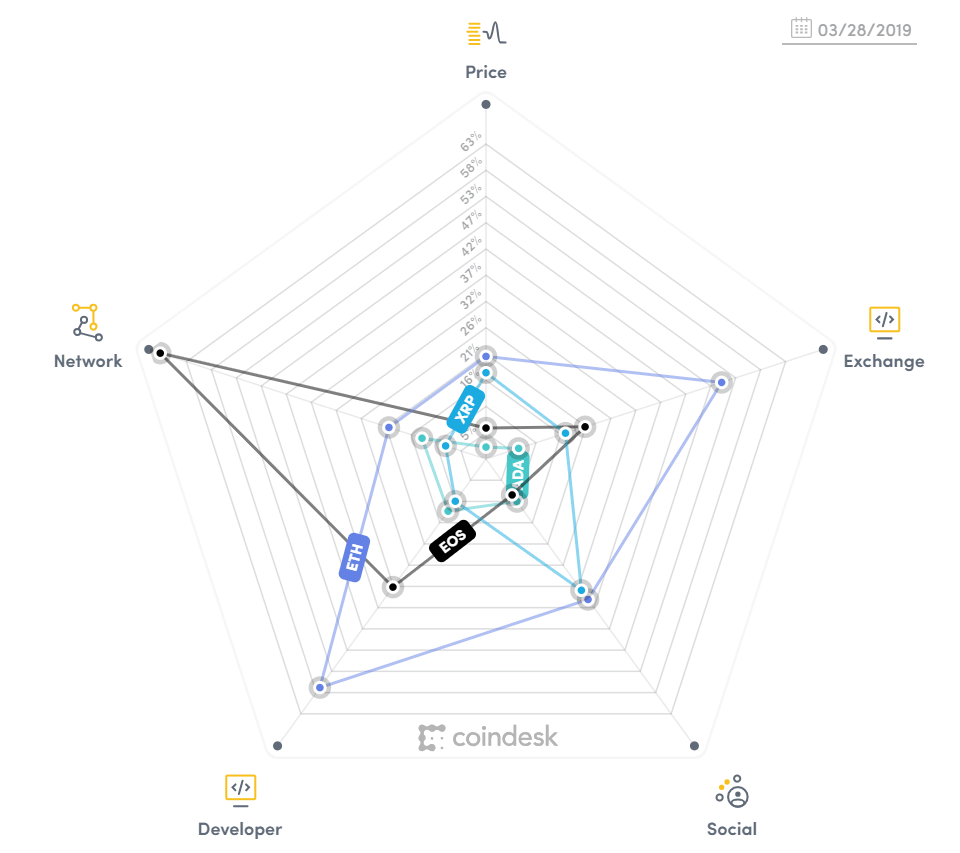

The large-cap winner of altseason over the last few days has clearly been EOS. The price graph will just kind of show a hockey stick at the moment, so instead let’s take a look at the comparative tool from CoinDesk, which shows it outperforming in the network category and second only to Ethereum in development.

As the Network progresses and we see more on chain transactions, it should influence the value as well. Though I wasn’t able to find any historical transaction chart for EOS (if anyone has one hook me up!), it’s estimated that there were more than 4 million transactions from nearly 100,000 active addresses over the last 24 hours.

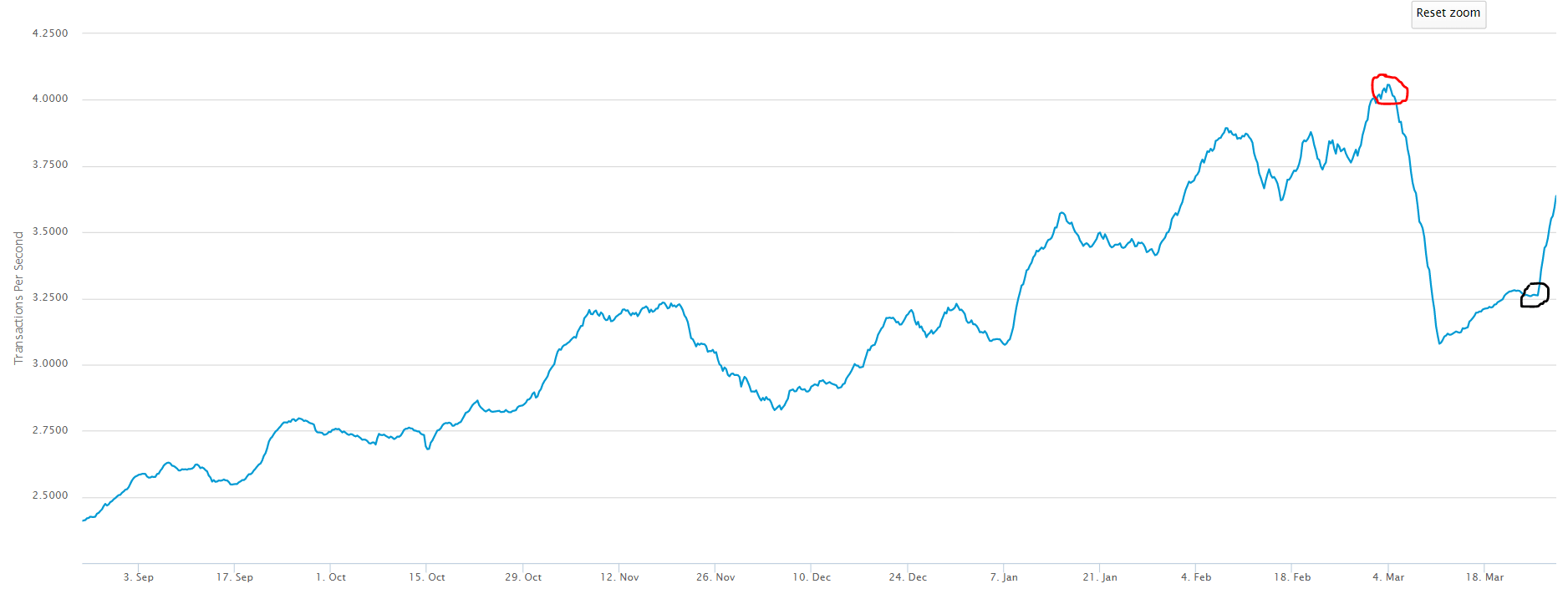

In the meantime, we can also see transactions on the bitcoin blockchain spiking again. Of course, this spike most likely due to the fact that Veriblock is now live, and is settling transactions from other blockchains back onto Bitcoin’s main chain.

In this graph, we can see the effect that Veriblock is having on Bitcoin’s TPS (transactions per second) rate. The red circle is when their test-net was terminated on March 4th. The black circle is when the main-net was launched on Monday.

So, it’s not only the altcoins that are gaining in usage. Even bitcoin is managing to become more useful as interoperability increases.

As always, many thanks for your high level of participation in these daily market updates. Your messages on social media with comments, questions, and insight are my main source of inspiration.

Best regards,

Mati Greenspan

Senior Market Analyst

Connect with me on….

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/

LinkedIn: https://www.

Your Social Investment Network – www.eToro.com

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.