By Elad Lavi, Executive Vice President Corporate Development & Strategy

For too long retail investors have been dismissed as unsophisticated, emotional, or simply stupid and impulsive. We had hoped this outdated narrative had reached a peak with the meme stock frenzy of 2021, yet myths take time to bust. So we’ve been busy crunching the data to help paint a picture of what the retail investor was doing in 2024 and what that means for the retail investing landscape going forward.

Why does the retail investor matter?

Technology is driving innovation and opening up access to capital markets. As the global capital markets continue to expand and evolve, retail investors are no longer passive bystanders. They account for a growing proportion of daily trading volumes which means that their buying decisions matter.

On a global basis, retail investors accounted for 52% of global assets under management in 2021, which is expected to grow to over 61% by 2030. They are starting to invest at a younger age. On average, Gen Z began investing at age 19, compared to age 32 for Gen X and age 35 for Baby Boomers. A great wealth transfer is also unfolding. According to UBS Global Wealth Report 2024, an estimated $83.5 trillion in assets are expected to be transferred to younger generations within the next 20 to 25 years.

We know Americans invest, but what about elsewhere?

We believe the trend of increasing retail participation extends to non-U.S. markets where there has historically been less retail participation. The most recent Federal Reserve Survey of Consumer Finances states that 58% of U.S. families had some sort of exposure to the stock market in 2022, the highest level ever recorded. Comparatively, the E.U. had 7% exposure in 2023, as reported by Oliver Wyman, and the U.K. had 20% exposure, as reported by a survey conducted by the Department of Work and Pension.

Yet, Oliver Wyman forecasts that Europe will add 22 million new brokerage accounts by 2028 which means penetration in the adult population will increase by 72% from 6.8% in 2023 to 11.7% in 2028.

But retail investors lose money…

Technology has levelled the playing field and today’s retail investor have access to the tools and knowledge they need to succeed. Activity on the eToro platform shows that users are not just learning about investing, they are applying that knowledge to successfully meet their long term financial goals.

We analyzed the data for eToro users in 2024. The results show that 74% of eToro users were profitable, rising to 80% for eToro Club members. But what does a year show? Quite a lot, but let’s add 2023 into the mix too. We also probed the data for eToro users in 2023 and 79% of users and 85% of Club members were profitable, .

So what are retail investors buying?

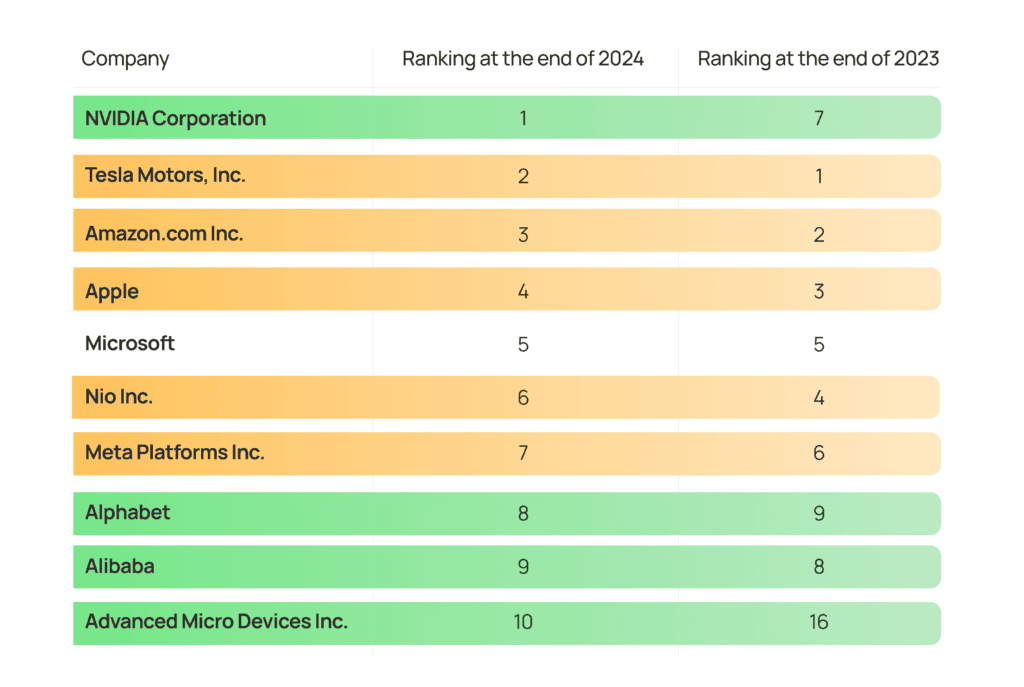

The list of most widely held stocks on the eToro platform was majorly disrupted in 2024. Nvidia jumped from seventh to first place, taking Tesla’s crown and bumping them to second place. There was also a new entry to the top ten as chipmaker Advanced Micro Devices rose from 16th to tenth place.

eToro users are also increasingly looking for global exposure within their portfolios. The top ten most held stocks outside of the US include major names like ASML Holding, LVMH, and Rolls-Royce, spanning industries from semiconductors and luxury goods to aerospace. The popularity of ASML and ASM International reflects retail investors belief in AI and their understanding of the importance of semiconductors to the value chain.

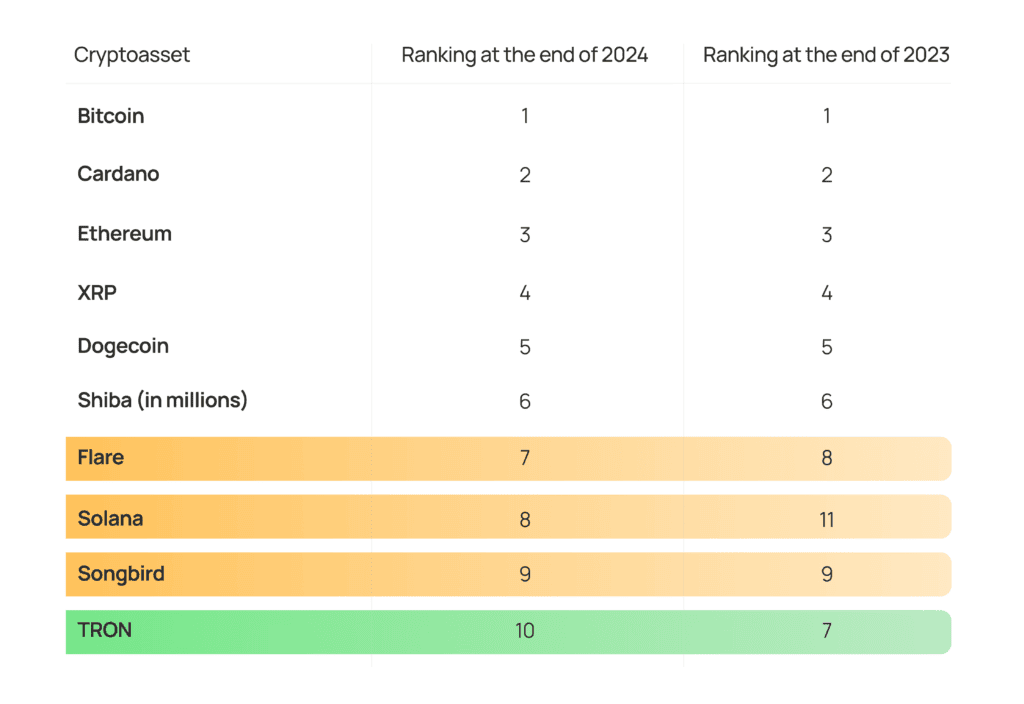

While we saw many altcoins rise in popularity in 2024, there was little change in terms of our top ten most held cryptoassets on eToro due to the buy and hold mentality of our users. Our users are HODLERs and we see cryptoasset holdings remain relatively stable even during periods of crypto winter.

Looking ahead

The rise of the retail investor is challenging old models of market behaviour. Markets now reflect not just fundamentals, but also collective belief. Retail investors play an increasingly large part in that belief system. Understanding the behaviour of retail investors is now vital to understanding how markets move.

The idea of ‘dumb’ retail money: a lone, amateur investor making ill informed decisions is out of date. The retail investor of 2025 is informed and connected. They represent the future of capital markets: a more inclusive, more engaged and highly interactive ecosystem.

Disclaimers:

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

eToro is authorised and regulated by the Financial Conduct Authority in the UK, in Cyprus by the Cyprus Securities and Exchange Commission, by the Australian Securities and Investments Commission in Australia and licensed by the Financial Services Authority in the Seychelles.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.