Please see this week’s market overview from eToro’s global analyst team, which includes the latest market data and the house investment view.

Trump’s first week and China’s challenge to US’ AI models

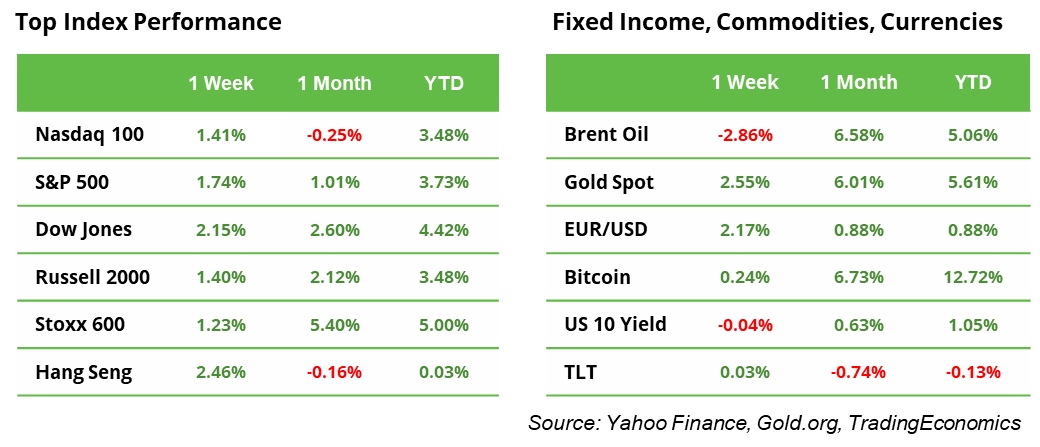

Last week, the S&P 500 index reached its first record close of the year, rising 1.7% to a level above 6,100 points. It marked the first week of President Trump in office, overwhelming Americans in general with an unprecedented number of executive orders. Investors, in particular, listened closely to the president’s statements on economic topics such as lower oil prices, reduced interest rates, and tariffs for companies that do not move production to the US.

The biggest economic announcement was the launch of the $500 billion Project Stargate, led by Oracle, OpenAI, and SoftBank, aimed at accelerating the development of U.S. data center infrastructure to maintain leadership in AI. Over the weekend, however, Chinese AI startup DeepSeek made headlines by surpassing ChatGPT on the Apple App Store just days after launching its flagship R1 model. DeepSeek’s model appears to outperform those from OpenAI, Google, and Meta, despite using less advanced NVIDIA chips and significantly less capital.

Asian markets reacted nervously on Monday, with SoftBank’s stock, for example, dropping 8%. Nasdaq futures indicate a 2% lower opening. These developments will bring even more attention to several major Q4 earnings reports this week, including Microsoft, Meta, and Tesla on Wednesday, followed by Apple on Thursday. Other large companies reporting this week include Visa, Mastercard, Caterpillar, Boeing, Starbucks, Intel, ExxonMobil, LVMH, SAP and ASML.

Macro Outlook for the week, including Fed and ECB interest rate decisions

In the week ahead, the global economy and markets will focus on key developments in the US, including: 1. the FOMC meeting, which is expected to leave interest rates unchanged 2. Key economic data releases such as PCE and ECI, which are particularly relevant for a Fed that remains heavily dependent on data, and, 3. Fourth-quarter GDP growth figures.

Globally, market participants will also keep an eye on: 1. Eurozone GDP data, 2. Widely-expected 25 bp rate cuts by the ECB and the Bank of Canada, and 3. Inflation reports from various Eurozone countries.

Trump and commodity markets: will the copper/gold ratio reverse its trend?

The price of gold gained 2% last week and is now less than 1% away from its record high of $2,790, reached in October. Copper, on the other hand, ended the week slightly weaker, down 0.4% at $4.32 – 16% below its all-time high.

The copper/gold ratio is often viewed as a leading indicator for the 10-year US Treasury yield and as a tool to evaluate global economic prospects. In the long term, gold has clearly outperformed copper, with the copper-gold ratio declining significantly over the past two decades (see chart). Whether this ratio sends a positive signal in the coming months largely depends on US trade and tariff policies.

For many investors, gold remains the ultimate safe haven. Its price movements are heavily influenced by real yields (annual bond yields minus inflation) and the strength of the US dollar; a stronger dollar makes gold more expensive, and vice versa. Copper, by contrast, is considered a leading indicator of economic growth. It plays a crucial role in equipment manufacturing, building construction, and infrastructure development. Rising demand for copper often signals an expanding economy, with Asia (particularly China) serving as a key driver of global copper demand.

Earnings season: big names reporting

Last week, President Trump issued an executive order designating cryptocurrency as a national priority. The order establishes a crypto advisory council to facilitate the integration of digital assets into the U.S. economy and directs federal agencies to update their digital asset policies. While the omission of specific mention of Bitcoin disappointed its proponents, the move marks a significant departure from the previous administration’s stricter stance, aiming to foster innovation and position the U.S. as a global leader in the digital asset space.

Macro and earnings data releases

Macro

US Durable Goods (28/1), Fed rate decision (29/1), Eurozone GDP growth Q4, ECB rate decision, US GDP growth Q4 (30/1), US PCE inflation (31/1)

Earnings

27 Jan. AT&T

28 Jan. Boeing, Starbucks, General Motors, LVMH, SAP

29 Jan. Microsoft, Meta, Tesla, IBM, ServiceNow, ASML, Deutsche Bank

30 Jan. Apple, Visa, Mastercard, Caterpillar, Intel, Shell, Infineon

31 Jan. ExxonMobil, Chevron

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.