The start of a style rotation in equity markets

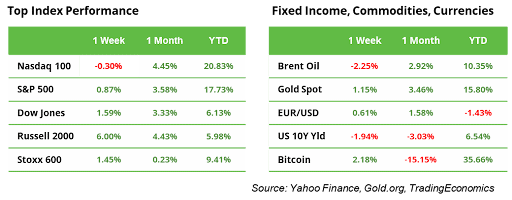

Last week, we saw the beginning of a rotation that had been long overdue. The small-cap Russell 2000 Index gained 6%, while the technology-driven Nasdaq 100 Index shed 0.3%. The trigger turned out to be the new US CPI number for June on Thursday, which came in at a soft -0.1%, whereas the consensus had expected +0.1%. Bond yields went down, the US dollar weakened to 1.09 against the euro, and gold reached the $2,400 level again. The equity market rally broadened as tech stocks were sold, but 84% of all NYSE-listed shares went up, led by the real estate and utility sectors. The market now gives an 88% chance that the Fed will cut interest rates for the first time in September, with more cuts expected afterward.

Furthermore, the Japanese Nikkei 225 reached a new all-time high. US bank stocks retreated after earnings reports due to pressure on net interest income, and Bitcoin recovered slightly from a disastrous drop of 15% in a month. China Q2 GDP at 4.7% missed the 5.0% forecast.

This week, investors will try to get more guidance on future rate cuts in Europe when the ECB meets on Thursday for another monetary policy meeting. Without major macro indicators on the agenda, attention will shift towards the Q2 earnings season, with Dow Jones constituents Goldman Sachs, UnitedHealth Group, and Johnson & Johnson reporting, joined by semiconductor giants ASML and TSMC, and streaming service Netflix.

ECB seen keeping rates flat, market looking for new guidance

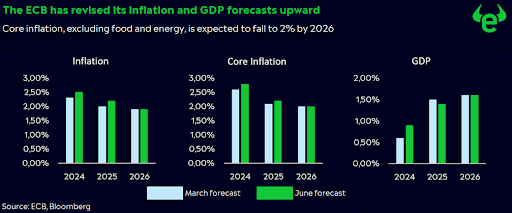

In June, eurozone inflation fell to 2.5% year-on-year, while core inflation remained unchanged at 2.9%. As long as interest rates remain above 3%, the ECB’s monetary policy will likely remain restrictive. The current key interest rate is 4.25%, which offers scope for further interest rate cuts, despite the latest adjustment of interest rate expectations by the central bank in June. Recently, the central bank has been cryptic about its interest rate trajectory but aims not to surprise the markets. Christine Lagarde could potentially prepare the market for a rate cut in September or October at her press conference on Thursday.

Economic crisis in Germany and its consequences for Europe

The German ZEW survey results in June revealed a dramatic gap between economic expectations and the assessment of the current situation (47.5 points vs. -73.8 points). While the crisis is not yet over, the worst may be behind us. As Europe’s largest economy, accounting for almost 30% of the eurozone’s GDP, Germany has been stuck in stagnation for two years. This economic weakness is weighing on the whole of Europe and simultaneously increasing the likelihood of interest rate cuts. The manufacturing sector, in particular, remains Germany’s Achilles heel, while the service sector is more stable. The ideal scenario for July (data on Tuesday) would be a less pessimistic assessment of the current situation and stable economic expectations.

Have US building permits stabilized in June?

Wednesday will give us a fresh number for June. In May, building permits fell to 1.4 million, the lowest level since June 2020. The decline is not surprising as high interest rates are holding back new construction projects. In the US, most mortgages have a fixed term of 30 years, with the average interest rate currently at 6.89%. Without a turnaround in interest rates, a recovery in the property market is hard to imagine. However, help could come soon: markets are pricing in a 88% probability that the Fed will cut interest rates in September. Bond yields play an important role as they reflect expectations regarding interest rate policy.

The importance of ASML and TSMC earnings

The strong Nasdaq performance is largely driven by the semiconductor sector. The leading SMH ETF is up 57% year-to-date. On the global list of largest stocks, Taiwanese foundry TSMC is ranked 8th and is on the verge of entering the prestigious $1 trillion market cap club. Dutch chip equipment maker ASML is ranked 20th. The earnings reports of these two companies this week will give investors the first indication of whether the tech rally has legs into the second half of the year.

Earnings and events

Mon 15/7: Goldman Sachs, Blackrock. Tue 16/7: UnitedHealth Group. Wed 17/7: ASML, Johnson & Johnson. Thu 18/7: TSMC, Netflix.