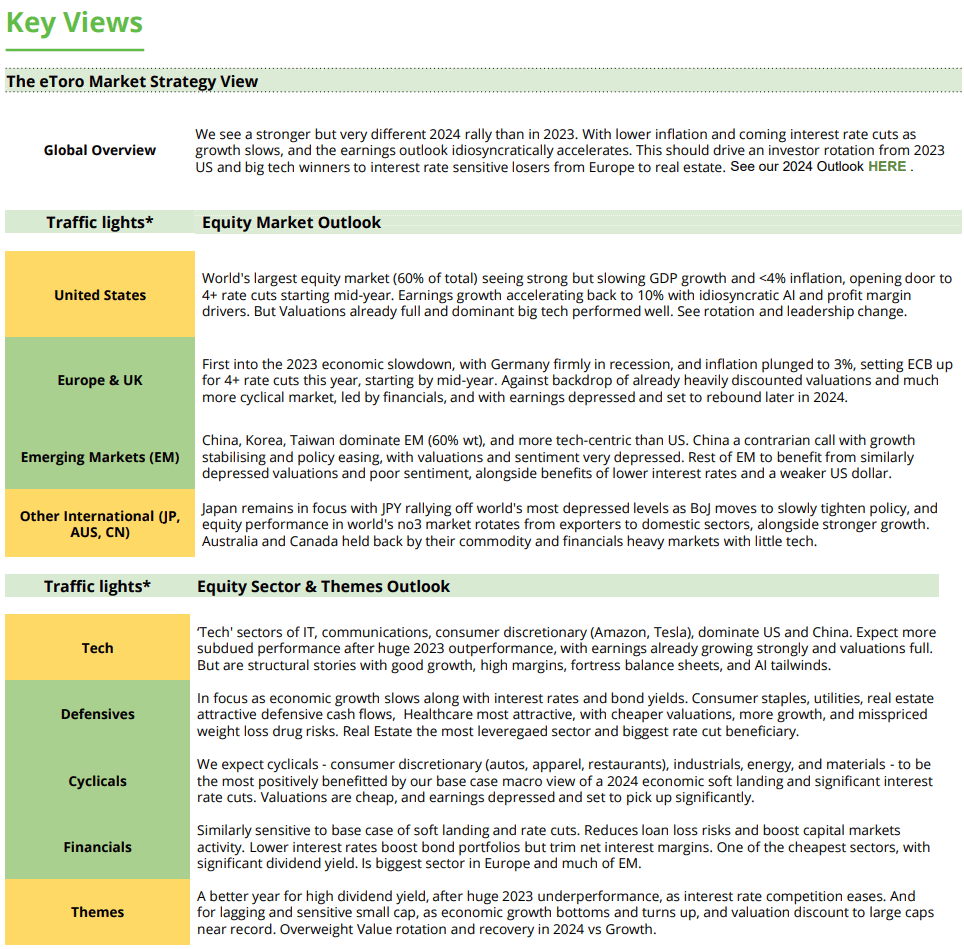

Please see this week’s market overview from eToro’s global analyst team, which includes the latest market data and the house investment view.

The Fed delivered a historic 0.5% interest rate cut

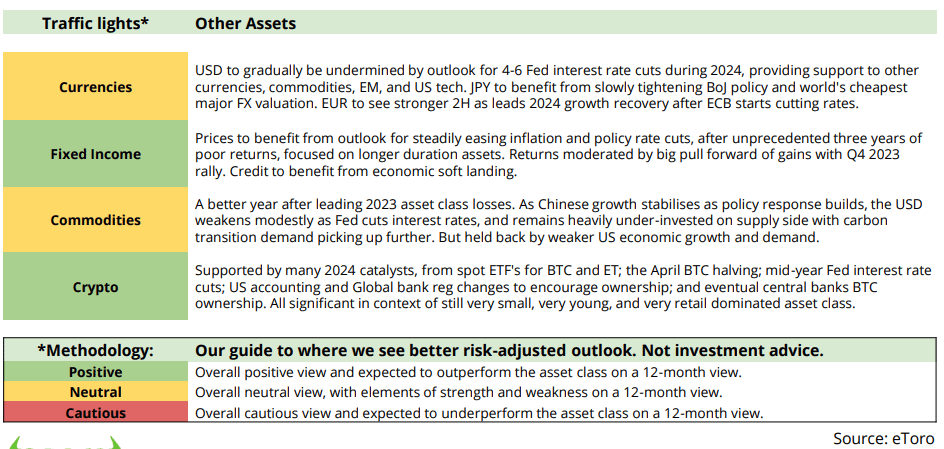

The Fed cut interest rates by 0.5%, as it saw room to do so. Inflation has eased significantly, commodity prices are relatively soft, wage increases are modest, and labour markets require support. The Fed anticipates economic growth stabilising at 2%, unemployment peaking at 4.4%, and inflation slowly converging towards its 2% goal. A neutral economic climate calls for more neutral interest rates of around 3% in approximately two years. This initial 0.5% cut shows that the Fed is very much willing to support the economy if and when needed.

Although traders had assigned a higher probability to a 0.5% rate cut before the announcement, financial markets still appeared surprised, uncertain whether the larger cut was positive or negative news. Only the following day did sentiment turn bullish, with the Dow Jones ending the week at a new all-time high above 42,000, and the S&P 500 briefly reaching 5,700 for the first time. In the bond market, the 2-year Treasury yield dipped to 3.55%, finishing the week below the 10-year yield of 3.73% for the first time in a long period. This supports the Fed’s sunny view of an economic Goldilocks scenario on the horizon.

This week, investors will look forward to speeches by several Fed committee members to gain more insight into the first rate cut in four years and any guidance for the future.

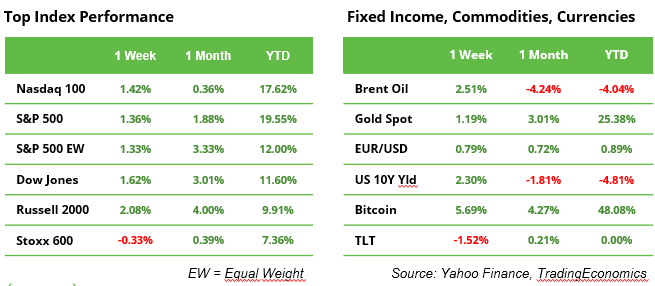

Last week, in other markets, the European STOXX 600 shed 0.3% (see table), the US dollar weakened, gold hit yet another all-time high above $2,600, oil recovered from previous local lows, and Hong Kong stocks gained 5%. See more on oil and the Chinese economy below.

Oil prices stabilise, key resistance still far away

Brent oil prices recovered to $74 last week after recently falling to their lowest level since the end of 2021. However, it remains to be seen whether this will be enough to create a sustainable bottom. Traders are concerned about a possible oversupply in the coming year, as demand from China and the US is weakening and non-OPEC countries could expand their production. On the other hand, interest rate cuts could boost demand for energy again. From a technical perspective, the $71.36 mark currently serves as key support. To end the downward trend, the price must sustainably exceed the upper limit of the descending triangle, which currently stands at around $88. There are further short-term resistances at $76.71 and $81.94.

PMI data: situation in Europe much more critical than in the US

The US and the Eurozone have one thing in common: both regions are growing, driven by a strong service sector that is compensating for weakness in the manufacturing sector. However, the US economy is more robust. In August, the US composite PMI stood at 54.6, while the eurozone’s was dangerously close to the 50 mark at 51.0 – a clear sign that the risk of recession is greater in Europe. The US, on the other hand, still has room for a slowdown. If the PMI readings for both regions fall in September, investors may favour Wall Street. However, if the European PMI improves, it could make Europe’s equity markets more attractive again.

The Call for Economic Stimulus in China Grows Louder

The Chinese economy is still grappling with a significant property crisis. Declining house prices are putting pressure on retail sales, manufacturing output, and subsequently, commodity prices. While this contributes to lower inflation levels elsewhere, the domestic Chinese economy is set to miss the 5% target for economic growth this year. A former Chinese government executive suggested that a stimulus package of $1.4 trillion would be required to get the economy back on track. However, the Communist Party did not change its policy during the important Third Plenum meeting in July, leaving interest rates unchanged and appearing to rely on strong exports. After eight months in 2024, China’s trade balance is on track for a surplus close to $1 trillion for the year, which would mark yet another record.

The next six weeks will be critically important for the ongoing trade war between Europe and China over electric vehicles. Final EU tariffs are due to be set in early November. China has threatened to retaliate against the already fragile EU economy with, for example, higher tariffs on Spanish pork bellies. Should the Chinese government decide in favour of a stimulus package, it could provide a tailwind for global economic growth as well.

Earnings and events

Besides the line-up of many US central banker’s speeches, the economic calendar is fairly light. The view on inflation will be updated on Friday with the August number for PCE (personal consumption expenditures) inflation, the Fed’s favourite gauge. Earnings releases include chip company Micron and retailer Costco, late Charlie Munger’s favourite stock.