Estée Lauder has faced a challenging year, landing among the S&P 500’s worst performers, with its stock down over 50% year to date. Compared to peers like Coty Inc., L’Oréal, Shiseido, and Beiersdorf (the parent company of NIVEA), Estée Lauder has delivered the weakest stock performance.

The reasons? Soft sales in China, a sluggish travel retail rebound, shrinking margins, impairments, withdrawn guidance, and even a dividend cut. But does this paint the full picture? Is the market being overly bearish? Have Estée Lauder’s iconic brands truly lost their value in just a year?

Let’s find out!

1. Company overview

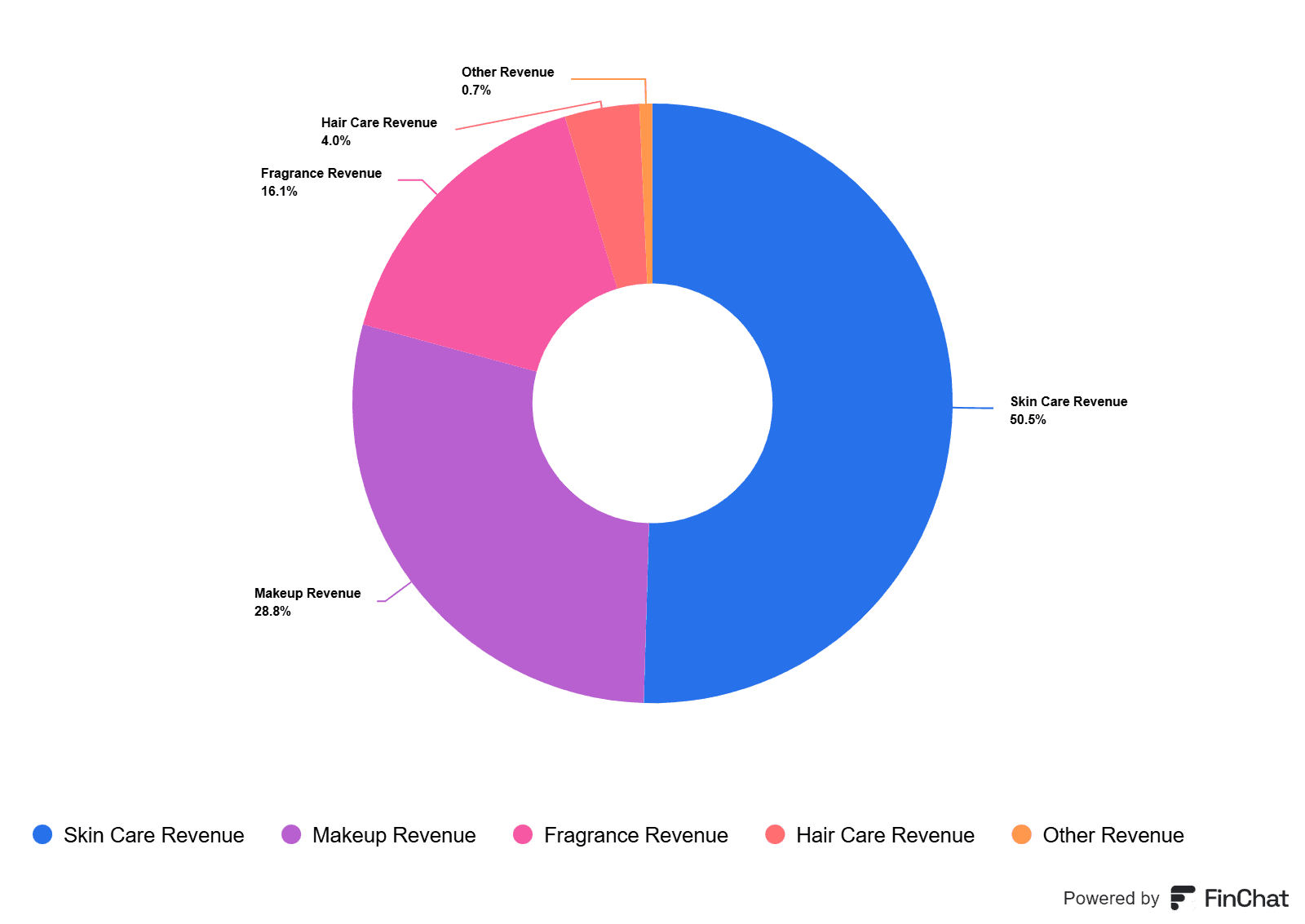

The Estée Lauder Companies (Ticker Symbol: $EL) is a global beauty leader, offering skincare, makeup, fragrance, and hair care through iconic brands like Estée Lauder, Clinique, M·A·C, La Mer, Jo Malone, and more. It generates 50% of its revenue from skincare, 29% from makeup, and 16% from fragrances.

Source: Finchat

Geographically, it earns 30% from the Americas, 39% from EMEA (including 19% from travel retail), and the rest from Asia/Pacific. Products are sold through diverse channels like department stores, specialty retailers, online platforms, and duty-free locations worldwide.

a. Key Financials

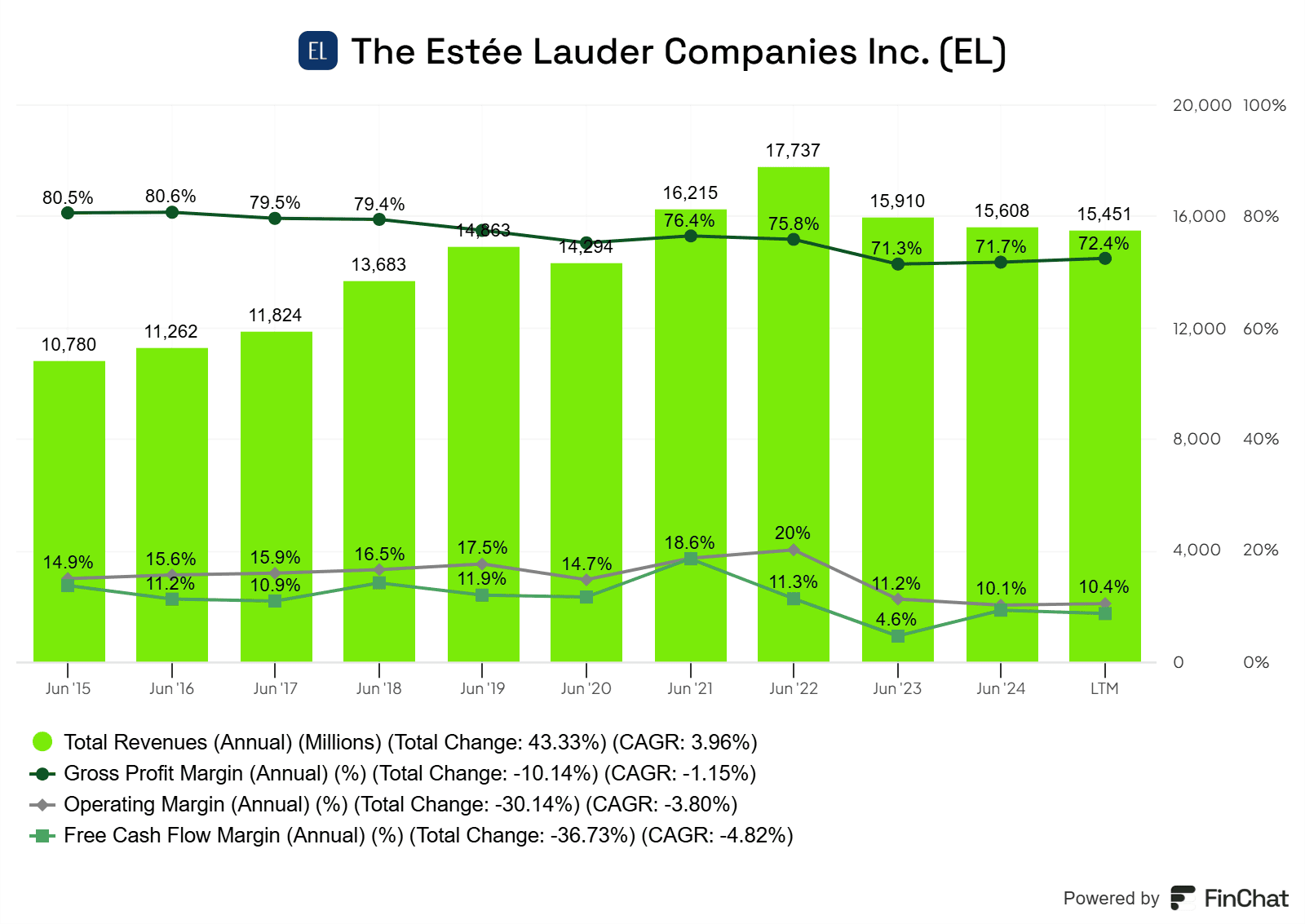

- Revenue for the trailing twelve months (TTM) as of Q1’FY25: $15.5 billion, reflecting a 3.4% CAGR since FY14.

- Operating income for TTM Q1’FY25: $1.6 billion (margin of 10.4%), with a -1.2% CAGR since FY14.

- Cash and equivalents: $2.4 billion, compared to total debt and lease liabilities of $10.0 billion.

Source: Finchat

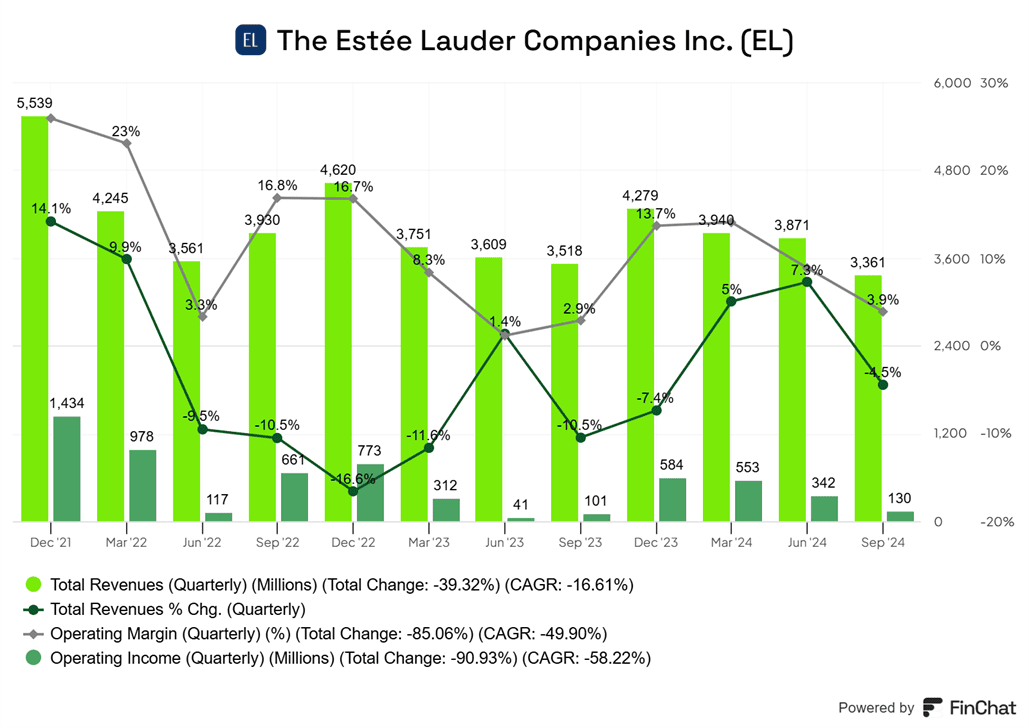

Here’s what has unfolded in recent quarters: Estée Lauder has struggled over the past two years due to headwinds in Travel Retail and China. However, signs of recovery emerged in March (Q3 FY24) and June 2024 (Q4 FY24), with organic growth rates of 6% and 8%, respectively. Unfortunately, the latest quarter saw a 4% decline in sales and a 5% drop in organic growth, driven by weak demand in China, low conversion rates in Asia Travel Retail, and challenges in Hong Kong SAR. Excluding these pressures, growth would have been a modest 1%. On the bright side, Japan and Priority Emerging Markets delivered strong performances.

Profitability has also been under pressure, with operating margins declining from 16.5% in early FY23 to 3.9% in Q1 FY25, driven by sales deleverage and shrinking gross margins. Encouragingly, gross margins began recovering in Q2 FY24, reaching 73%. Further improvements are anticipated, bolstered by the Profit Recovery and Growth Plan (PRGP), which aims to rebuild margins, cut costs, and optimize operations over FY25 and FY26.

Source: Finchat

b. Valuation

- The stock price has ranged from a 52-week high of $160 to a low of $62, with a market cap of $26.6 billion and a current price of $72.1. Analysts project an upside of 11.6%.

- Valuation multiples:

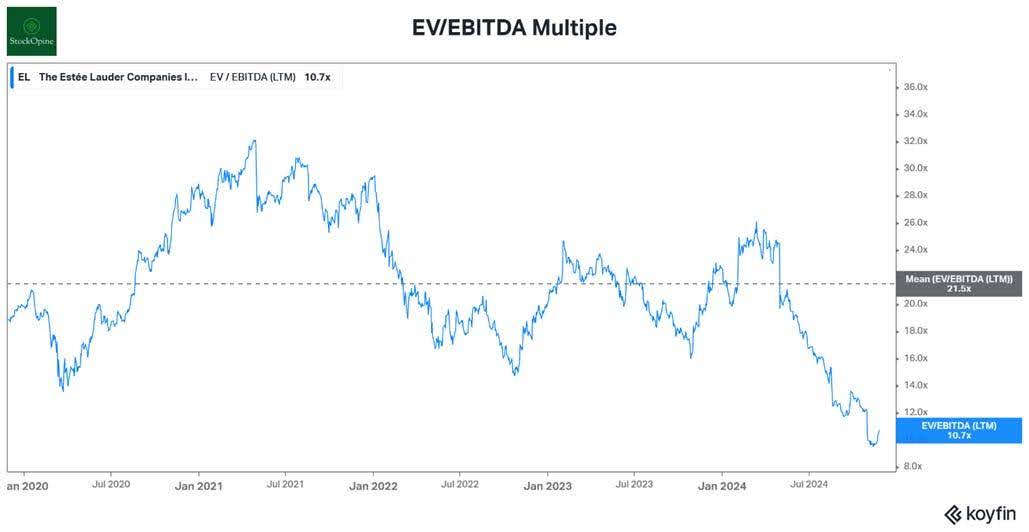

- TTM EV/EBITDA: 10.7x (5-year average: 21.5x)

- TTM EV/Sales: 2.2x (5-year average: 5.1x)

Source: Koyfin

2. Thesis

a. Competitive Advantages

Iconic Brands: Estée Lauder boasts a portfolio of globally recognized brands that cater to diverse customer needs, fostering strong loyalty and driving market share growth. These brands consistently rank highly in third-party evaluations.

Source: BrandDirectory

- Extensive Distribution Network: Operating in nearly every country and across multiple channels—including specialty retailers, e-commerce, and travel retail—Estée Lauder leverages its scale to serve customers efficiently worldwide. E-commerce, a significant growth driver, now represents 28% of sales (up from 15% in FY15) and is projected to grow at a 12% CAGR, reflecting its strategic importance.

b. Opportunities

- Sales Mix: Estée Lauder’s significant exposure to China and Travel Retail, which account for roughly 50% of its sales, positions it to capitalize on profitability gains as sales recover in these channels and operational leverage improves. Industry estimates project 6% CAGR growth for China and 9% CAGR for Travel Retail through 2028, bolstered by China’s government stimulus initiatives.

- PRGP Plan: Designed to drive growth, the Profit Recovery and Growth Plan focuses on enhancing gross margins, reducing costs, and investing in customer-facing activities. Early signs of its success were evident in Q1 FY25, with profitability improvements already underway.

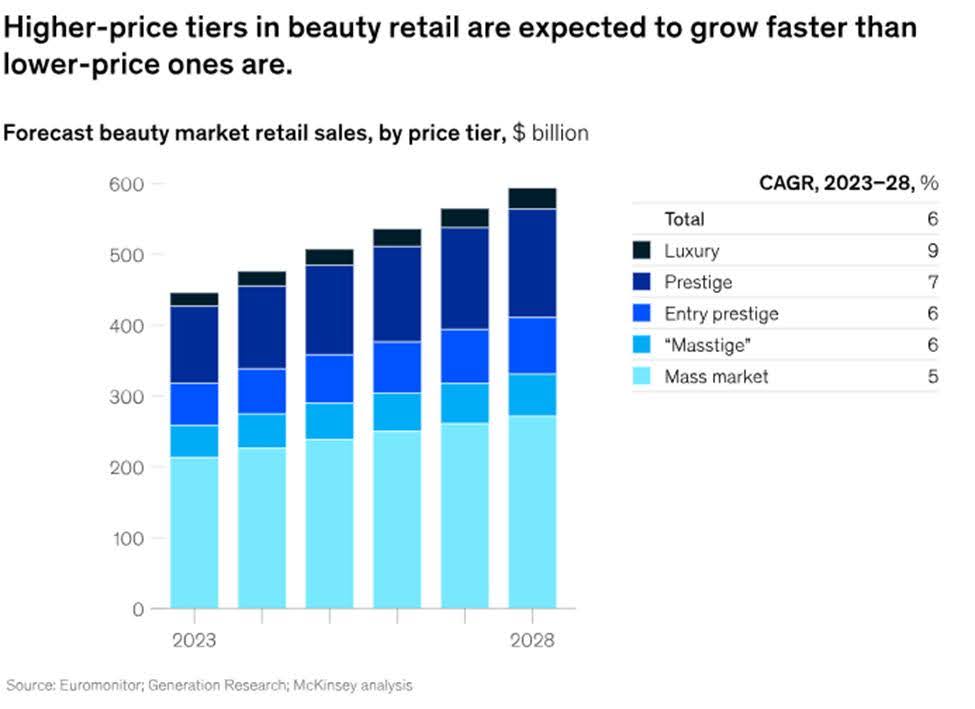

Market Growth: The global beauty market is forecasted to grow to $590 billion by 2028, reflecting a 6% CAGR. Estée Lauder’s emphasis on the prestige and luxury tiers, which are expected to grow at 7% and 9% CAGR, respectively, is encouraging.

Source: The beauty industry boom: Can growth be maintained? | McKinsey

c. Peer review

- After comparing Estée Lauder’s challenges in China and Travel Retail with its peers, I concluded that these issues are not unique to the company. Moreover, the reported market share gains in China, especially within the prestige beauty category and innovations in night skincare, further validate this. Here’s a sample of what other companies CEO’s are stating.

- Beiersdorf: “I mean, if you look at the performance of La Prairie, obviously, China is impacting us and not only China, brick-and-mortar, but also China travel retail.” –Vincent Warnery, CEO

- L’Oréal: “So on China, I’ll start with — it’s broadly consistent, whether it’s in Hainan or China. But let’s say that overall, the market — our estimation of the market, which is quite robust, that the market was overall slightly positive in Q1, then moved to mid-single-digit negative in Q2 and higher mid-single-digit drop in Q3.” – Nicolas Hieronimus, CEO

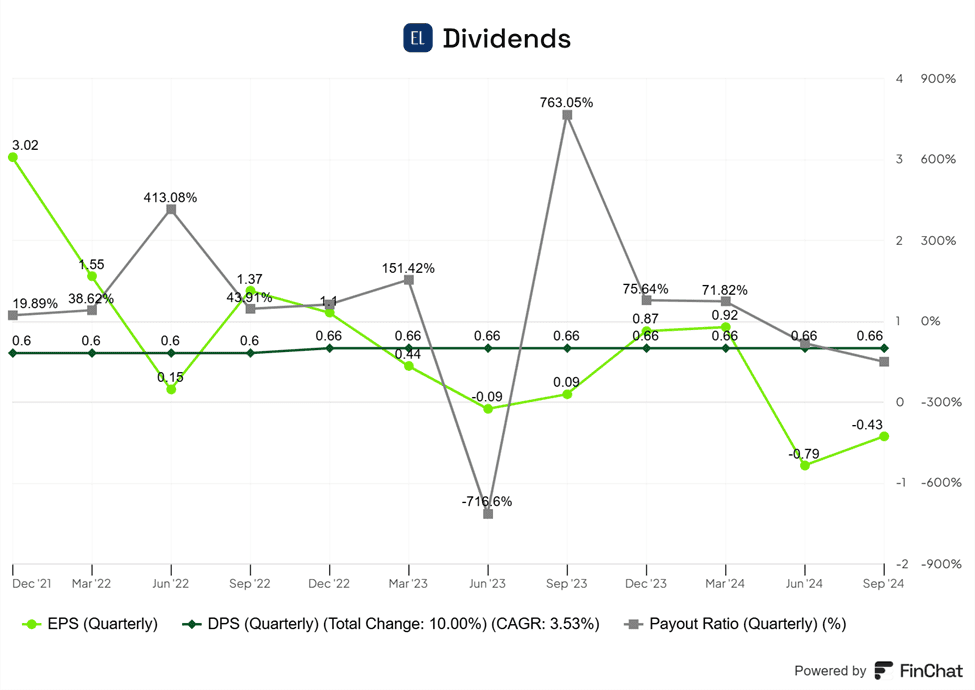

d. Dividend cut and insider purchase

- In Q1’25, Estée Lauder reduced its dividend from $0.66 to $0.35 per share to improve financial flexibility, address challenges in China and Travel Retail, and better align its payout ratio. The company remains financially stable, with strong debt management and an interest coverage ratio exceeding 4x. While dividend cuts often signal difficulties, I view this decision as a prudent move to prioritize growth opportunities, streamline costs, provide financial flexibility to new leadership, and avoid risks of stagnation.

Notably, board member Paul Fribourg (on the board since 2006) demonstrated confidence by making his first open-market purchase, investing $25 million in shares.

Source: Finchat

e. Valuation

- The valuation was too attractive to overlook, offering a ‘margin of safety’. At an EV/EBITDA multiple of 10.7x, significantly below its 5-year average of 21.5x, I see potential for multiple expansion as profits normalize and sales leverage kicks in. Compared to L’Oréal’s and Shiseido’s 5-year averages of 24.9x and 21.7x (and current multiples of 18.2x and 18.7x, respectively), I believe there is at least potential for Estee Lauder’s multiple to rise to 15x over the next 12-24 months, offering an upside of 50%-100%.

3. Risks

- Mainland China and Travel Retail: A key part of my thesis is the recovery in these regions over the next few years, which should position the company ahead of peers due to its reliance on these markets. However, prolonged challenges could delay the anticipated profitability improvement and multiple re-rating.

- Acquisitions: Recent impairments show that previous acquisitions have destroyed shareholder value. The risks associated with recent (DECIEM, TOM FORD, etc.) and future acquisitions remain unchanged.

- New Leadership: Over the past few months, Estée Lauder announced a new CEO, CFO, and leadership team in the Americas. While this introduces some execution risk, the company’s ‘promote-from-within’ culture, along with high insider ownership (~37%) from the Lauder family, provides confidence that this risk is minimized.

4. Conclusion

In my view, the worst is already priced in, and I remain optimistic about Estée Lauder’s long-term prospects, supported by industry growth projections—particularly in e-commerce, specialty retail, and the recovery of the Travel channel. Given my available cash, I’ve decided to initiate a 4.5% position in my eToro portfolio.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.