In recent years, it’s become harder for investors to diversify their portfolios out of the US. That’s for a number of reasons. Firstly, the sheer performance of US markets has made it difficult for investors to look elsewhere. Back-to-back years of 20%+ gains for the S&P 500 have made other markets look far less attractive for investors.

On top of that, most non-US markets suffered from an economic downturn, including China. This was a region once sought after by fund managers and retail investors alike, but a property crisis and sluggish economy have seen investors turning away.

Emerging market equities can enhance portfolio diversification for investors heavily exposed to US and developed markets, thanks to historically low correlations, high share of domestic revenues, and differing economic and market cycles.

If we look at emerging markets, India stands as one of the fastest-growing major economies. Its economy is projected to expand by 6.6% over the fiscal year 2024-2025, the highest rate among key global economies. For comparison, China hit 5% GDP growth last year while the US economy grew 2.5%. India’s growth is set to continue with forecasts for GDP growth of between 6.7% and 7.3% in fiscal year 2025-2026. India’s economy is fundamentally driven by domestic consumption, unlike most other large emerging economies such as China, which are mainly export-led.

This growth is underpinned by a growing middle class, technological advancements, and government reforms to enhance the business environment. India recently unveiled a record USD$11.5 billion in tax cuts that gave the middle classes significant relief as Prime Minister Narendra Modi seeks to cushion the economy against global headwinds.

Domestic and foreign investments in the region have grown significantly since fiscal year 2020. The growing involvement of domestic investors highlights India’s demographic advantage and expanding middle-class wealth. This is driving consumption, supporting the labour market, and reinforcing the resilience of India’s capital markets against global shocks.

This inflow of domestic investors helped offset the significant loss of foreign capital inflows, which fell to almost zero in 2024 amid a rotation to the US market. However, with rising political uncertainty and frothy valuations over in the USA, this trend may very well reverse.

The Indian market is trading at a notable discount compared to U.S. equities. While the S&P 500 currently holds a P/E ratio of nearly 25, its Indian counterpart—the Nifty 500—trades at a more moderate 23.9. With inflation well within the Reserve Bank of India’s target range and a neutral monetary policy stance, India could offer relative stability for investors looking to hedge against the potential impact of tariffs on global markets.

However, for those unfamiliar with emerging markets, navigating India’s investment landscape can be complex. That’s why we’ve put together a list of promising Indian companies to help diversify your portfolio. Let’s dive in.

#1 MakeMyTrip

MakeMyTrip is like India’s Booking.com, just turbocharged. Its business model is all about connecting your travel dreams with reality. From transportation to hotels and insurance, they have all you need. What began as a small venture catering to US-India travel has since grown into India’s largest online travel agency, commanding a 30% share of the air travel market and expanding its presence to 150 countries.

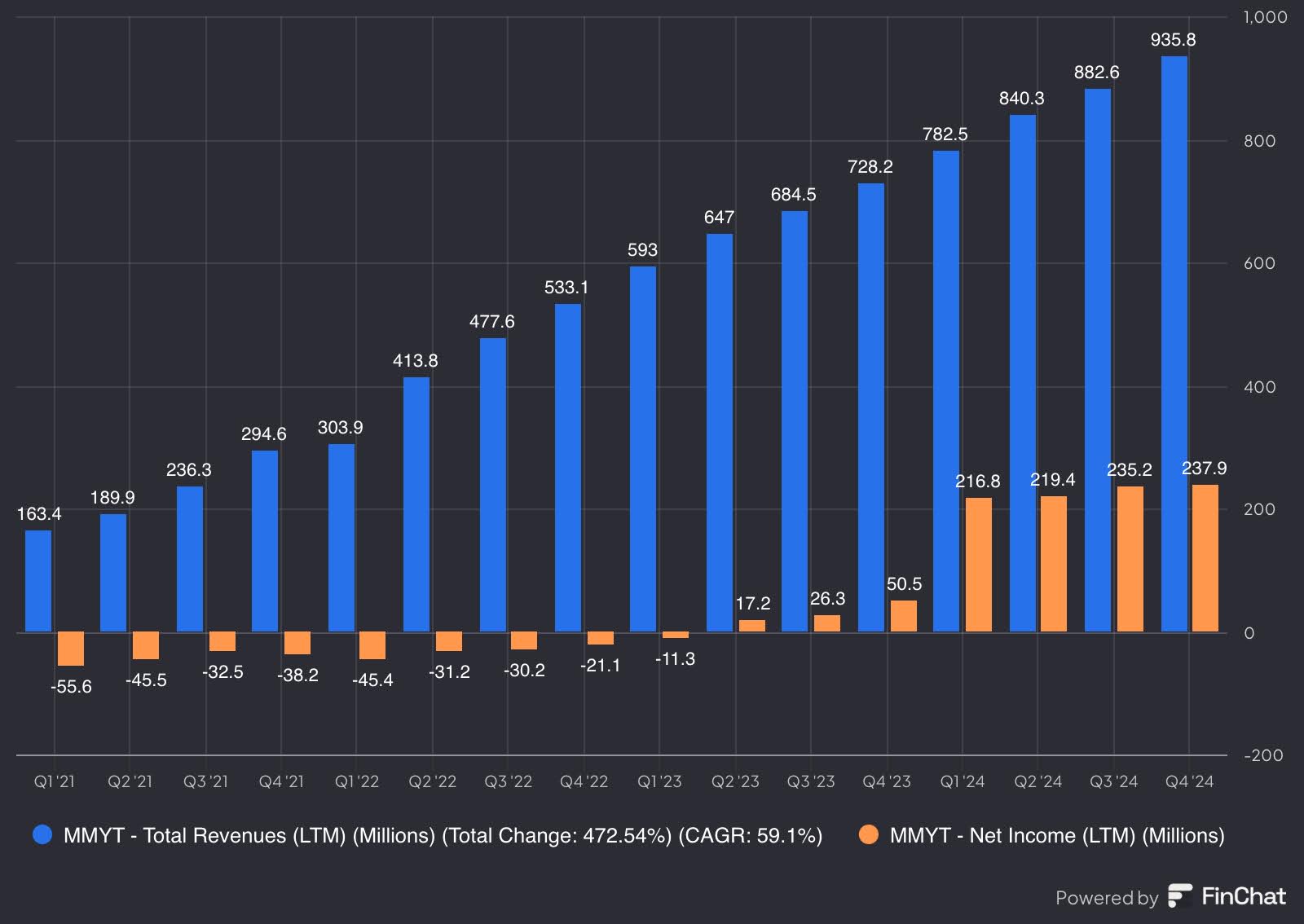

By prioritising aggressive growth and creating a seamless booking experience, they’ve managed to serve over 75 million customers and pull in $783 million in revenue in the past year. That growth stemmed from air travel, seeing a 36% increase year-over-year as consumers continued to travel more following the pandemic. The company has continued to deliver impressive growth, with revenues increasing at a staggering 62.9% annually over the past three years. Looking ahead, analysts project a 22.5% annual revenue growth over the next five years.

Explore MakeMyTrip stock on eToro!

Shares have rallied over 100% in the last year with the business recently becoming profitable. The market expects to see earnings continue to grow at 30% each year until 2028. It comes with a pretty lofty valuation at 72x forward earnings meaning it will need to keep delivering on its growth. But MakeMyTrip hasn’t seen a slowdown in travel demand and continues to benefit from rising disposable incomes in India.

#2 Reliance Industries

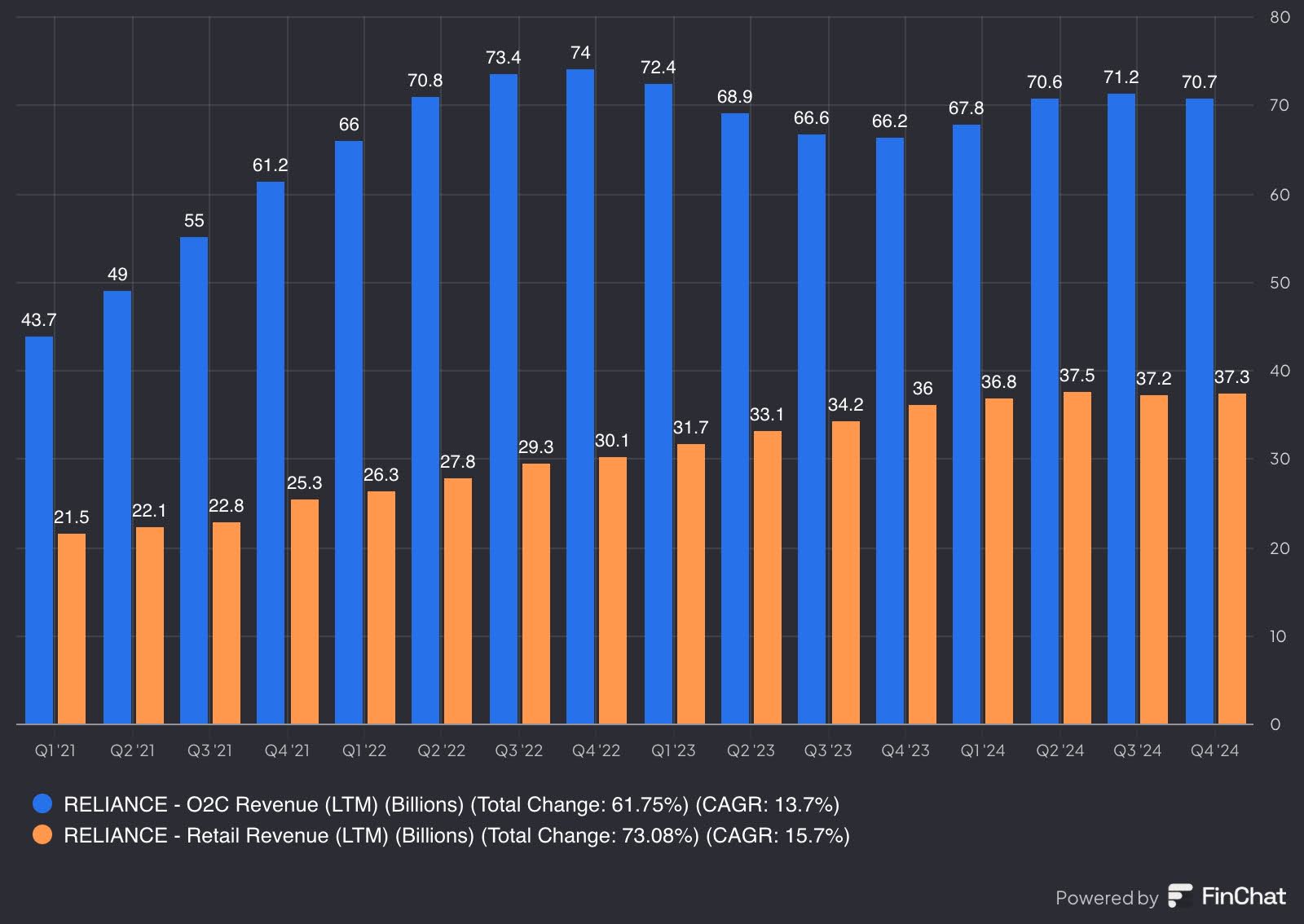

Reliance Industries, a Fortune 500 company, is India’s largest private sector enterprise, having transformed from a textile and polyester manufacturer into a sprawling conglomerate. Today, its business spans materials, retail, entertainment, oil & gas, and green energy, making it a key player in India’s economic transformation. The company put India on the global energy map and spearheaded a nationwide retail and digital revolution. Under Mukesh Ambani’s visionary leadership, Reliance has aggressively expanded into e-commerce and digital services, reshaping the country’s business landscape.

Reliance ranks as the 86th largest company in the world and the #1 in India, employing nearly 350,000 people. It plays a crucial role in the country’s economy, accounting for nearly 10% of India’s total merchandise exports. Despite its global reach, the company remains heavily domestic, generating 65% of its revenue from India. The petrochemical business remains its backbone, contributing 61% of total revenues, while retail, an increasingly significant segment, makes up 30%. This business diversification has helped Reliance maintain steady growth, even as global energy dynamics shift.

Explore Reliance Industries stock on eToro!

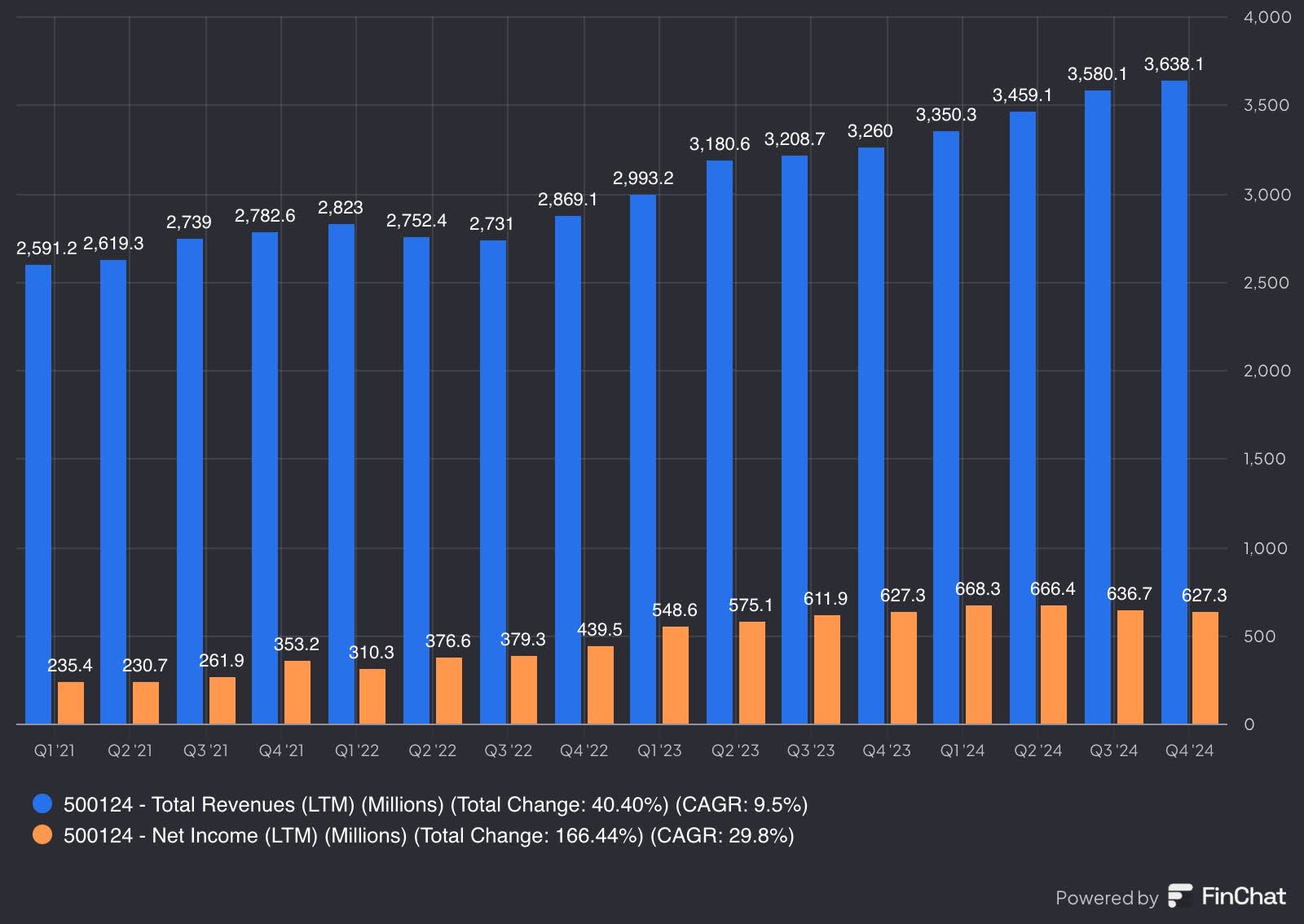

Reliance trades at a P/E ratio of 24.7x, slightly below its long-term average of 27.8x, suggesting room for upside if earnings growth continues. Over the past few years, the company has delivered 9.6% annual revenue growth and 12% annual net income growth. However, the stock has declined 11% over the past year, primarily due to concerns over regulatory scrutiny, margin pressures in its refining business, and slower-than-expected monetisation of its digital and retail arms.

#3 ICICI Bank

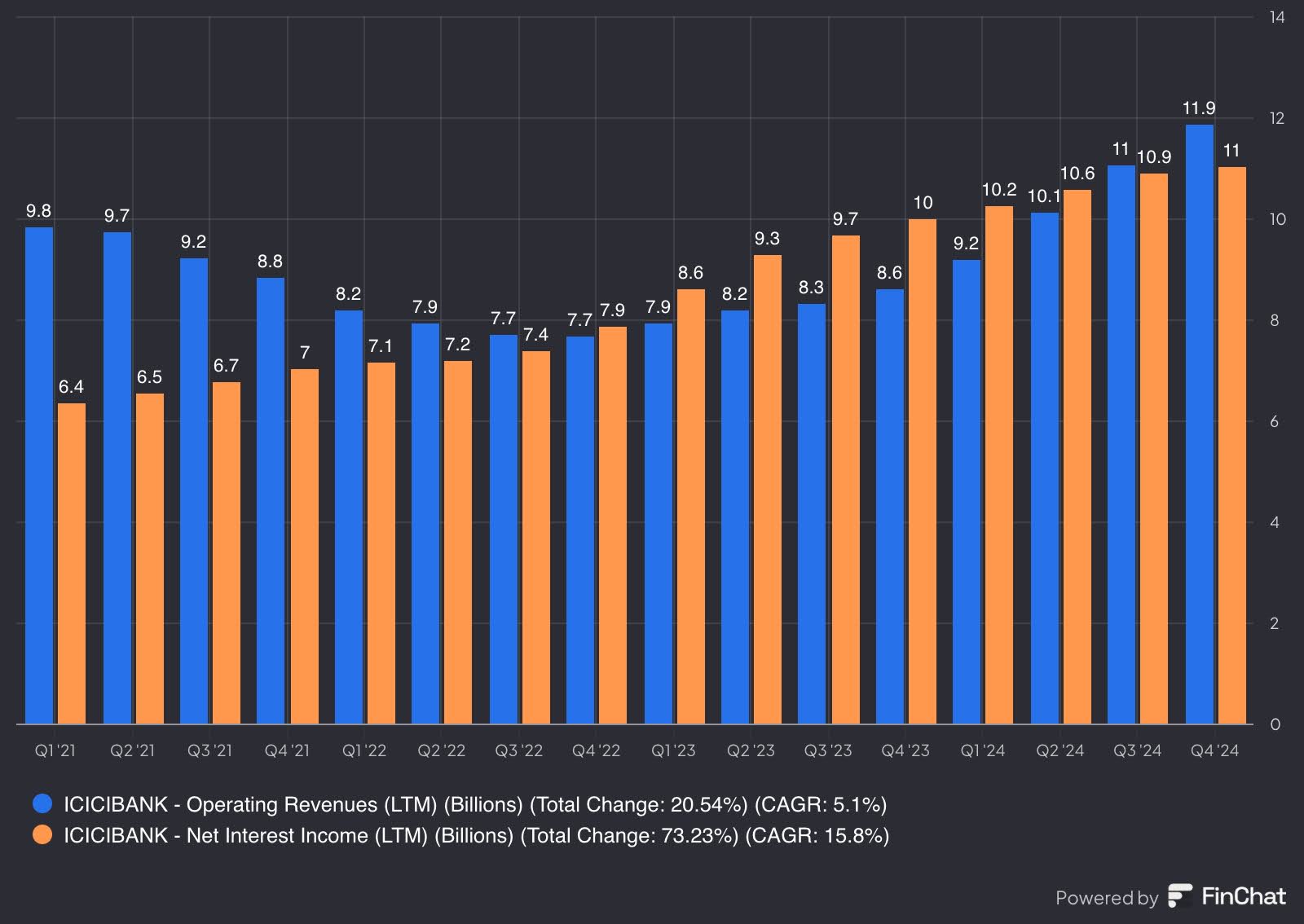

ICICI Bank, one of India’s largest private sector banks, is often regarded as the JPMorgan of India. It plays a crucial role in India’s financial ecosystem, offering a full suite of retail and corporate banking services, including loans, credit cards, wealth management, and insurance.

The bank has capitalised on India’s booming economy, expanding its digital offerings and benefiting from strong consumer demand for credit. It has consistently outpaced industry growth, driven by its focus on technology and rapid growth in the middle class. The bank has a network of about 5,420 branches and some 13,625 ATMs in India. In addition to its growing online presence, ICICI has established itself as a leader in India’s digital banking revolution.

Explore ICICI Bank stock on eToro!

Over the past year, ICICI has delivered an impressive 27% revenue growth, fueled by rapidly increasing deposits, loan issuance, and business banking expansion. Higher interest rates in India have also worked in its favour, allowing the bank to earn over 8% interest on its loan portfolio—a significant margin advantage compared to many global banks.

ICICI’s P/E ratio of 19 suggests that investors expect its strong growth trajectory to continue. For context, JPMorgan trades at a P/E of 14, reflecting a more mature, slower-growing market. Meanwhile, ICICI’s stock has gained 24% over the past year, a testament to investor confidence in its long-term potential.

#4 Larsen & Toubro

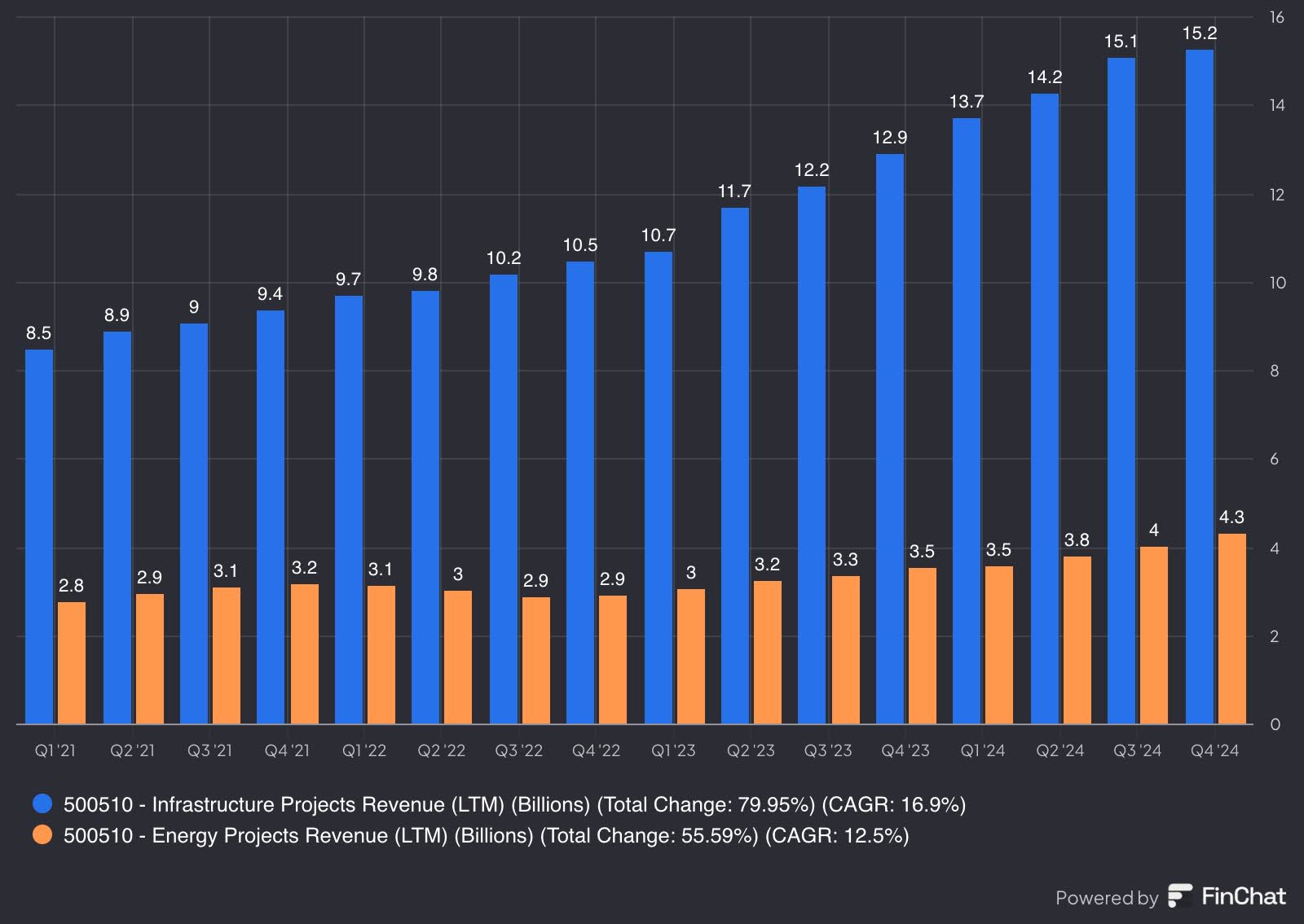

Larsen & Toubro (L&T) is another giant Indian conglomerate specialising in engineering, construction, and manufacturing. As a key player in India’s economic expansion, L&T is responsible for large-scale infrastructure, energy, and industrial projects, both domestically and abroad. Over the years, the company has diversified into technology, IT services, and machinery manufacturing, reinforcing its position as a critical enabler of India’s modernisation.

A major tailwind for L&T has been the Indian government’s aggressive infrastructure push, which continues to drive revenue growth and profitability. With no signs of this momentum slowing, the company is well-positioned to capitalise on rising demand for urban development, energy projects, and industrial expansion.

L&T reported a strong quarter, with order values surging 52% year-over-year. This robust order inflow has fueled a 17% increase in revenue, highlighting strong demand across its core businesses. Additionally, the company maintains a Return on Equity (ROE) of 16%, reflecting solid profitability and efficient capital allocation.

Despite its strong fundamentals, L&T’s stock has struggled, declining 6.5% over the past year. This pullback may present an opportunity for investors looking to gain exposure to India’s long-term infrastructure boom at a more attractive valuation.

#5 Dr Reddy’s Laboratories

Dr. Reddy’s Laboratories is a major pharmaceutical company that manufactures and markets a diverse portfolio of over 190 medications and 60 active pharmaceutical ingredients (APIs) used in drug production, diagnostic kits, critical care, and biotechnology. While the company is headquartered in India, its operations span 76 countries, employing over 26,000 people. However, the bulk of its manufacturing facilities remain in India, giving it a cost advantage.

Despite its Indian roots, Dr. Reddy’s has successfully diversified its revenue streams, generating 80% of its sales from foreign markets. North America is particularly crucial, serving as the primary market for its generics segment, which provides affordable alternatives to patented drugs. This segment alone contributes 88% of the company’s total revenue, underscoring its importance to the business.

Explore Dr. Reddy’s stock on eToro!

Over the past three years, Dr. Reddy’s has delivered solid 14% annual revenue growth, with profits outpacing sales. Thanks to a healthy net margin of 17%, earnings have expanded at a robust 33% annual rate over the same period. However, despite its financial strength, the stock has declined 5% over the past year. At a P/E ratio of 17x, Dr. Reddy’s trades well below its five-year average of 22x earnings and lags behind competitors, which trade at an average P/E of 23x. This discount could indicate undervaluation, but it also reflects market concerns—particularly the competitive pressures from GLP-1 obesity drugs, which are reshaping the pharmaceutical landscape.

#6 State Bank of India

With a history dating back to 1806, the State Bank of India (SBIN) is India’s largest commercial bank and a dominant force in the country’s banking sector. Holding a 25% market share, SBI leads in home, auto, and education loans, cementing its position as the go-to bank for millions of Indians. It also has a strong international presence, operating 241 branches across 29 countries, making it a global banking player.

SBI has successfully embraced digitization, launching YONO (You Only Need One), a financial super app that integrates banking, investments, and digital services into a single platform. With its deep reach in both rural and urban markets, the bank plays a crucial role in India’s financial inclusion efforts, catering to a broad customer base.

Unlike ICICI Bank, which has a more diversified lending model, SBI is primarily a retail bank, with over 90% of its deposits and 55% of its loans originating from retail clients. This strong deposit base provides a stable funding source, reducing its reliance on volatile corporate lending.

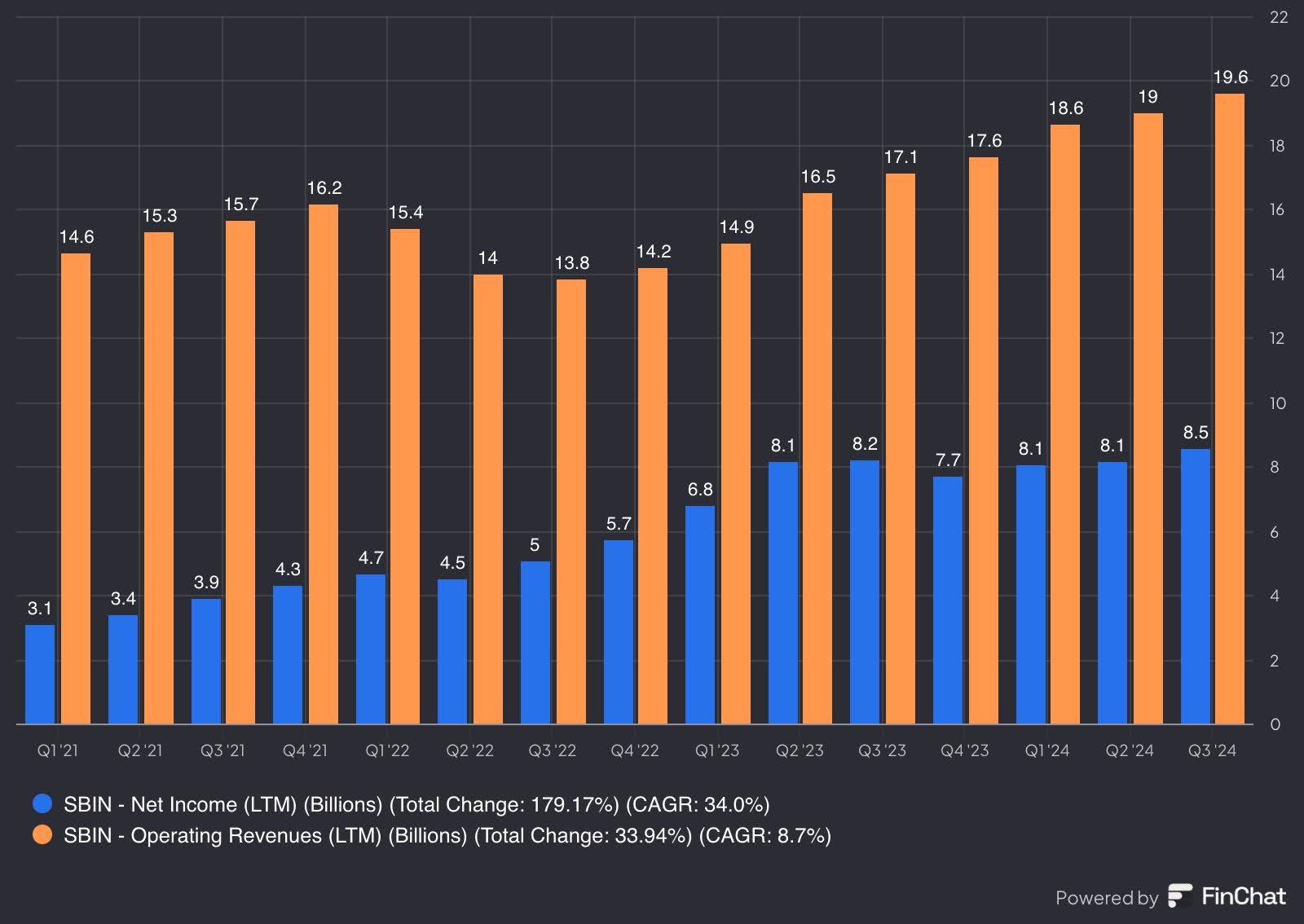

Over the past year, deposits grew 11%, while profits surged 21% year-over-year. Looking at a longer horizon, revenues have expanded at a 15% annual rate over the past three years, while earnings have grown at a remarkable 44% per year. This growth has been fueled by rising credit demand and higher interest income, as elevated interest rates have boosted bank profitability.

Despite these strong fundamentals, SBI remains undervalued compared to its peers. The stock has gained 12% over the past year but is still trading at a P/E ratio of 8.3x, well below its five-year average of 10x and significantly cheaper than competitors, who trade around 15x earnings on average. Additionally, the bank offers a steady dividend yield of 1.8%, providing an income stream for investors.

#7 HDFC Bank

HDFC Bank is India’s largest private sector bank by assets and market capitalization, standing alongside ICICI Bank and the State Bank of India (SBI) as one of the country’s “too big to fail” financial institutions. HDFC cemented its position as the leader in housing financing by merging with the Housing Development Finance Corporation (HDFC Ltd.) in 2023, creating a financial giant with deep penetration in India’s mortgage market.

It serves more than 68 million customers worldwide and provides a variety of wholesale, retail, and depository financial services through more than 6,340 branches and some 18,130 ATMs, including cash deposits and withdrawal machines throughout India.

Beyond housing finance, HDFC has built a diverse financial ecosystem with subsidiaries spanning banking, insurance, mutual funds, and other financial services. The company’s growth is driven by the increasing demand for housing loans in India’s urban and semi-urban areas. The bank continues to expand its offerings, capitalizing on its strong brand and extensive franchise network to stay ahead.

Explore HDFC bank stock on eToro!

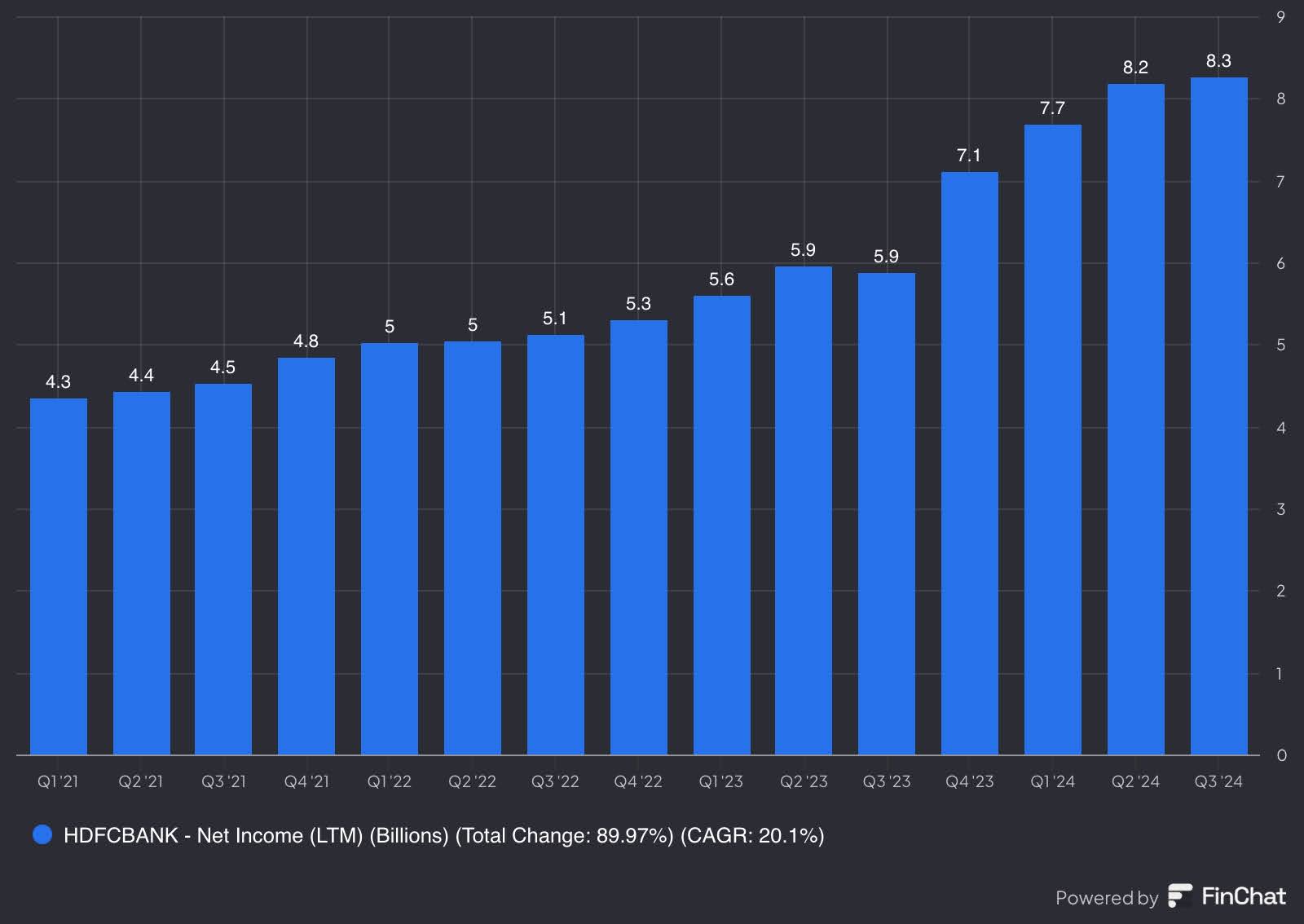

Despite the ongoing post-merger integration, HDFC’s financials remain robust. Over the past year, revenues have grown 16%, while earnings have risen 18% annually. Given its size and disciplined management, HDFC also ranks among India’s best-capitalized banks, reinforcing its financial stability.

HDFC Bank has been on a strong bull run, with shares rising 22% over the past year. Yet, its valuation remains attractive. The stock trades at a P/E ratio of 16x, below its five-year average of 19.7x, suggesting room for multiple expansion. Looking at the price-to-book (P/B) ratio, which reflects what investors are willing to pay for each dollar of the bank’s assets, HDFC is currently valued at 2.6x, below its long-term average of 3.2x. This indicates that, despite the recent rally, the bank could still have more upside.

As you can see, India provides many investment opportunities across different sectors. With relatively attractive valuations and bright growth prospects, India may be the ideal emerging market to diversify your portfolio. Check out these seven stocks now!

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.