Apple’s new iPhone lineup shows little innovation and might make investors wonder what the company’s growth prospects are, as it already trades at 33x P/E ratio

Apple launch event, highly expected by fans and investors

Mobile phone sales are forecast to increase this year due to more favorable macroeconomic conditions and improved consumer sentiment, reversing a negative trend seen over the last few years. This is good news for major phone manufacturers that are starting to bring new models to the market this fall. Apple ($AAPL) did have its iPhone 16 range of phones reveal show and investors reaction was muted. But what is next for the tech giant?

The global phone shipments forecast for 2024 was raised by research company Counterpoint to 1.23 billion units, a 5% increase compared to last year. But this figure is still 21% below the heights of 2017 of 1.56 billion units. The signal is important though as it’s reversing the decreasing trend we have seen since 2021. Analysts believe that the introduction of Generative AI will raise the shipments forecast beyond this year as major manufacturers are rushing to install this new technology into their new devices. This is likely to trigger increasing adoption. Counterpoint estimates are that the share of GenAI-capable smartphones is expected to go from less than a fifth in 2024 to more than half in 2028 with Apple’s AI (Apple Intelligence), available in its upcoming models, likely to boost GenAI devices in the whole smartphone market. It could create an opportunity for Apple to rise to the top in annual shipments as soon as in 2025.

The highly expected iPhone 16 launch event showed a continuation of lack of innovation for Apple products. We have seen a new generation of Apple watch – 10 – with a larger screen and better visibility at an angle, the same Apple Watch Ultra 2 with a new color, new Airpods – 4th generation – with a slight redesign to make these more comfortable, updated Airpods Max but with USB C now and new colors and the new iPhone 16.

But, in my opinion, one of the most interesting announcements is one that does not involve buying new hardware if you already own a pair of Airpods Pro 2: the possibility to professionally test your hearing at home and to use the headphones as a hearing aid. A software update will make this possible and might help users save money for the paid service at the audiologists. This made hearing aid companies tumble. Amplifon, Demant and GN Store Nord were among notable decliners.

New iPhone lineup continues to show little innovation

Now back to the iPhone launch. In the past couple of years the new generation of iPhones brought only camera and processor improvements. This year was a bit different as the new iPhones 16 lineup received besides a new processor and a different camera also two new buttons. In fact, the new button was called the camera button. It is a tactile, sapphire glass button that allows users to start and control the phone cameras by a sequence of presses, taps or slide gestures. The non pro iPhones also received the Action button introduced last year on the iPhone Pro 15 models.

Picture source: Apple

Part of the show was dedicated to the new Apple Intelligence and how it will improve users life, but the system will be available next month only in US English in beta, in most regions around the world. This is making all new users of Apple 16 phones beta testers. It is a worrisome trend that was seen in other areas dominated by technology.

But in the European Union the generative AI function of Apple terminals will not roll out when it releases them. If traveling outside of the EU, Apple Intelligence will work when the device language and Siri language are set to a supported language it is mentioned on Apple site. The reason, the company said, is due to privacy concerns stemming from the Digital Markets Act. But during the launch show Apple said that they are working to expand next year the languages supported to French , Chinese, Japanese and Spanish. And this might impact the appeal of new Apple terminals.

Folding Iphone still far, competitors way ahead

Investors are also waiting for new form factors like flip or foldable phones and a ramp up in innovation. Apple’s entry into foldables is expected in 2027 but for now analysts estimate that Chinese brands such as Huawei, HONOR and Motorola will drive growth in this market.

In fact Huawei tried to steal the iPhone’s thunder with its new phone launch just hours after the Apple event, revealing the world’s first tri-fold smartphone, the Hero Mate XT. The phone features three panels that can be folded up to three times. It has a 10.2-inch screen and is available in red and black. Successful sales of the Mate XT smartphone, which currently has more than 3.7 million pre-orders since becoming available online Saturday, would be another indication of the company’s sustained resurgence despite US sanctions. The base model starts at 19,999 yuan ($2,800), twice as much as the Iphone 16 Pro Max flagship that starts at $1199 in the US. Apple said that generative AI, like ChatGPT, on its iPhone 16 would allow users to create text and images with natural-language prompts. It’s unclear whether the Mate XT includes any AI features. According to CNN sales of Huawei’s flagship smartphones rose 72% in the first five months of 2024, compared to the same period a year ago. Also Nvidia ($NVDA) earlier this year named Huawei a top competitor in a number of areas, including in the production of processors that power AI systems.

Apple lost to Samsung the leadership in the market share at the end of Q1. Apple’s shipments declined 13% YoY, as worldwide iPhone shipments came in at 50.6 million or 17% of global market share. Samsung accounts for 20% shipment share or 59.4 million units.

Are Apple incremental improvements enough for investors?

The presentation gave some incremental improvements of Apple products to appeal to some of its customers but received a somewhat muted reception from social media influencers. But is it enough for investors? During the presentation the reaction was muted but the price deteriorated while Apple presented the new iPhones. The price recovered after the end of the event.

Picture source: eToro

Apple is a company that is very important for investors. It is the fourth most held stock by individual investors in eToro globally. That is why the interest and the expectations for the new iPhone are high, given that phone terminals sales accounted for half of Apple revenues in Q2 this year.

But was this launch enough to boost Apple evaluation that currently sits at a P/E ratio of 33X? Will the new products raise revenue and profitability perspectives of the company? The company is so big now that to move the needle of profitability will need a big increase in revenue. Apple is currently having a revenue of $386 billion with 102 billion net income in the past 12 months (TTM). At the current level of net income margin of 26.44% to raise profitability by 1% it will require an increase in revenue of $3.856 billion. In Q2 the average increase in profitability of S&P 500 companies was 13%. To increase profitability yearly with 10% Apple will have to show an increase in revenue of $39 billion which with the current lineup of products seem highly improbable. Estimates are that Apple revenue will grow with around 6.7% next year. This means an increase in revenue of 26 billion for the whole 2025.

And to make matters worse, latest news showed that Apple lost its EU court battle over €13 billion ($14.4 billion), a long-standing dispute concerning its tax arrangements in Ireland. It is not clear how this will impact the company’s finances and what are the next steps but it may add to investors worries.

Apple launch boosts chips manufacturers

Not all news from the Apple launch was bad for the industry. Analysts are considering that the new generation of iPhones will help Cirrus Logic ($CRUS), Qualcomm ($QCOM) and Broadcom ($AVGO).

The new iPhones coming with AI capabilities embedded will be powered by Apple’s A18 and A18 Pro chips, incorporating Arm’s newest A9 chip design, according to FT, which cited sources familiar with the matter. Also the A9 architecture will bring twice as much royalties to the company that has a long term contract with Apple. This made Arm Holdings to be the new large-cap Top Pick of Morgan Stanley analysts, citing mobile recovery, new edge AI opportunities and the resulting royalties’ expansion. The company’s stock price rose 73% year to date after the IPO but only 3% in the past six months.

Also Taiwan Semiconductor ($TSM) said that sales for August surged year-over-year, buoyed in part by demand for all things artificial intelligence. Taiwan Semi, which manufactures processors for Nvidia ($NVDA), Apple ($AAPL), AMD ($AMD) and others, said revenue for August came in at approximately $7.8 billion, up 33% from August 2023, albeit down 2.4% from July.

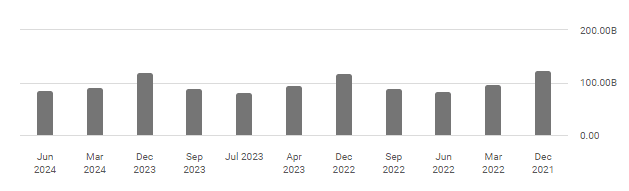

Picture source: Seeking Alpha

Previous launches ( see picture above) showed an increase in revenue during the last quarter and most likely this year will not be different. But the last two launches showed that in 2022 the revenues were 5.48% lower compared with the same period in 2021 and in 2023 these rose with only 2.07% as the inclusion of USB-C in the iPhone 15 range prompted some users to upgrade. Supply-chain analyst Ming-Chi Kuo expects iPhone 16 shipments for 2024 to be about 89 million units, down slightly from the 91 million units of the iPhone 15 shipped in the same period last year. As Apple tries to order what it will sell, this indicates that the company is not anticipating a huge jump in customer demand for the new phones. We will see if the new camera button, the action button for lower tier models and the promise for Apple Intelligence will be enough to create the increase in revenue and profitability that investors seek.

Investors are interested in Apple stock but current company sales prospects combined with the recent loss of its EU court battle over €13 billion ($14.4 billion) taxes might raise some questions about the stock evolution. Investors still remember that Warren Buffets fund slashed its Apple holding by 50% only one month ago.