Please see this week’s market overview from eToro’s global analyst team, which includes the latest market data and the house investment view.

Pressure on equity markets, CrowdStrike, and President Biden

What a week! Last week, the tech rout continued, taking the Nasdaq down 4% and the S&P 500 down 2% for the worst week since April. The Dow Jones (+0.8%) and Russell 2000 (+1.7%) only partly profited from the rotation, as an unexpected glitch at cybersecurity firm CrowdStrike caused short-term troubles at Microsoft, other corporations, air traffic, and hospitals. The European STOXX 600 shed 2.7%. On top of it all, President Biden dropped out of the upcoming election under pressure, with Vice President Harris the most likely candidate to obtain the Democratic nomination to run. On Monday morning, markets were almost unchanged from Friday, trying to assess how likely a ‘red wave’ on November 5 may be and what it would mean for markets. In China, the PBoC unexpectedly lowered the key interest rate from 1.8% to 1.7% to support the economy, pushing Chinese government bond prices up.

This week will be almost all about corporate Q2 earnings, with 138 companies in the S&P 500 reporting, accompanied by a wealth of European multinationals. Crypto markets look forward to the Ethereum spot ETF starting trading on Tuesday, and Republican nominee Trump speaking at the Bitcoin Conference in Nashville on Saturday. The 33rd edition of the Olympic Games will start in Paris on Thursday, with investors eager to learn whether it will help companies like Nike and Adidas to shine again.

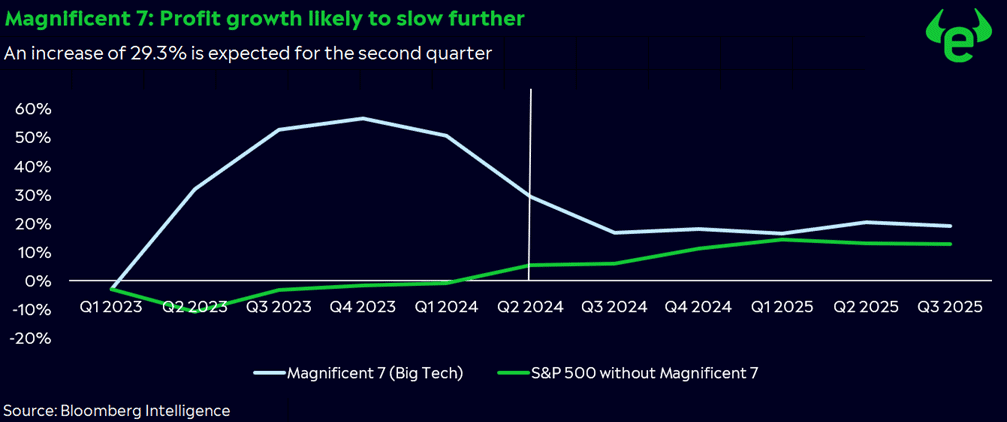

The Magnificent 7’s profit growth is expected to continue slowing

The profit growth of the Magnificent 7 is expected to slow to 29% in the second quarter of 2024, compared to an average of 35% in 2023 (see chart). Despite this slowdown, the tech giants’ profits could still be six times higher than those of the rest of the S&P 500, which is forecast to grow by only 5%. Given the ongoing sector rotation away from Big Tech, investors are expected to scrutinize results more critically. Alphabet and Tesla are the first of the Magnificent 7 to release their quarterly earnings. In contrast, Netflix impressed last week by adding 8 million new customers and raising its annual revenue and profit margin forecasts.

Fresh US growth and inflation data by the end of the week

On Thursday, an update of the expected US GDP for Q2 will be released. Consensus sees 2.0%. That’s higher than the 1.4% for Q1; however, recent surveys indicate rising recession risks. The ISM Services PMI unexpectedly fell below the 50-point mark in June, suggesting a potential future contraction. This is concerning, as services are central to the US economy. Since service prices are currently the biggest driver of inflation, weakness in this sector could further dampen inflation. On Friday, the core PCE (personal consumption) rate, the Fed’s favorite inflation measure, is projected to fall from 2.6% to 2.5%.

Strategic commodity germanium takes the spotlight

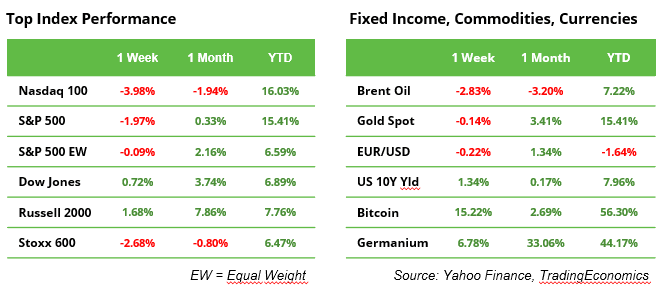

While the Biden administration has recently floated the idea of using more severe trade restrictions for selling advanced semiconductor technology to China, a Chinese government entity seems to have been buying germanium, a strategic metal key to chipmaking. The price of germanium jumped another 7% last week, for a total increase of 33% in a month and 44% year-to-date (see table). Investors may recall the Chinese government put export restrictions on gallium and germanium a year ago, when the first US measures for chip export were about to kick in. Although Chinese state buying has not officially been confirmed, it may signal another episode in the trade war between the two superpowers.

A big earnings week ahead

In the US, no fewer than 138 of the companies included in the S&P 500 Index will report earnings this week. They are joined by a wealth of European multinationals. A selection:

Communications: Alphabet, Verizon

Car makers: Tesla, General Motors, Ford, Porsche, Stellantis, Mercedes

Luxury goods: LVMH, Hermes, Kering

Consumer staples: Coca Cola, Unilever, Nestle

European banks: Deutsche Bank, Lloyds, BNP Paribas, Banco Santander, UniCredit

Technology: SAP, IBM, Texas Instruments

Other sectors: Visa, AstraZeneca, BASF