Please see this week’s market overview from eToro’s global analyst team, which includes the latest market data and the house investment view.

NVIDIA and Bitcoin keep ‘risk on’ in fast-moving markets

Entering the final trading week of November, risk is still on. Strong earnings from NVIDIA last week provided relief to equity growth investors and lifted broader market sentiment. Bitcoin maintained its rapid ascent towards the $100,000 milestone, contributing to wider crypto optimism. President-elect Trump has announced all of his cabinet nominations, nearly two months ahead of his move to the White House.

Despite a shortened trading week due to Thanksgiving on Thursday, investors face no respite in these fast-moving markets. The historically robust Q4 is in full swing, with analysts projecting double-digit US earnings growth (see below). In contrast, Europe continues to grapple with sluggish economic growth and budgetary challenges, further weakening the euro against the US dollar. In Australia, the commodity-rich S&P/ASX 200 Index reached a new all-time high this morning. Interestingly, this flurry of activity is taking place against a backdrop of relative calm, with the VIX (“fear gauge“) Index trading at just 15 points, well below its historical average.

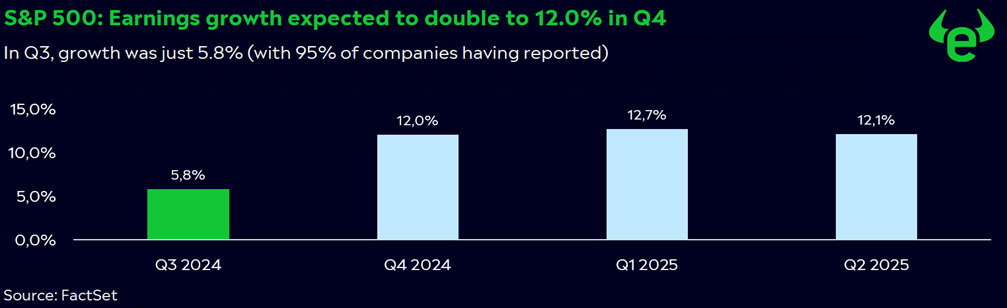

S&P 500: double-digit earnings growth projected for at least the next three quarters

The Q3 earnings season for S&P 500 companies is nearly complete, with 95% having reported their results. Of these, 75% exceeded earnings expectations, while 61% posted positive revenue surprises. However, this performance is far from extraordinary, more solid middle ground.

For Q4 and beyond, analysts are forecasting a return to double-digit earnings growth (see chart). For Q4, EPS growth is projected at 12.0% and revenue growth at 4.7%. Note these projections can and will be adjusted based on new macro and micro data coming in.

The technology sector (29% of the S&P 500), remains the heavyweight. Market leaders such as Nvidia and Apple will continue to exert a disproportionate influence on the overall market. The financial sector, representing 15%, ranks as the second-largest. Overall, the market’s focus is on the effects of easing inflation and lower interest rates. Positive signals could provide a boost to cyclical sectors such as industrials, energy, and materials. Negative signals may bring more defensive sectors, such as healthcare, real estate, consumer staples, and utilities to the fore.

The markets are at a critical juncture: optimism could drive cyclical stocks higher, while disappointments might prompt a shift towards defensive sectors. Investors would be wise to remain vigilant and adapt their strategies accordingly.

Crypto markets looking at Donald Trump to nominate a new SEC chair

Bitcoin, Binance Coin, XRP, Solana, and Dogecoin have all surged by over 100% in 2024 so far, while Ethereum and Cardano are “lagging” behind with gains of 44% and 58%, respectively. Although Bitcoin continues to dominate the spotlight, accounting for 60% of the crypto market’s total value of $3.2 trillion and nearing the $100,000 milestone, Donald Trump’s crypto-friendly campaign has been a significant driver of the broader market’s growth.

This momentum could accelerate further when the president-elect announces his nominee to lead the SEC following Gary Gensler’s departure on 20 January 2025.

Black Friday: guidepost for the Christmas business and the stock markets

Black Friday is more than just a shopping event: it offers early insights into the trajectory of the holiday season and serves as a key indicator for stock markets. E-commerce takes centre stage, with 71% of US consumers planning online purchases. Sales are expected to reach $10.8 billion, representing a 9.9% increase from last year.

Retailers use the day to boost sales and clear inventories, with digital platforms such as Amazon, Alibaba, and Zalando benefiting from their extensive reach. In 2023, global online sales on Black Friday rose by 8% to $70.9 billion. Meanwhile, Cyber Monday is gaining traction, with sales projected to reach $13.2 billion.

Companies with significant US revenue are well-positioned, as the country’s economy remains resilient. In contrast, economic recovery in Europe and China continues to lag. Globally, a normalisation process is underway, with falling inflation and lower interest rates enhancing consumer purchasing power. However, Trump’s proposed tariffs and geopolitical tensions could dampen consumer sentiment. Black Friday remains a critical litmus test, for both retailers and investors alike.

Calendar

25 Nov. Germany Ifo business climate

26 Nov. FOMC minutes + earnings from Dell, CrowdStrike and HP Inc.

27 Nov. US durable goods

28 Nov. Thanksgiving, US markets closed

29 Nov. Eurozone inflation, India GDP growth for Q3