This week, China announced a significant economic stimulus package aimed at revitalizing its slowing economy. The measures, announced by the People’s Bank of China (PBOC), include a combination of monetary easing and capital market support. These actions are designed to stimulate growth after recent sluggish economic data and a property market crisis. It is the largest stimulus package since the pandemic. However, when asked on CNBC about what he looks to buy in China, billionaire and Appaloosa Management hedge fund founder and president, David Tepper answered: “Everything! ETFs, I would do futures – everything.”

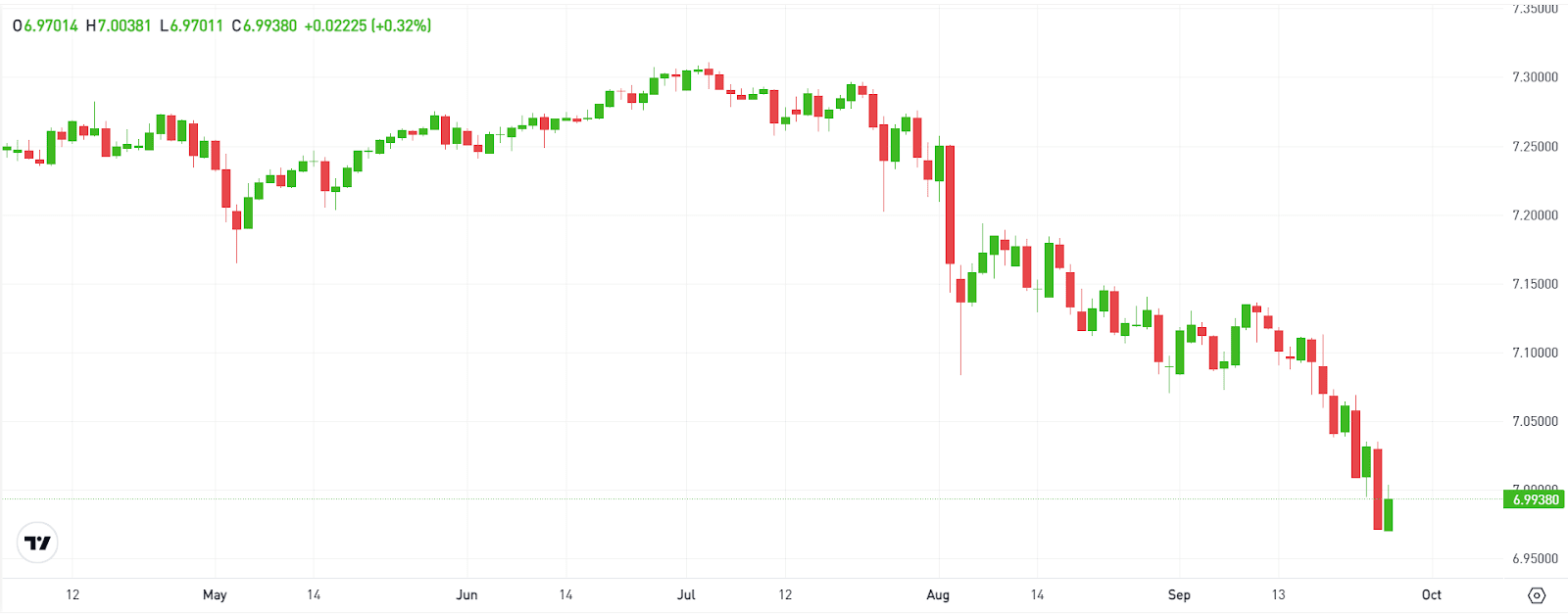

The PBOC decision comes after last week’s Fed’s hefty reduction of the interest rate and this is putting less pressure on the yuan that is currently appreciating versus the US dollar ($USDCHN). But what are the stimulus measures?

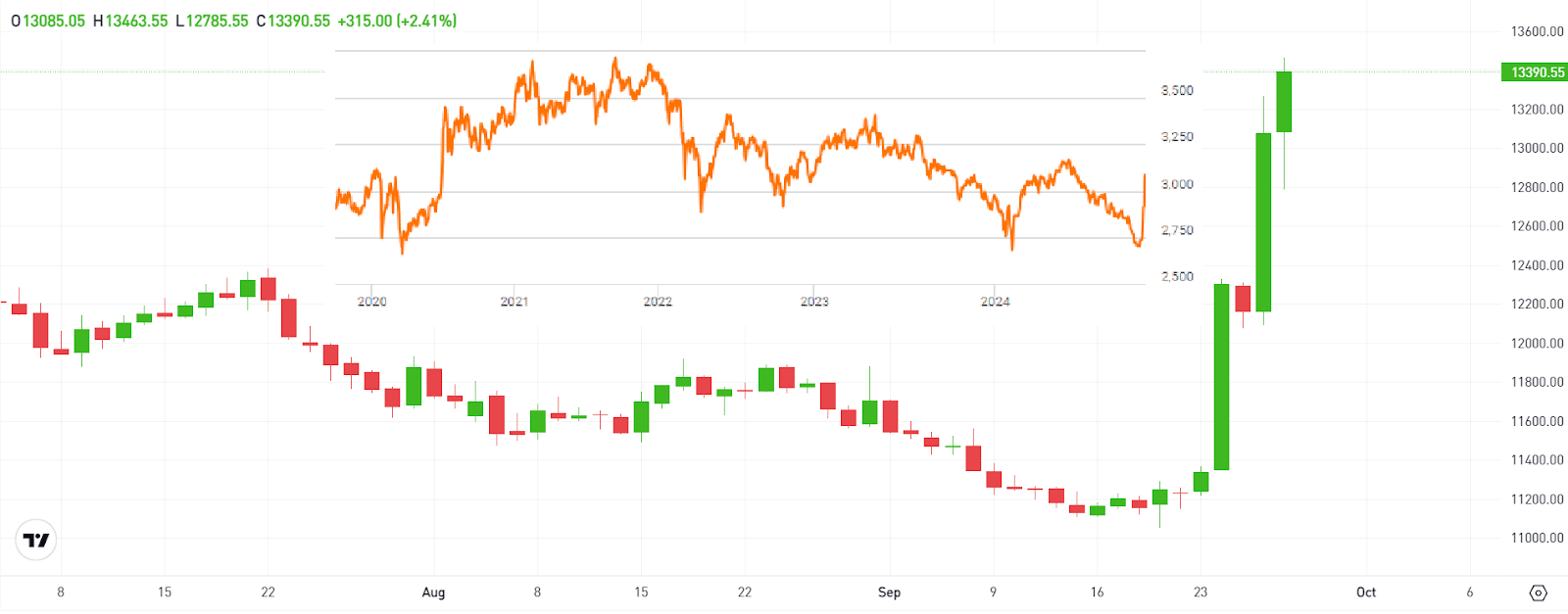

Picture source: Etoro 1 Day chart

Key Stimulus Measures:

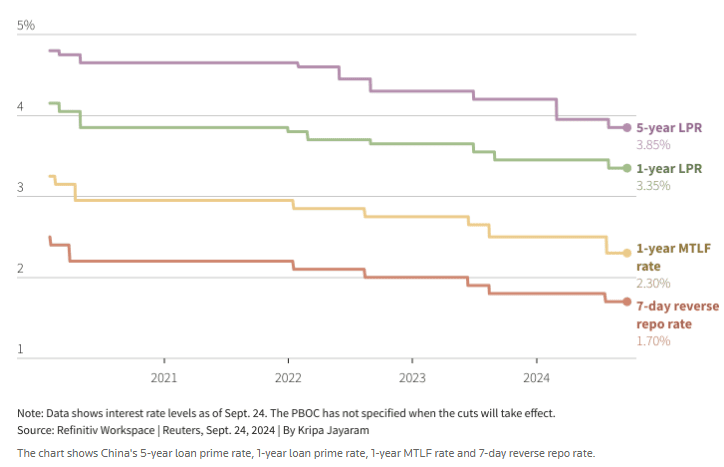

Monetary Easing:

- The PBOC will reduce the reserve requirement ratio (RRR) by 50 basis points, freeing up approximately $142 billion for new lending. Further cuts of up to 0.5 percentage points may follow later this year.

- A reduction in key interest rates, including a 0.2 percentage point cut in the seven-day reverse repo rate to 1.5%, will lower borrowing costs across the economy.

Mortgage and Property Market Support:

- Interest rates on existing mortgages will be cut by 0.5%, with the minimum down payment for second homes reduced to 15%. This is part of a broader effort to stabilize the property market, which has been in severe decline

Capital Market Support:

- The central bank introduced a $71 billion liquidity swap program for funds and insurers to boost stock market activity and will offer low-interest loans to commercial banks for share buybacks and increasing stock holdings.

Picture source: Reuters

Investment Opportunities:

As a result of these measures, several sectors and investment assets are expected to benefit:

- Chinese Technology Companies: U.S.-listed shares of major Chinese firms like Alibaba ($BABA), PDD Holdings ($PDD), and Li Auto ($LI) have surged following the announcement, with increases of up to 12% in some cases.

- Metals and Commodities: China’s stimulus is boosting global demand for raw materials. Copper prices have risen due to China’s role as the largest consumer of industrial metals.

- Chinese Property Stocks and Real Estate Funds: The property market measures, particularly the mortgage rate cuts, could benefit Chinese real estate firms and funds with exposure to the sector, though these investments remain high-risk.

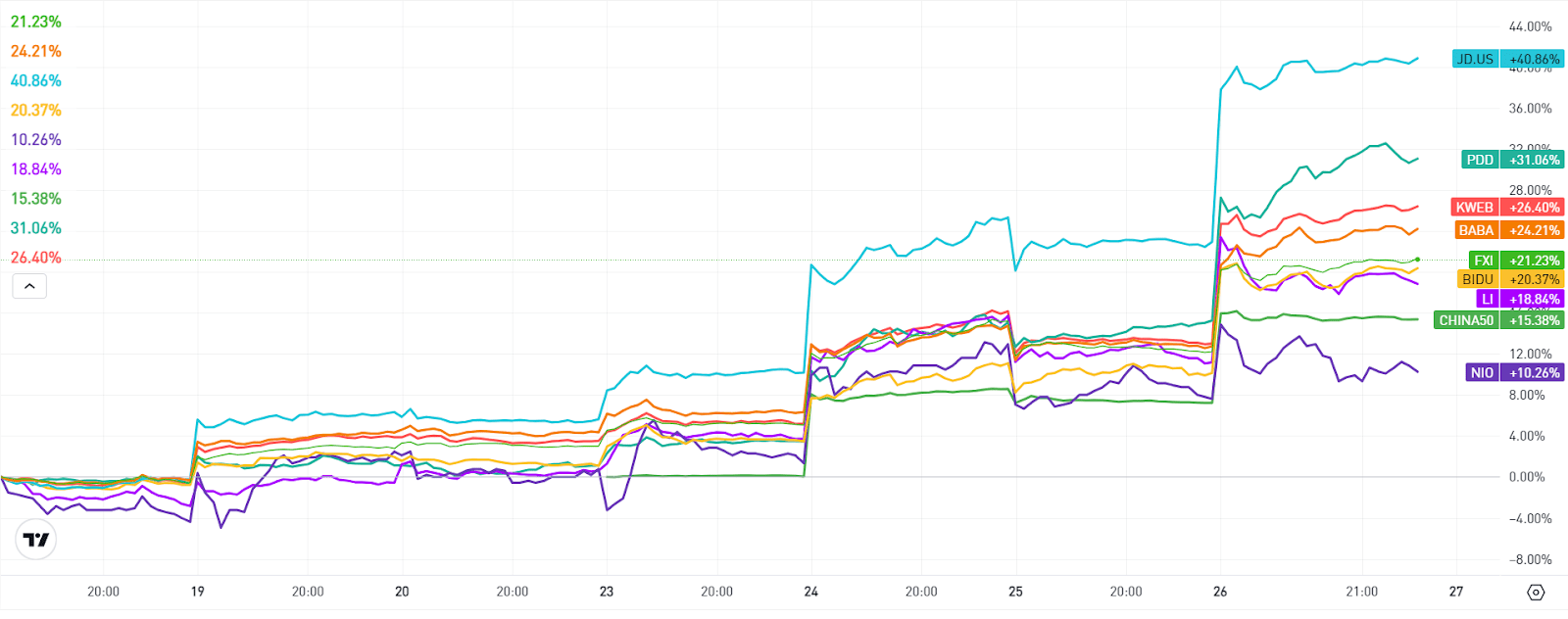

Picture source: eToro 15 minutes chart

To explore specific investments benefiting from these moves, you can look at exchange-traded funds (ETFs) tracking Chinese stocks like KraneShares CSI China Internet ($KWEB) or individual U.S.-listed stocks of companies like Alibaba ($BABA), JD.com ($JD), Baidu ($BIDU), NIO ($NIO) and Li Auto ($LI). The market already reacted positively to the stimulus package and we have seen a surge (see picture above) in all these assets.

Charts source: eToro

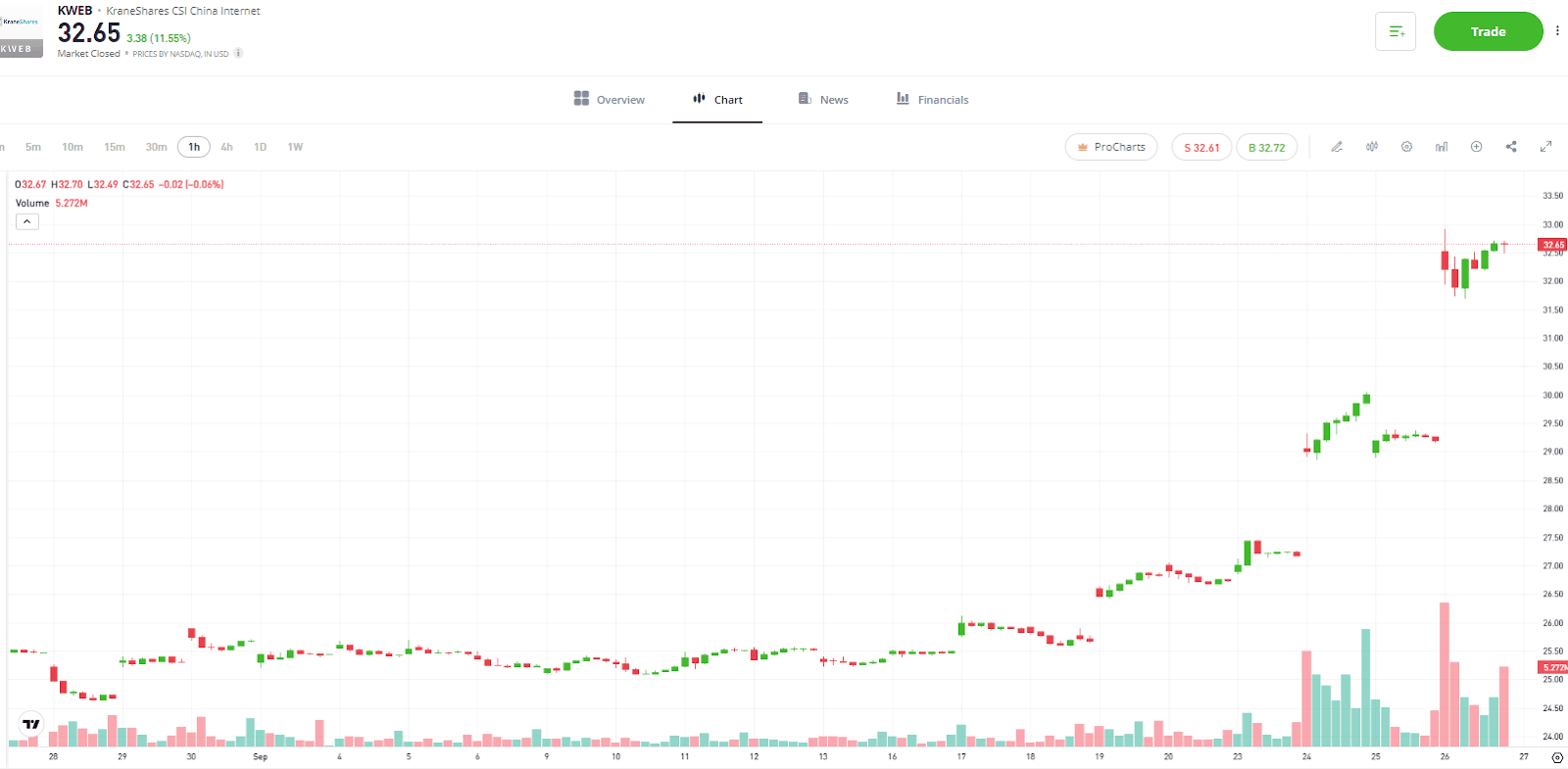

KraneShares CSI China Internet ETF ($KWEB) tracks and mirrors the results of publicly traded Chinese companies that focus on internet services. In the past month the index gained 28%, with over 22% increase in the past week (see charts above), due to market expectations that we will finally see a stimulus package aimed at fighting the slowdown in the Chinese economy. But a glance at the long term chart shows that the fund traded at a high of 104 USD in 2021. Usually such stimulus have long term implications on the economy and companies performance.

David Tepper, founder and president of Appaloosa Management. Cameron Costa | CNBC

Billionaire and Appaloosa Management hedge fund founder David Tepper said his big bet after the Federal Reserve’s rate cut was to buy Chinese stocks. What is David Tepper buying in China? “Everything,” he says.

Tepper also noted the Chinese market is cheaper than U.S. equities. “You’re sitting there with single multiple P/Es with double-digit growth rates for the big stocks that trade over here,” Tepper said. “That’s kind of versus what, you know, the 20-plus on the S&P.”

Source: eToro CHINA50 1 Day chart, Seeking Alpha 5Y chart

The Shanghai Index ($CHINA50) – see picture above – gained over 12% in the past 5 days, and the stimulus measures are having a positive impact on other Asian markets as well, as the regional economies are expecting to benefit from revitalization of the Chinese economy.

Year to date the Shanghai Index returned almost a 3% increase but it is at -1% in the past 12 months and at only 5% growth in the past 5 years. But there is still room for growth for the Chinese financial markets if you look at the 5 years chart (the orange chart in the corner of the above picture), as the index is still well below the 2021 heights. While looking at the opportunities, investors should also carefully consider the risks that they may face and make their own analysis.