Please see this week’s market overview from eToro’s global analyst team, which includes the latest market data and the house investment view.

Markets cheer on Trump’s return to the office

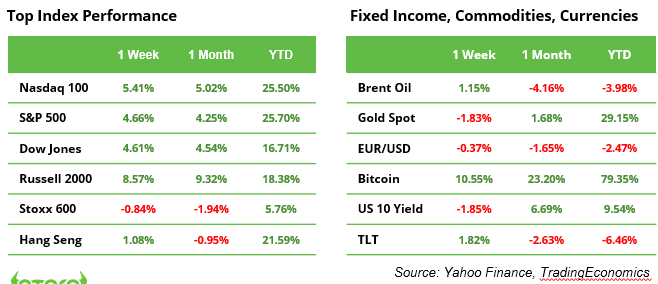

With his return to the White House, Donald Trump has become only the second American “boomerang” President after Grover Cleveland in 1893. Equity markets cheered, much like in 2016, on the promise of lower taxes and reduced regulation. On 6 November, the S&P 500 rose by 2.5%, the Nasdaq gained 3.0%, and the Dow Jones increased by 3.6%, setting new records led by the anticipated “Trump sectors” (see table). The small-cap Russell 2000 surged by an impressive 5.8%, driven by expectations of a more favourable climate for deal-making and corporate takeovers.

Bond “vigilantes,” fearing higher debt and increased inflation under Trump’s leadership, pushed the US 10-year yield up to 4.5%. Bitcoin soared by 9% on Wednesday and maintained its momentum to reach the $80,000 level for the first time ever over the weekend. The US dollar strengthened to 1.07 against the euro, marking the best week for the greenback since 2020. Tesla stock jumped by 29% in a week, as investors believe Elon Musk will be rewarded handsomely for his strong support during the election campaign.

In “other news”, the Fed cut its policy interest rate by 0.25%, bringing it to a range of 4.50% to 4.75%. Meanwhile, Germany saw its coalition government collapse (see next page), and China unveiled a $1.4 trillion stimulus package that underwhelmed investors. The US has ordered Taiwanese chipmaker TSMC to halt shipments of the most advanced chips to China. The trade war between these two global powers is intensifying by the day, even as Trump’s second presidency has yet to commence.

The week ahead

In the US, investors will receive October CPI numbers on Wednesday, and October retail sales on Friday. Furthermore, the Q3 earnings season will continue with, amongst others, results from Home Depot, Cisco, Disney, and Applied Materials, German Top 5 stocks Siemens, Deutsche Telekom and Allianz, and China’s retail giants Alibaba, Tencent and JD.com.

Table. S&P 500 Index sector performance after Trump’s victory was announced

Source: Google Finance. Price returns in USD between 5 and 8 November 2024

Are renewable energy stocks sold off unjustified?

Following Trump’s “drill, baby, drill” election, renewable energy stocks took a significant hit. Enphase Energy dropped 26%, Vestas Wind, despite reporting earnings, fell 23%, and Plug Power decreased by 18%. The sector faces strong headwinds from lower fossil fuel prices and higher tariffs on components imported from China, which threaten to slow down the growth of solar, wind, and hydrogen technologies. However, the rising energy demands of chip production and AI data centers may keep all available energy sources in demand. The sell-off seems to be more of a market overreaction to immediate political changes rather than a reflection of the sector’s future potential.

Government crisis in Germany, Scholz plans new elections by March

The “traffic light coalition” of the SPD, Greens, and FDP has collapsed. Chancellor Olaf Scholz has fired Finance Minister Christian Lindner after clashes over the 2025 budget. Scholz wanted increased investments to revive the stagnant economy, but Lindner refused to breach the debt brake, citing his oath of office.

With only a weakened SPD-Greens minority government, reforms are now difficult. This uncertainty exacerbates Germany’s fragile economy, especially the struggling automotive sector. The Commerzbank takeover by Italy’s UniCredit adds to the chaos, delaying critical infrastructure and renewable energy projects.

The crisis is pushing Germany toward new elections. The opposition demands a vote of confidence this week, but Scholz plans to delay it until mid-January to finalize projects. Elections could happen by late March, following the 60-day constitutional timeline.

Earnings and events

Appealing companies on three continents will report earnings this week. In addition, semiconductor equipment maker ASML will host an Investor Day, updating its 2030 outlook.

Earnings releases:

12 Nov. Home Depot, Shopify, Spotify, Softbank, Occidental Petroleum

13 Nov. Cisco, Tencent, Allianz

14 Nov. Disney, Applied Materials, JD.com, Siemens, Deutsche Post + ASML Investor Day

15 Nov. Alibaba