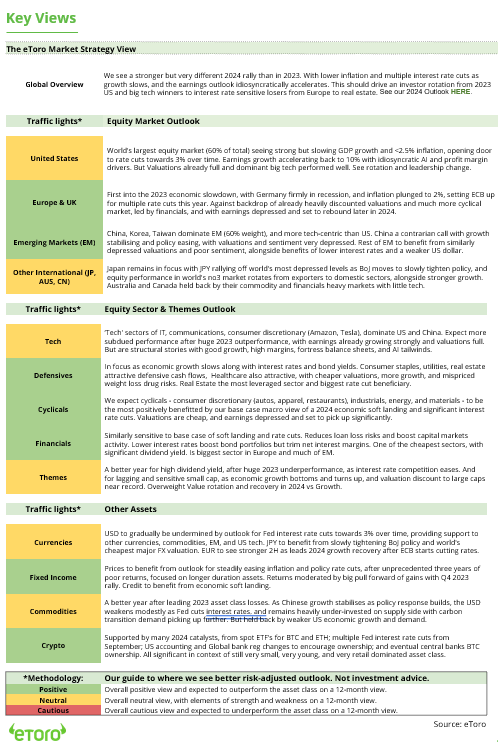

Decoding China’s Tech Surge

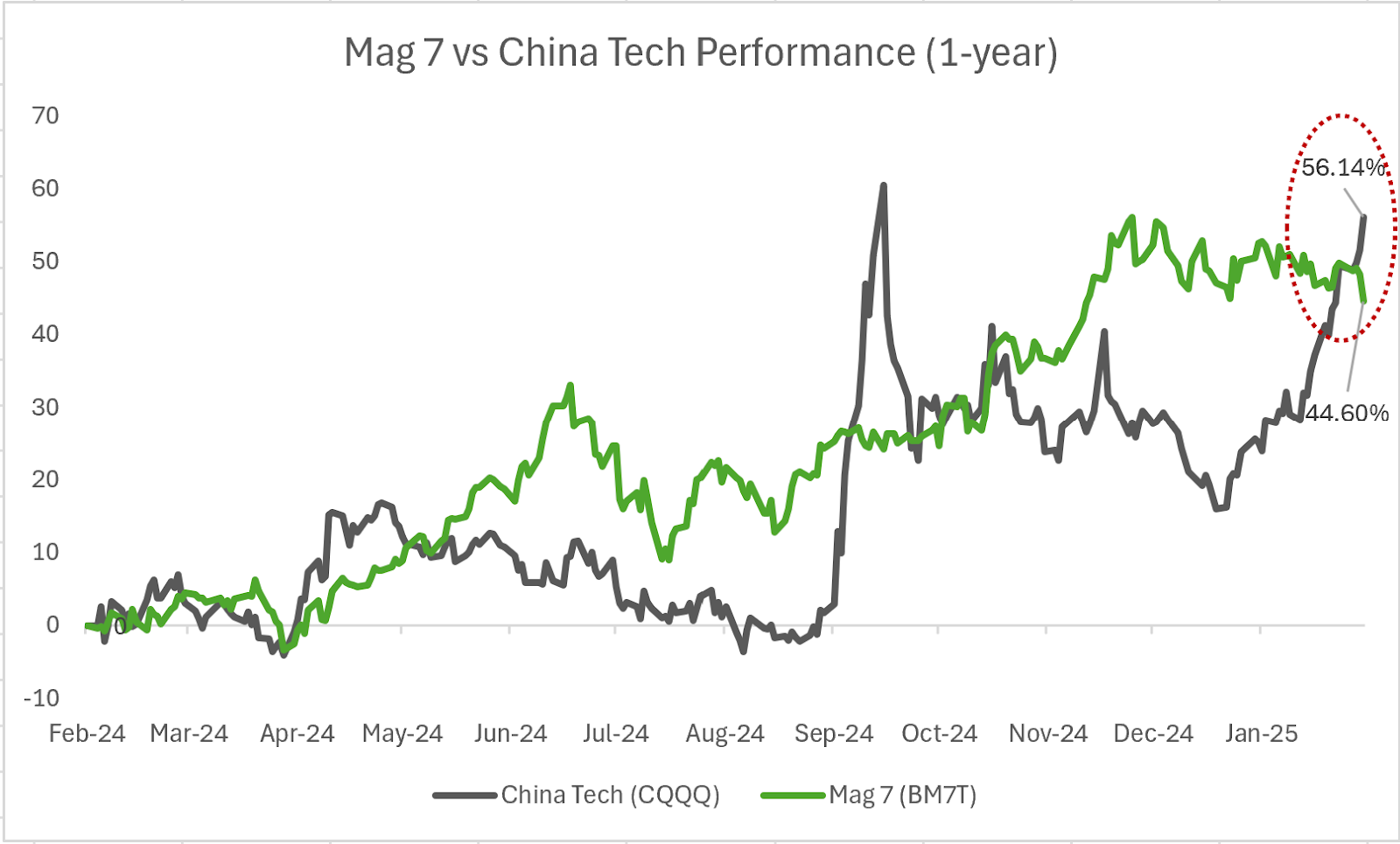

Investors are re-evaluating the tech gap between China and the United States, sparking a revaluation of Chinese tech stocks. The Hang Seng Tech Index, tracking giants like Alibaba, Tencent, and JD, has surged 31% year-to-date in local currency terms. Here we look at the reasons behind the surge.

AI Boom and Innovation: DeepSeek’s AI breakthrough is attracting global interest in China’s tech and AI sectors, especially among companies once considered undervalued. With Alibaba teaming up with Apple to integrate AI features into the Chinese iPhone and Tencent’s WeChat incorporating DeepSeek, demand for AI cloud computing is expected to grow rapidly. This accelerated progress in AI is also driving down costs.

Attractive Valuations and Growth Potential: Despite some market volatility, long-term growth prospects remain strong, with current valuations at only 65% of their US counterparts. While the best time to buy was a year ago—when valuations were deeply discounted, offering a much larger margin of safety before the nearly 60% rally—Chinese tech stocks still present opportunities. Earnings surprises and a shift of institutional investments into the sector are fueling momentum. Moreover, while Beijing’s September policy pivot helped reduce downside risks, innovation-driven tech breakthroughs are likely to sustain the recovery better than rebounds driven purely by policy shifts and market re-pricing.

Government Support and Renewed Confidence: Signs of increased government support for private businesses are also boosting sentiment. President Xi Jinping’s active engagement with top executives from Alibaba, BYD, and Tencent underscores efforts to restore confidence in the tech sector after years of regulatory crackdowns.

Despite the bullish outlook, investors must consider potential risks: First, while China has signaled support for private enterprise, past crackdowns remain fresh in investor memory. Second, export controls on advanced chips and AI-related technology could slow down China’s progress. Third, ongoing tensions with the US and Europe could impact foreign investment flows.

Bottomline: China’s tech resurgence is no longer just a policy-driven rebound but a shift fueled by innovation, rising AI competitiveness, and strong government support. With valuations still below US levels and institutional flows increasing, Chinese tech stocks continue to present compelling opportunities- though investors must remain mindful of regulatory and geopolitical risks.

Growth vs. valuation: Is Nvidia worth its price?

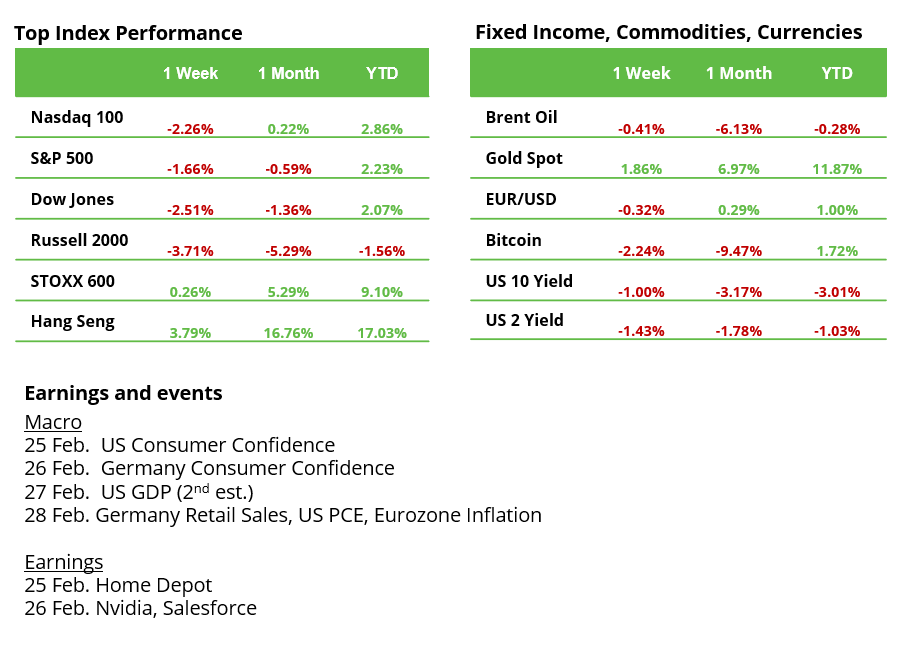

Sector Rotation Pressures Tech Stocks: Since the beginning of the year, tech stocks have been among the biggest losers in the S&P 500. With a modest 0.9% decline, the sector lags behind the broader market. Only Consumer Discretionary stocks have performed worse at -3.4%. Meanwhile, Energy, Health Care, and Communications Services are the winners, gaining between 5% and 6%.

Nvidia Earnings on Wednesday After Market Close: Analysts expect EPS growth of 61.2% to $0.79 and $38.1 billion in revenue. Investors should watch for any signs of weakening demand and how smoothly the transition to Blackwell chips unfolds, as these could drive the next performance leap and growth cycle.

Supply Chain and Tariffs as a Risk: Nvidia relies heavily on TSMC, which could become a weak spot if Trump imposes new tariffs. China also remains a risk, as trade conflicts and export restrictions could further limit market access.

High Valuation, but Exceptional Profitability: Nvidia trades at a forward P/E of 34.2, above industry peers, but its LTM EBIT margin of 62.7% underscores its superior profitability. Nvidia is not just a growth stock—it’s a highly efficient profit machine.

Third Breakout Attempt Possible: Nvidia has narrowed the gap to its record high to 10%. Since November, the stock has faced two failed breakouts at $149 (see chart). The uptrend remains intact, making a third attempt possible. Support levels at $100.84 and $90.58 could provide a cushion in case of selling pressure.

Bottomline: Nvidia has quickly recovered from DeepSeek-related losses, but the key question remains: What’s next? Wednesday’s earnings report will provide not just an update on Nvidia, but also insights into where we stand in the AI cycle. With its high valuation, potential risks are in focus. To stay competitive, Nvidia must diversify its supply chain and reassess its China strategy. Investors are looking for clear answers.

Source: eToro, TradingView

Weekly Performance and Calendar

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.