ECB cut rates, what will the Fed do?

Last week, both the S&P 500 and Nasdaq 100 indices reached new record highs, while mid and small cap averages retreated. The Europe STOXX 600 Index was 1% up after the ECB cut rates with 0.25% as expected, despite a modest increase in its inflation outlook. US job openings came in weaker than expected, but the most watched official jobs report on Friday was at 272K much better than the 190K consensus. Equity markets remained stable as at the same time the unemployment rate in May rose to 4.0%, a level not seen since January 2022. The US dollar however got stronger and bond yields spiked up, putting all attention to new inflation data and the Fed’s rate decision, both on the agenda for Wednesday this week. In the commodity markets, gold dipped to a 2-month low after the Chinese central bank paused buying, and NatGas spiked up 15% as Asia and Europe competed for tight supply. Bitcoin ended $69,500.

EU elections: Europe swings to the right

Populist right parties win substantially at the European Parliament elections, particularly in France. President Macron immediately stepped down and announced new local elections that should take place within a month. The incumbent EU coalition, led by Von der Leyen, however keeps its majority upon securing 398 out of 720 votes. Whether that will be enough for her personally to win a second 5-year term remains to be seen. EUR/USD decreased 2% on Monday morning.

Fed to release an updated ‘dot plot’

With US inflation at 3.5% in March and 3.4% in April, economists have pushed back their expectations for a first rate cut from July to September. Even a lower number than the expected 3.4% for May, that will come out during the FOMC meeting on 12 June, won’t change this. Market will focus therefore on the quarterly update of the renowned ‘dot plot’. Will the eighteen members of the Committee see one, two or still three rate cuts in 2024? The latter is difficult to imagine with the US economy still holding up strong and, for example, the Atlanta Fed GDPNow model predicting Q2 GDP growth at 3.1%.

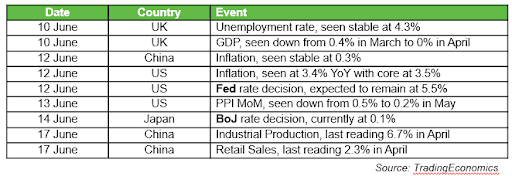

Key macro data to watch

G7 Summit in Italy

The G7 Summit will be held in Italy from 13 to 15 June. Besides the regular members, Italian Prime Minister Georgia Meloni has invited an unusually high number of twelve additional world leaders to join, including those of India, South Africa, Brazil, Argentina and Saudi Arabia. New trade deals with commodity-rich countries may help to push inflation down. Ukraine’s President Zelensky will join during the opening session, whereas Pope Francis will be the key note speaker at the closing session.

Apple Worldwide Developers Conference

With the three $3 trillion companies, Microsoft, NVIDIA and Apple, now making up 20% of the broad S&P 500 Index any development on AI will be watched as if it was a macro event. Next up is Apple that will kick off its annual Worldwide Developers Conference with a keynote address on 10 June. Apple has been silent on AI till so far, leaving the stock lagging competitors as a strong AI strategy is seen as a necessity to revamp growth. Focus will be on both hardware and software, with investors looking for an upgrade planning of all devices, and a potential team up with OpenAI, Google or a third party for development of large language models.

Earnings and events

NVIDIA will start the week with a share price around $120 after a 10-for-1 stock split, which makes the stock eligible for inclusion in the Dow Jones. Three Top 20 tech stocks report earnings: Oracle, Broadcom and Adobe. On Thursday, Tesla will hold its Annual General Meeting with the vote on Musk’s 2018 option award on the agenda. Stellantis will host an Investor Day to outline, amongst others, how it intends to cope with cutthroat competition out of China.

Chinese fashion giant Shein may file for a £50 billion IPO at the London Stock Exchange. CrowdStrike, KKR and GoDaddy will join the S&P 500 Index after a rebalancing on 27 June, replacing Robert Half, Comerica and Illumina. This may move stock prices as index tracking funds will have to incorporate the changes.