Introduction

Commodities, often overlooked in traditional investment portfolios, offer a unique opportunity for diversification and risk management. This guide aims to provide a comprehensive overview of commodities, exploring their role in strategic asset allocation, their performance across market cycles, and the various ways to invest in them.

Understanding Commodities

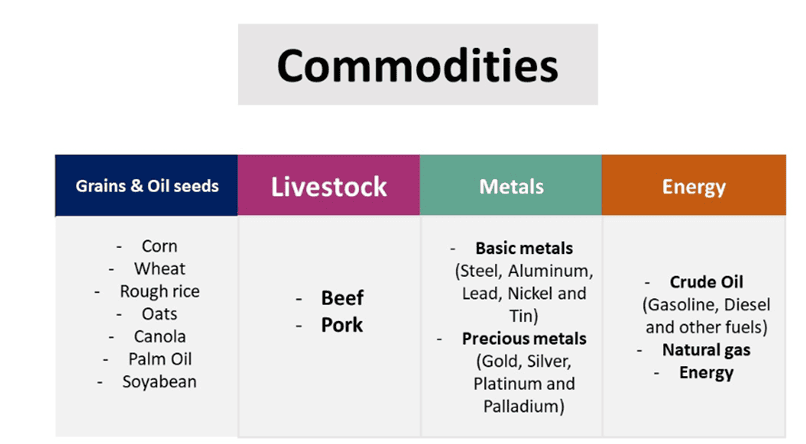

Commodities are tangible, tradable products that are typically standardized and interchangeable. They fall into two main categories:

- Natural Resources: These include industrial metals (copper, aluminum, zinc, nickel), precious metals (gold, silver, platinum, palladium), energy (crude oil, natural gas, coal), and other resources like water and timber.

- Agricultural Products: These include grains (corn, wheat, soybeans, rice), soft commodities (sugar, coffee, cocoa, cotton), and livestock (cattle, hogs, poultry).

Key characteristics of commodities:

- Standardization: Commodities are typically traded in standardized units, ensuring uniformity and comparability.

- Fungibility: Commodities of the same type are considered interchangeable.

- Price Fluctuations: Commodity prices are influenced by factors like supply and demand, economic cycles, and geopolitical events.

The Role of Commodities in Diversification

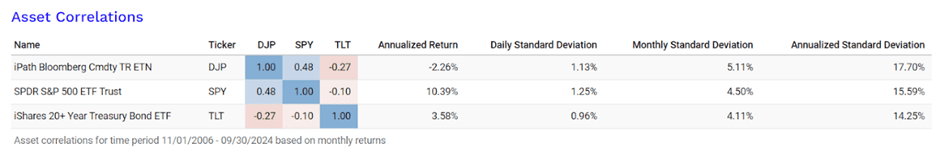

Commodities can significantly enhance portfolio diversification due to their low correlation with traditional asset classes like stocks and bonds. This means that they often move in different directions than stocks and bonds, providing a hedge against market downturns.

Strategic asset allocation:

- Core-satellite approach: Allocate a portion of your portfolio to commodities as a core holding, providing a stable foundation.

- Tactical allocation: Shift your allocation to commodities based on market conditions and your investment objectives.

- Risk parity: Allocate assets based on their volatility, ensuring a balanced risk exposure across different asset classes.

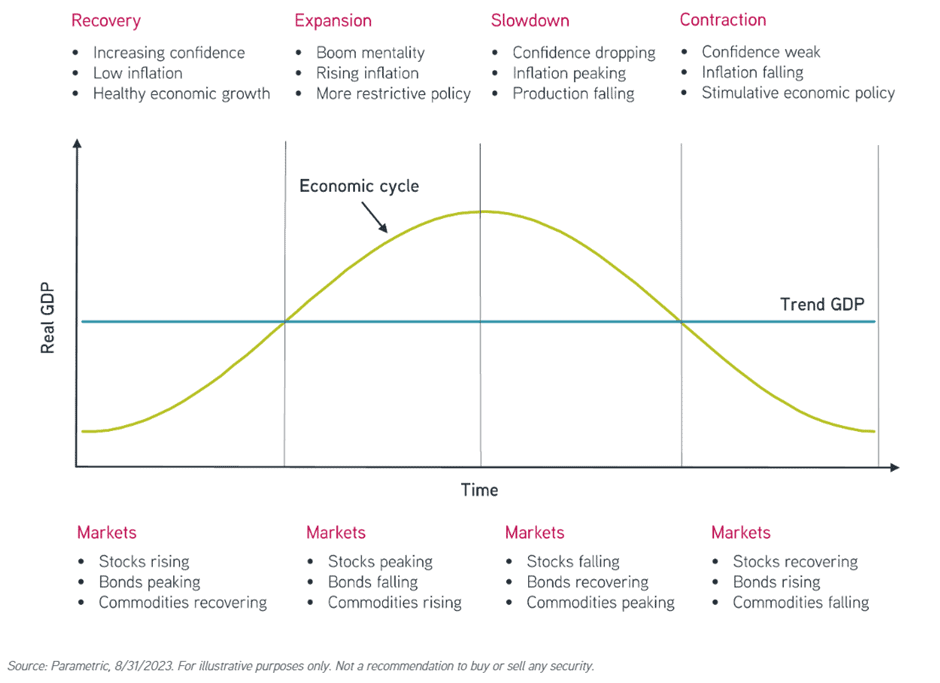

Commodities across market cycles:

- Bull market: Commodities can benefit from increased economic activity and rising demand.

- Bear market: Commodities can act as a safe haven during economic downturns, especially precious metals like gold.

- Sideways market: Commodities can provide returns independent of the overall stock market, offering opportunities for tactical trading.

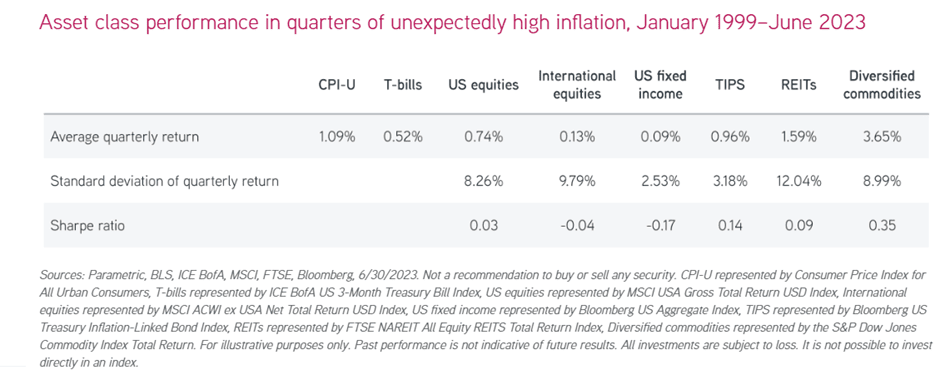

The chart showing the performance of commodities compared to stocks and bonds in different market cycles:

Commodities, such as gold, oil, and industrial metals, are often seen as a safe-haven asset during periods of inflation. Unlike bonds, whose returns are fixed and do not keep pace with rising prices, commodities tend to appreciate in value when inflation accelerates.

Why are commodities a good investment during inflationary periods?

- Direct link to the real economy: Commodities are essential inputs for the production of goods and services. When the economy is strong and inflation is rising, demand for these commodities tends to increase, driving up prices.

- Preserving purchasing power: By investing in commodities, investors seek to protect their purchasing power against the erosion of currency value.

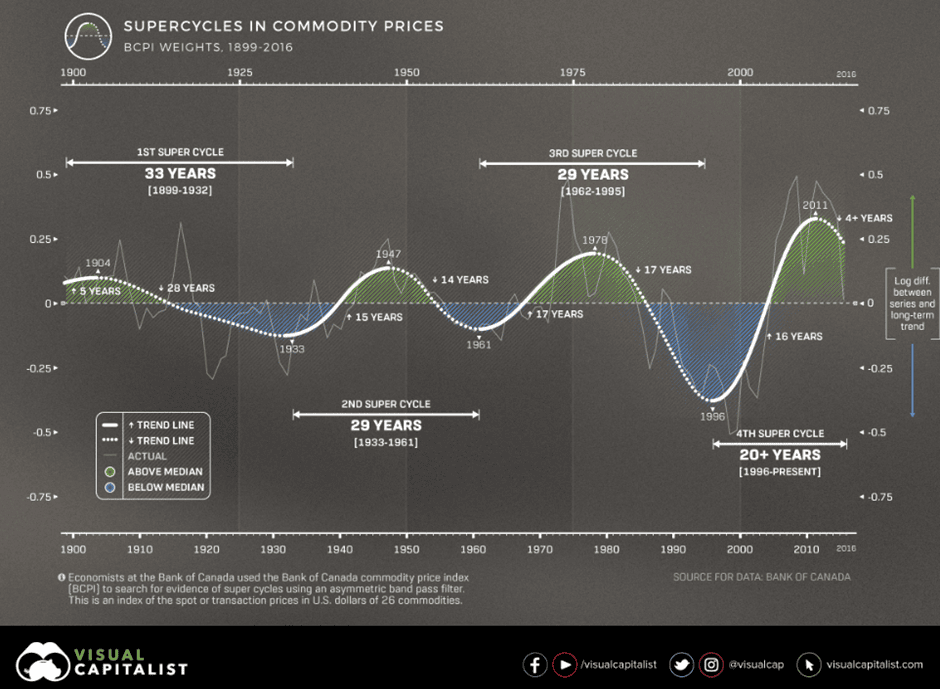

Commodities: An opportunity tied to supercycles

Investing in commodities can be highly profitable, particularly during the upswings of long economic cycles known as “supercycles.” These periods are characterized by strong demand and high prices for commodities. Economic cycles: Commodity performance is closely tied to economic cycles. Therefore, even during the downturns of a supercycle, it is possible to profit by exploiting price fluctuations. Current outlook: current conditions, marked by inflation, infrastructure investment, and the energy transition, suggest that we may be on the cusp of a new commodity supercycle.

Investing in Commodities

There are several ways to invest in commodities:

Direct investment: purchasing physical commodities, such as gold or silver, can provide ownership and potential price appreciation. However, this involves storage costs and risks.

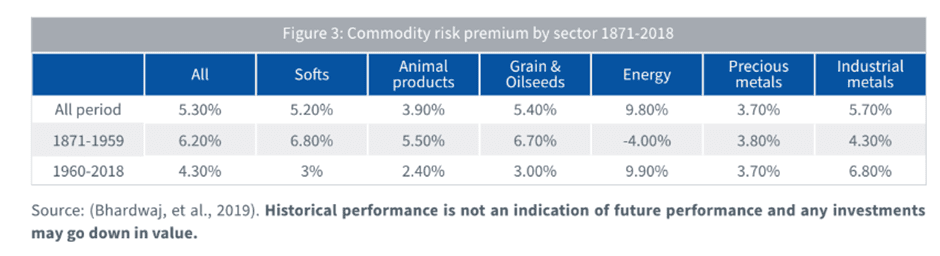

- Futures contracts: commodity futures, contracts that allow investors to buy or sell a specific quantity of a commodity at a predetermined future date and price, have historically offered returns that exceed inflation. This additional return is known as the risk premium.

Why the premium?

Commodity futures serve as a hedging tool for producers. To protect against price fluctuations, producers are willing to pay a premium. This “insurance premium” is then passed on to investors who purchase these contracts.

Diversification matters

It’s important to note that not all commodities perform the same. For example, precious metals often exhibit different return patterns compared to agricultural products.

The role of commodity futures in generating returns

While commodities themselves might not consistently outperform inflation, commodity futures—due to their role as a hedging instrument—can offer investors a significant additional return.

Key factors influencing the risk premium

The insurance role of futures contracts

- Keynesian Theory: producers buy futures contracts to hedge against price volatility. By paying a premium, they transfer risk to investors.

- Risk compensation: Investors receive a risk premium as compensation for taking on this price risk.

- Contango and Backwardation: Regardless of whether the futures curve is in contango (future prices higher than spot prices) or backwardation (future prices lower than spot prices), the risk premium persists.

The Theory of Storage

- Convenience Yield: This refers to the benefit of holding a physical commodity (e.g., for a refiner).

- Inventory Levels: Convenience yield is often inversely related to inventory levels.

- Market Dynamics: Backwardation indicates a high convenience yield, while contango suggests higher storage costs.

- Inventory Risk Premium: The risk premium can be seen as compensation for bearing the risk of holding inventory.

- Exchange-traded funds (ETFs): Commodity ETFs provide exposure to a basket of commodities through a single investment, offering liquidity and diversification.

Commodity-linked securities: These include bonds, stocks, and derivatives that are linked to the performance of specific commodities.

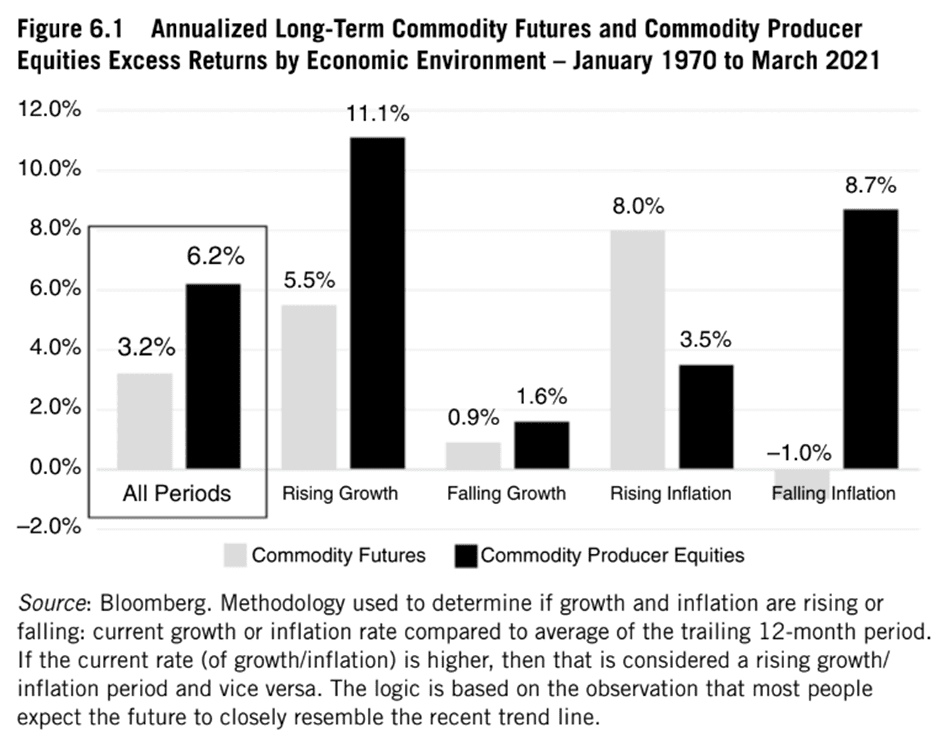

The chart above demonstrates that equities of commodity-producing companies have outperformed commodity futures. Nevertheless, commodity futures exhibit lower correlation with equities and are more sensitive to inflationary environments.

Key considerations when investing in commodities:

- Risk tolerance: Commodities can be highly volatile, so assess your risk tolerance before investing.

- Investment horizon: Consider your long-term investment goals and how commodities fit into your overall financial plan.

- Diversification: Ensure your commodity investments are well-diversified across different sectors and commodities.

- Costs: Be aware of the fees associated with investing in commodities, such as transaction costs and ETF expense ratios.

Conclusion

Commodities provide a robust hedge against portfolio volatility. Given their low correlation with traditional asset classes like stocks and bonds, they can help to reduce overall portfolio risk and potentially boost returns. Although emerging market equities, often linked to commodity production, display a somewhat higher correlation, commodities remain a valuable diversification tool.