Australia is often called “the lucky country” and it’s easy to see why. The land down under has a great climate, amazing beaches, an abundance of natural resources, some of the world’s most livable cities, a number of top universities, and a first-class healthcare system. It is also located within close proximity of some of the fastest-growing economies in the world including China, Indonesia, and India, which gives it a huge advantage economically.

While Australia’s stock market only represents around 2% of global equity markets, it shouldn’t be ignored. This is a market that has a lot to offer investors including growth, value, dividends, and diversification. And after a period of underperformance relative to global equities, the Aussie market now looks set to enjoy its time in the sun. That being the case, eToro has recently launched its AussieEconomy Smart Portfolio. Focused specifically on top Australian companies, this portfolio is designed to help investors capitalise on the potential growth of this unique economy.

Why invest in Australia?

One thing that stands out about Australia from an investment perspective is that the country — which is the 13th largest economy by GDP in the world today — has a phenomenal growth track record. Before the COVID-19 pandemic hammered the global economy in 2020, Australia had registered 29 years of consecutive GDP growth, and in March 2017, it took the record for the longest run of uninterrupted GDP growth in the developed world. Through drought, flood, the dot-com crash, and even the Global Financial Crisis (GFC) of 2008/2009, the country has continued to grow. It’s worth noting that during the GFC, Australia was the only major economy to avoid a recession. It was saved by high demand for its natural resources by China.

In addition, it’s a low-risk, stable country. Australia has a strong legal framework as well as transparent regulation, and a robust rule of law that mitigates corruption. As a result, it’s rated highly in terms of political stability. Between 1996 and 2020, for example, its average score on the Political Stability Index (which ranges from -2.5 to +2.5) was 0.99. To put that number in perspective, the US and the UK received scores of 0.44 and 0.48 respectively over that period, while the average score across all 194 countries was -0.07.

Australia’s financial markets are also governed by a strong regulatory and compliance system, and this has attracted top international businesses to the Australian Stock Exchange (ASX).

Trade 0% commission Australian Stocks

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

A closer look at the Australian stock market

As for the Australian stock market, it’s a diversified market that offers an attractive mix of growth, value, and income.

One sector that dominates the market is mining. This sector includes names such as BHP Billiton, Rio Tinto, Fortescue Metals, Newcrest Mining, and Pilbara Minerals. These companies benefit from the country’s wealth of iron ore, copper, nickel, tin, lithium (a key component in electric vehicle batteries), and gold. They also benefit from the country’s close proximity to China and the high demand for commodities from the economic powerhouse. Around two-thirds of China’s iron ore imports, for example, come from Australia.

Financial services is another major sector within the Australian stock market. Here, the market features leading banks such as Commonwealth Bank of Australia, Australia & New Zealand Banking Group (ANZ), National Australia Bank, and investment bank Macquarie Group. These companies have all benefitted from the nation’s rise in GDP over the long run.

The third-largest sector in the Aussie market is healthcare. Here, the market features some big names in the healthcare space including hearing aid company Cochlear, vaccine specialist CSL, and medical diagnostics business Sonic Healthcare. These companies are all global players with great long-term track records.

Some other top ASX-listed companies that are worth highlighting include Aristocrat Leisure, a top manufacturer of gaming machines, Qantas Airways, one of the world’s major airlines, and Woodside Petroleum, which is set to become the world’s 10th-largest oil and gas producer, following a merger with BHP’s petrol business.

Overall, the Australian stock market is quite unique in terms of its composition, meaning that it can potentially help investors diversify their portfolios.

Why now could be the time to consider Australian shares

In the long run, Australian shares have generated very respectable returns. Over the last 30 years, for example, the Australian stock market has delivered returns of around 10% per year for investors. However, this figure doesn’t tell the whole story, as there have been times when Aussie stocks have outperformed relative to global equities, and times when they’ve underperformed.

During the dot-com bubble of the late 1990s, Australian shares lagged behind global markets as investors piled into the technology sector. But Australian stocks then outperformed between 2001 and 2008 as mining stocks and banks did well. More recently, US tech shares have had another boom over the last decade or so, which has put Australian shares behind.

However, with the macro environment (high inflation, surging commodity prices, rising interest rates, etc.) now favouring miners and banks again, it looks like the Aussie market could be set for another strong run. If history is anything to go by, the decade ahead could be a period of strength for Australian shares. Typically, it has been after an extended period of underperformance that Aussie companies have generated their best returns.

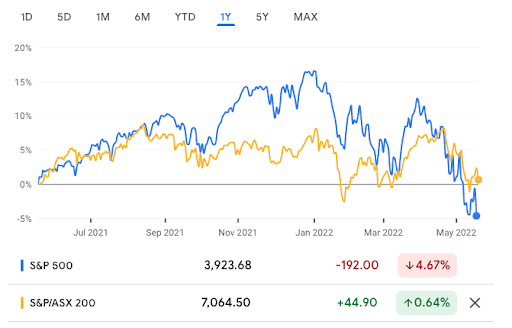

We are already seeing some very promising signs. In the first four months of 2022, the Aussie stock market, as measured by the S&P/ASX 200 Index, generated a positive return for investors while US shares, as measured by the S&P 500, fell more than 10%.

Past performance is not an indication of future results

Distant on the map yet so easy to invest in today!

To help investors gain exposure to the Australian stock market, eToro has created the AussieEconomy Smart Portfolio. This is a fully invested investment portfolio focused on top Australian companies.

Through this Smart Portfolio, investors can gain exposure to ASX-listed stocks in a range of sectors — including mining, oil & gas, financials, healthcare, software, and chemicals — with just one click. Holdings include BHP Billiton, National Australia Bank, Woodside Petroleum, CSL, and more.

You can find out more about this new Smart Portfolio here.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.