US companies are returning a considerable amount of capital to its shareholders via share buybacks at the moment. According to Goldman Sachs, annual S&P 500 buybacks are likely to top $1 trillion next year. So, what’s the rationale behind this capital allocation strategy? And more importantly, how can investors benefit from it?

Explore Our Buybacks Smart Portfolio

Understanding share buybacks

When a company has surplus cash on its balance sheet, there are many things it can do with the capital. Share buybacks — also known as share repurchases — are one option. An alternative to making acquisitions or paying dividends to investors, buybacks involve a company buying back its own stock from the marketplace. The aim is to reduce the number of shares in the company available for trading.

Why companies buy back their own stock

From a company’s perspective, buybacks have several advantages.

For starters, they can help to increase earnings per share (EPS). This is because they reduce the number of shares in circulation among which profits have to be split. For example, let’s say a company with $1 million in earnings and 1 million outstanding shares buys back 10% of its stock. Prior to the buyback, the company would have had earnings per share of $1; however, after the stock repurchase, EPS are $1.11.

Secondly, relative to paying dividends to investors, buybacks are a far more flexible way of returning capital to investors. Dividends typically represent a long-term commitment to paying regular cash distributions, which doesn’t always align with a company’s financial situation or strategic priorities. With buybacks, however, there is no pressure to continually engage in them — companies can simply repurchase shares when they have the cash available. This flexibility allows businesses to modify their strategies for returning capital to shareholders based on shifting business dynamics or emerging investment opportunities.

Buybacks can also help to offset dilution from stock-based compensation. These days, many companies allocate stock awards and options as part of their compensation packages. By executing buybacks, businesses can meet their obligations to employees and management without diluting current shareholders’ equity, thereby, aligning the interests of both groups. This factor is particularly relevant for technology companies, which tend to reward their employees with a lot of stock options.

Finally, buybacks are a signal of management’s confidence in the company’s future prospects. By repurchasing shares, management is signalling that the company has excess cash on hand that isn’t better invested elsewhere. It’s worth pointing out that companies often repurchase shares when they believe their stock price is lower than it should be. Here, management is essentially saying: “the stock is a bargain right now, and we’re going to take advantage of it.”

The history of buybacks

For much of the 20th century, share buybacks were actually deemed illegal because they were seen as a form of market manipulation. However, this all changed with the introduction of the US Securities and Exchange Commission’s (SEC) Rule 10b-18 in 1982. This rule offered companies a “safe harbor” for repurchases under certain conditions without the risk of being accused of market manipulation. The economic deregulation of the 1980s, along with a shift towards maximising shareholder value, further solidified buybacks as a favoured corporate strategy. In the late 1990s, buybacks saw a notable surge as companies flush with cash sought to deploy excess capital effectively. And the trend continued into the 21st century, with buybacks becoming a very common capital allocation tool among large corporations, particularly those in the technology sector.

Recent trends

As for recent trends, research by Wall Street firms shows that buybacks are on the rise. For 2024, Goldman Sachs is forecasting that total US buybacks will hit $925 billion, an increase of about 16% on last year’s figure1. Next year, it expects buybacks to top the $1 trillion mark for the first time. It’s worth noting that the bank believes the high levels of buybacks should be supportive for share prices.

Within the buyback market, the top participants today are mega-cap technology companies such as Apple, Alphabet, and Nvidia, which are all swimming in cash right now. However, companies in other areas of the market are also getting involved. For example, in October, defence and aerospace company RTX announced that it would repurchase $10 billion of its stock (this buyback is being funded by debt in a process known as a “leveraged buyback”), despite the fact that it was facing some issues with its aerospace engines. Investors are also seeing more participation in the buyback market from mid-cap and small-cap companies.

Looking ahead, the trajectory of share buybacks is likely to be affected by a number of factors including:

- Corporate earnings — stronger earnings tend to leave companies with more excess cash to deploy while weaker earnings can put a strain on cash flow.

- Market conditions — a market pullback could present companies with opportunities to buy back stock at more favourable prices.

- Corporate tax rates — higher taxes may necessitate a reallocation of resources, dampening buyback prospects. On the other hand, reduced tax rates could increase disposable corporate capital, potentially increasing buybacks.

- Regulatory considerations — debate over buybacks is intensifying and new regulations could potentially result in reduced buyback activity. Recently, the US introduced a 1% excise tax on buybacks exceeding $1 million, although this hasn’t had any negative impact on buyback activity. President Joe Biden has also proposed quadrupling the tax on corporate stock repurchases, however, this has yet to be officially announced.

Compared to other geographic markets, the US is the clear leader in buybacks today. However, there is a growing trend of increased buyback activity across Europe, Japan, and other markets. This suggests a potential global shift in corporate payout strategies.

How buybacks are executed

There are two main ways that a company can execute a buyback. The most common method is an open market repurchase of stock. Here, companies buy back their own shares at prevailing market prices over time, sometimes as part of a predetermined repurchase plan. The other way is via tender offers. This involves inviting shareholders to sell their shares back at a premium over the market rate within a specific period. Depending on the company’s financial strategy and objectives, repurchases can be financed through cash reserves, operational cash flow, or debt.

Note that for a company to legally buy back its own shares under the Companies Act 2013, it must ensure that the buyback is authorised by its articles of association, receive approval through a special resolution at a general meeting (or a board resolution if the buyback is 10% or less of the total paid-up equity capital and free reserves), and complete the buyback within a year from the date of passing the resolution. The post-buyback debt-to-equity ratio cannot exceed 2:1, and only fully paid-up shares can be repurchased. In addition, companies are prohibited from issuing the same kind of shares within six months post-buyback, except for bonus issues or to fulfil existing obligations.

The benefits for investors

For investors, the main benefit of buybacks is potential share price appreciation. We mentioned earlier that buybacks can increase a company’s earnings per share (EPS) over time. And, higher EPS can lead to an increased share price. Another way of thinking about this is that by reducing the number of shares outstanding, each existing share’s portion of the company’s profit increases, potentially making the remaining shares more valuable.

Another potential benefit is share price support during market downturns. One of the immediate benefits of a company initiating a buyback program is the arrival of a big buyer in the market. This increased demand for a stock can lead to short-term price support, providing a buffer against volatility.

Buybacks can also have tax benefits for investors. Unless you invest in a tax-advantaged account, dividends are usually taxable. However, when a company uses excess cash to buy back its own stock, it doesn’t create a taxable event for shareholders.

Explore Our Buybacks Smart Portfolio

Critics of buybacks

It should be noted that buybacks are not viewed favourably by all market participants. Some investors argue that buybacks can be a short-sighted strategy, and that firms should be using their surplus cash to invest in new products or expand into new markets — moves that could create lasting value for the company and its shareholders.

Then, there are dividend investors, who typically prefer to pocket dividends over receiving a capital return in the form of a share buyback. This is understandable. When a company pays a dividend, investors receive cash directly — a guaranteed return. However, when a company buys back stock, it doesn’t guarantee future returns.

Overall though, buybacks are generally viewed quite positively by investors.

Case study: Apple

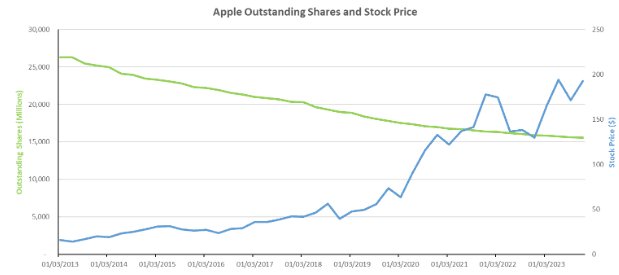

One well-known company that has been buying back a lot of its own stock recently is Apple. Between 2013 and 2023, the company spent about $600 billion repurchasing its own shares.

There are some investors who believe that this has not been the most optimal approach to capital allocation. These investors believe that the capital could have been used to fund acquisitions or new projects, in order to generate more growth in the future.

However, over the 10-year period leading up to the end of 2023, Apple’s share price rose roughly 850%, or 25% on an annualised basis, against annual net income growth of only 9%. This suggests that the buybacks have helped the performance of the stock and benefitted investors.

Past performance is not an indication of future results.

Past performance is not an indication of future results.

eToro’s Buybacks Smart Portfolio

To help investors capitalise on the share buyback boom, eToro has developed the Buybacks Smart Portfolio. This is a fully allocated portfolio focused on companies that are creating shareholder value by buying back large amounts of their own stock.

Centred on the US market, the Buybacks Smart Portfolio offers access to a diverse range of companies from different sectors including Technology, Healthcare, Consumer Goods, and Financial Services. Each company in the portfolio has been screened to ensure that it has attractive growth prospects, financial stability, good ESG credentials, positive analyst ratings, and strong historical buyback performance. The portfolio consists of 30 stocks in total, each weighted according to a sophisticated ranking model.

Through the Buybacks Smart Portfolio, investors can gain access to buyback kings such as Apple, Alphabet, and Meta Platforms — all of which have rewarded investors with massive buybacks in recent years.

You can find more information on this Smart Portfolio here.

Sources:

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.