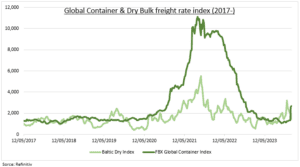

DISRUPTION: Memories of the 2021 global supply chain breakdown are quickly returning. But they are wrong. With Houthi attacks driving a 70% plunge in Red Sea container shipping volumes, against a backdrop of a drought-driven halving of Panama Canal capacity. This has seen a doubling of global container freight rates, lengthened transportation times, and rekindled inflation fears. But we see at least five big differences now. It’s much smaller, more localized, more specific, and with much weaker demand, and greater supply. Container shippers, from Maersk (MAERSKB.CO) to Hapag-Lloyd (HLAG.DE), should enjoy the gains whilst they can.

TRADE: Shipping accounts for around 80% of global trade and the disruption is real. But it should not be overdone by investors. Container rates have surged, but from low levels (see chart). 2021 saw the Fed’s global supply chain pressure index spike to four times long term average levels, with the average cost to move a 40ft container rose from under $2,000 to over $10,000. Whilst spot rates don’t reflect prices paid by most shippers on annual contracts. The disruption is now focused on China to Europe routes. 2021 kick-started an inflation shock that saw global price rises near triple to 8.7% in 2022, but with a much stronger demand backdrop.

DIFFERENT: This is not a repeat of 2021. Then saw an explosion of global consumer goods demand at the same time as unprecedented global supply disruption. Now the impact is 1) more localized to Europe, or around 25% of global GDP. 2) More specific to container freight, with little impact on bulk or air freight rates so far, especially with China commodities demand weak. 3) With very different demand, with the EU manufacturing PMI currently at a recessionary 44, and producer prices falling 9%. 4) The container freight industry is facing looming over supply, with new ships equal to around 25% of current capacity due for delivery over the next three years.

All data, figures & charts are valid as of 15/01/2024.