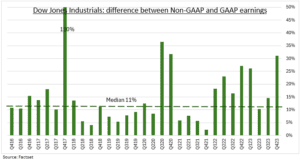

THE GAP: Company earnings are the most important stock price driver in the long term. And accounting is the ‘language of business’. All companies must report their earnings in line with ‘generally accepted accounting principles’ (GAAP). But companies may also report non-GAAP earnings as a supplement. And a high and rising 80% of the Dow Jones Industrials (DJIA), for example, do. And these exceed GAAP numbers by a huge 33%. Three times the 30-quarter median (see chart). It’s a mixed blessing. Often giving a clearer view of underlying performance. But can be misused. Signaling weaker earnings quality. And the no.1 source of SEC comments.

NON-GAAP: Most US companies choose to report non-GAAP measures. To give investors a more accurate picture of underlying earnings. Often excluding one-time events or non-operating items. Like a loss on an asset sale or effect of changes of foreign exchange rates. Measures such as adjusted earnings, core earnings, or EBITDA. Critics argue this can be abused, with no standard definition of these measures. They are often also used to drive executive pay. The SEC says these cannot mislead and need to be reconciled. Those DJIA stocks with the greatest non-GAAP divergence last quarter were Walgreens (WBA), Dow (DOW), and Verizon (VZ).

GAAP: All publicly traded US companies must report on a GAAP basis. These are set and periodically revised by the Financial Accounting Standards Board (FASB). So that company’s financial statements are complete, consistent, and comparable. The global equivalent is the International Financial Reporting Standards (IFRS). This is widely used globally outside the US. There are a number of presentational and calculation differences between them. With the FASB more rules-based and IFRS principles-led. Upcoming US accounting changes include how to calculate credit losses, on lease accounting, segment reporting, and crypto investments mark-to-market.

All data, figures & charts are valid as of 10/03/2024.