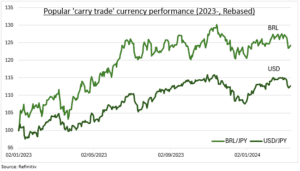

CHANGE: The ‘carry trade’ was a huge driver of currency returns in 2023. And has continued in 2024. With high yielders from the GBP to MXN the world’s top performers. But now faces twin headwinds. Of interest rate cuts in developed market G-10 and emerging market high-yielders, from US to Brazil. At the same time as the preferred low-yield funding currency, the JPY, faces its first interest rate hike since 2007. But the carry trade is down, not out. A push back in early rate cut expectations alongside 2-year lows in currency volatility has given a respite (see chart). Whilst carry rates remain attractive and other funding currencies, like CHF, are coming into view.

CARRY: The classic carry trade is to borrow money in a currency with low interest rates, like the JPY with its -0.1% policy rate. And invest in another with higher interest rates, like the BRL at 11.25%. Investors profit from the interest rate differential. And often from a strengthening of the latter currency, as it attracts inflows (see chart). The wide interest rate differential acts as a margin of safety for the investor. As well as helping to dampen currency volatility. Risks range from liquidity, with many emerging market crosses trading a tiny fraction of the $1.7 trillion daily of USD/EUR. To intervention, with only 31 of the world’s currencies classified as freely floating.

TODAY: 2023 was a banner year for carry, with total returns (interest and currency) as high as 40% for popular carry trades like MXN/JPY. Carry saw a new lease-of-life this year as rate cut expectations have been delayed. But we are near a tipping point. With midyear rate cuts coming from the Fed and ECB. At the same time as the world’s favourite funding currency, the cheap JPY, sees its first rate rise since 2007. But opportunities remain. The Swiss National Bank is leaning toward an early rate cut, that would make CHF a more attractive funding alternative. Whilst G-10 high-yielders GBP and NZD will be among the last to start cutting interest rates.

All data, figures & charts are valid as of 13/03/2024.