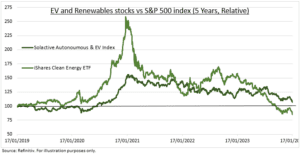

HALF-FULL: The Q4 boost to renewable and EV stocks was short-lived, from the COP 28 climate summit and investor ‘pivot party’ to laggards. Underperformance has resumed (see chart) with familiar headwinds of demand concerns and high interest rates alongside some new self-inflicted wounds. Tesla, the most held stock by retail investors, got off to the worst start to the year of all autos. These segments still have potential to be high risk zero-to-hero winners of the year. Valuations been transformed by price plunges in recent months. Demand still growing fast, with a long and visible runway. Whilst interest rate cuts are coming. @RenewableEnergy.

EV’S: The segment has been hit by combo of EV demand slowdown and affordability concerns and ramping Chinese exports. Car rental giant Hertz (HTZ) slashed its EV offering given poor customer demand and high maintenance costs. Whilst Tesla (TSLA) cut prices in China and Europe to boost demand. And added self-inflicted pain as Musk raised corporate governance and board concerns. We think the EV investment glass-is-half-full. Battery costs have fallen, alongside plunged lithium prices. Global EV growth is set to be over 30% this year, led by US off its low base. And the long-term upside clear with EV’s <3% of the global installed vehicle base.

RENEWABLES: They are caught in a vice of high interest rates, solar over-capacity, and wind cost overruns. With nuclear a rare bright spot as uranium (SRUUF) soars. Renewables growth remains large and runway long. The world saw 50% renewables capacity growth last year. Only a fifth the total energy mix is from renewables. The IEA sees a 2.5x growth in renewables capacity by 2030, with the world on track to install more renewables in the next five years than all-to-date. Similar to EV’s, China is the renewables powerhouse, at 60% of total. The US dominates capital markets but is the sector laggard, and this often clouds investor opinions.

All data, figures & charts are valid as of 18/01/2024.