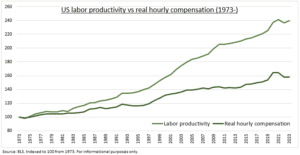

PRODUCTIVITY: The US has seen a process of ‘immaculate disinflation’. With the economy and labour market staying resilient even as inflation has plunged. This has confounded skeptics expecting recession and helped push the S&P 500 back into a bull-market. The biggest unsung driver of this has been the recent doubling of US productivity growth. This is the only ‘free lunch’ in economics. With raised output-per-hour (see chart) driving the economy and allowing higher wages, without adding to inflation pressures. And also contributing to an idiosyncratic earnings recovery, that is one of the two pillars of our bull market outlook alongside coming rate cuts.

DATA: Labour productivity, or output per hour, rose at an annualized 3.2% in Q4 last year. This was its third quarterly rise over 3% and double the long-term average. And comes after the biggest annual decline on record in 2022. There is skepticism that this rebound will last. That the data is often significantly revised and we are still working though pandemic disruptions. This could see a return to the hard trade-offs of a more typical business cycle. If not, the upside is to a ‘roaring 20’s’ of a post-pandemic, or Spanish flu, boom. As a tight labour market forces companies to boost productivity, leveraging the new tech and work-from-home tools they have.

IMPACTS: Wage growth has seemingly driven more investment in tech, automation, and training, as companies seek to boost efficiency. With business investment resilient even as interest rates soared. And alongside a big step up in government industrial policy stimulus for semiconductors, infrastructure, and renewables. Hope is this eases the long-standing ‘productivity paradox’ of greater tech adoption not translating to measured productivity growth. This is helping explain rising S&P 500 profit margins, despite slowing sales growth, with labour the biggest expense for most firms. Though with a big difference between winners and losers.

All data, figures & charts are valid as of 08/02/2024.