As Brits contemplate an inevitable economic downturn due to Covid-19, many have started to explore how best they can grow their personal finances to safeguard their future. One of these ways is through making investments.

With Brits starting to evaluate different investment options, many are undoubtedly turning to the internet to provide them with guidance and knowledge on how best to invest.

Interested in the most popular financial investments, eToro.com researched Google AdWords to discover which alternative investments Brits are most frequently inquiring about online during Covid-19, as well as traditional investments.

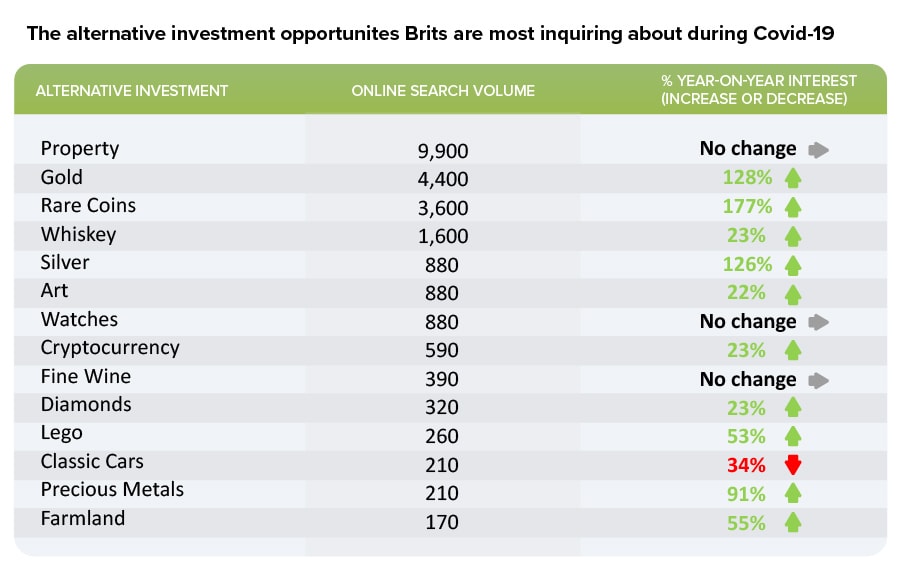

Alternative investments of interest during Covid-19

Property is the alternative investment that Brits are most looking into during the Covid-19 crisis, with 9,900 online searches last month (May 2020).

Gold is another strong non-traditional investment that Brits are contemplating, with 4,400 online enquiries in May and a 128% increase in year-on-year interest.

In third place is investment in rare coins. It appears that Brits have become even more intrigued as interest has increased by 177%, making it one of the most searched for investment opportunities.

Adam Vettese, analyst at eToro, comments: “While it is no surprise that property remains in the top spot, the surge in interest in gold and precious metals demonstrates investors desire for perceived ‘safe haven’ alternatives amid uncertain times.”

Alternative investments: regional breakdown

Property is the alternative investment that those living in North West, West Midlands, London and South West are most paying attention to during lockdown.

Renowned for their whiskey, it is perhaps unsurprising that Scots are thinking about purchasing premium collectable whiskey in the hope it will yield favourable returns in the future. Similarly, alcohol in the form of fine wine is being investigated as a serious investment opportunity by those in the South East and East Midlands.

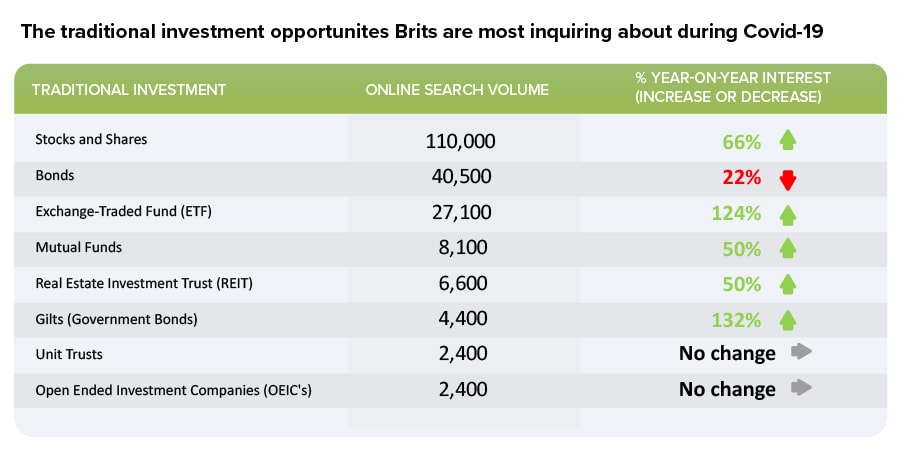

Traditional investments of interest during Covid-19

eToro found that stocks and shares are the traditional investment that Brits are most curious about with 110,000 online searches in May 2020.

This represents an 66% increase in interest compared to the same time period last year (May 2019).

Bonds were the second most explored traditional investment, generating 40,500 online searches. This is equivalent to 1,306 online searches for each day.

In third position are exchange-traded funds (ETFs). Online searches for ETFs in May 2020 amounted to 27,100, a colossal 124% rise from the same period last year.

“With many stocks available at discounted prices due to the Covid-19 induced market volatility, many British investors have been on the hunt for a bargain. The decline in interest in bonds corresponds to the sliding yields that are available at the moment for fixed income investments” says Adam Vettese, analyst at eToro.

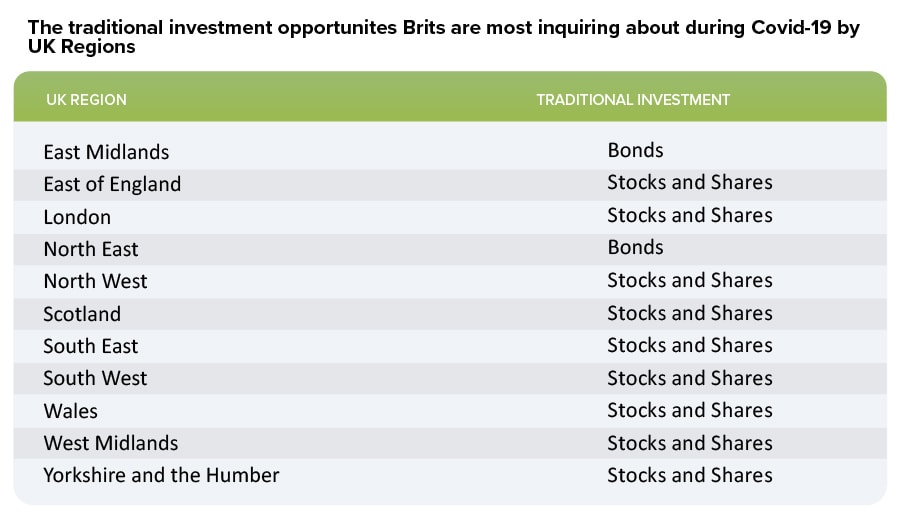

Traditional investments: regional breakdown

eToro found that stocks and shares seem to be the most sought-after traditional investment option in nine regions: East of England, London, North West, Scotland, South East, South West, Wales, West Midlands and Yorkshire and the Humber.

On the other hand, bonds are the most desired traditional investment opportunity in East Midlands North East.

Traditional investments explained

Stocks and shares

Stocks and shares are two names for the same thing. They represent the ownership of a proportion of a company and are typically bought/sold on a stock market. In some instances, a holder of shares is entitled to a fraction of a company’s profits paid out in the form of dividends, usually equivalent to how many shares they own.

Bonds

Bonds can be issued by companies or governments to investors when they want to raise money. The investor then receives a scheduled set of future payments. The market value of a bond fluctuates over time as the bond becomes more or less appealing to potential buyers.

Gilts (Government bonds)

Gilts are units of debt issued by governments when they need to raise funds for public spending. By buying gilts, you are lending money to a government, who in turn agrees to pay you back the full amount at a set date, along with any interest owed.

Exchange-Traded Funds (ETFs)

An exchange-traded fund (ETF) is an opportunity to invest in a wide range of bonds or shares in one package. ETFs generally track a specific market. ETFs are traded on the stock markets.

Mutual Fund

A mutual fund is a pool of investment where an investor’s money is put together with other investors’ money to purchase shares of a collection of stocks, bonds or any other securities. Mutual funds are typically managed by a portfolio manager.

Real Estate Investment Trusts (REIT)

Real Estate Investment Trusts (REITs) are companies that own, operate or finance income-producing real estate. REITs give investors a chance to own real estate. REITs own a range of commercial real estate that includes offices, hospitals, shopping complexes, warehouses and hotels.

Unit Trusts

A unit trust is an open-ended group investment product, where there is no limit on how much can be invested or how many people can invest in it. Units trusts are popular because they are created for everyday people earning normal salaries.

Open Ended Investment Companies (OEICs)

An open-ended investment company (OEIC) is a professionally managed group investment scheme that pools an investor’s money with other investors to invest in stocks, bonds and other securities.

If this blog post was of interest, why not get involved and understand the investment basics for yourself?

Methodology

eToro used a combination of reputable online tools such as SEMRush, Google Trends and Google Adwords to analyse thousands of online queries in the UK related to investments and from this, identify the traditional and alternative investments which generated the most online interest in May 2020.

Your capital is at risk

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.