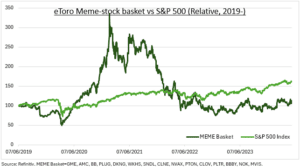

MEME: The faded loss-making consumer-focused meme stocks of 2021, from GameStop (GME) to AMC Entertainment (AMC), are rallying again. We see some similarities with the 2021 surge and examine how it could continue. With financial conditions looser than perceived and retail investors more important than ever. But we think it’s fundamentally different this time. And with investors once bitten twice shy. Our basket of the favourite 2021 meme stocks (see chart) is down by two-thirds since, and many a lot more. Retail investors still meaningfully own GME and AMC from those heady days, but recent platform activity seen sensible selling not buying.

DIFFERENT: This time it is different. The pandemic lockdown is over. Excess consumer savings are largely long-spent. Investor sentiment measures are lower. Short positions in these stocks are much smaller (though not small). Interest rates are much higher. Whilst broader indicators of investor euphoria are not responding to anything like the same degree, from crypto assets to ARK Innovation (ARKK) disruptive tech stocks. Even the MEME ETF had shut down for lack of interest. We think investors have largely learnt the lessons and taken the losses from 2021. And many moved on. Whether to the big recent rally from artificial intelligence stocks or from Bitcoin.

SAME: Could we be wrong? Retail investors are more important than ever. There are more of them. They own more stocks. And they use more social media. The number of r/wallstreetbets subscribers has grown to over 14 million from the 9 million level in 2021. And price momentum remains typically the most powerful investment style in finance. There is also a lot of cash on the sidelines. And many who have missed out on the early stages of this new bull market. Whilst these remain relatively small stocks. Where a little bit of new money goes a long way. And there are always a small minority of investors, retail and professional, prepared to do foolish things.

All data, figures & charts are valid as of 15/04/2024.