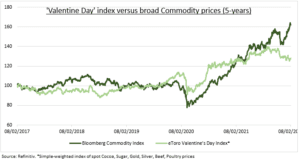

RARE RELIEF: Commodity prices are up 10% so far this year, for one of their best starts ever. We think this has further to go, with demand strong, supply tight, and inflation concern high. But not all prices have soared. Our ‘Valentine’s’ commodity price index has bucked the inflation surge and is flat versus last year. This is a relative bright spot for squeezed romantic consumers, and shows the commodity rally still has room to broaden.

VALENTINE INDEX: Our index is a proxy for common Valentine’s expenditures, like candy, jewellery, and a meal-out. We simple-weight cocoa, sugar, silver (SLV), gold (GLD), beef and poultry commodity prices and compare to the broad Bloomberg index (DJP) of 23 commodities. This shows a 1% gain vs the 30% one-year gain for the broad index. Commodities is a heterogeneous asset class, and its rally room to broaden further.

ROMANCE & RE-OPENING: US Valentine Day spend is estimated at $24 billion this year, or a romantic 10% higher than last year, to $175 each. Less romantically, 48% say they will not be celebrating. Most popular spending items include candy (56%), flowers (37%), and jewellery (22%). Bullishly, ‘re-opening’ activities like an ‘evening out’ (24%) and ‘experiences’ (41%) – concert or sports events – rebounded. 8% want crypto! Related stocks range from Hershey (HSY) to 1-800-Flowers (FLWS) and Richemont (CFR.ZU).

All data, figures & charts are valid as of 09/02/2022