VOLATILITY: Friday is one of the highest market volume days of year with ‘quadruple witching’ futures and options (F&O) expiry. This has become even bigger as retail-driven options activity has surged. It also comes at the end of a hectic week of Central Bank meetings and before Christmas holidays. We see more volatility, but little lasting impact.

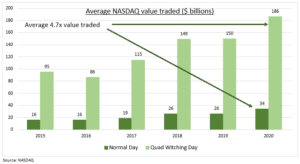

WHAT IS IT: The third Friday of March, June, September, and December see’s stock index futures and options, and individual stock futures and options, all expiring together. This drives a lot of portfolio rebalancing, contract rollovers and expirations. This quadruple expiration drives the highest equity traded volume days of the year, with an average near five times a normal day (see chart), and often more market volatility.

MORE IMPORTANT: Futures and options activity has soared. The volume of global exchange-traded derivatives has risen 39% this year versus last. This has been led by a 47% increase in equity indices and 43% in individual equity derivatives. Much of this has been driven by the rise of retail investors. There is little evidence quadruple witching sees weaker markets on the day itself, but some for modest weakness in the following week.

TODAY: After yesterday’s Fed relief, BoE is in spotlight with ECB. The BoE is caught between stronger than expected 5.1% inflation and omicron-led growth fears. Market is pricing a 100% chance it is the first major bank to raise rates at its February 3rd meeting.

All data, figures & charts are valid as of 15/12/2021