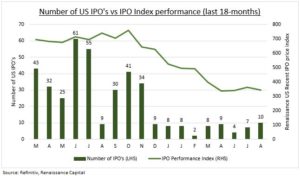

WINTER: It’s been a terrible year for new stock market listings and their performance as equities plunged into a bear market. The number of US IPOs is down 80% (see chart) this year. Only $18 billion has been raised versus $230 billion last year. The Renaissance IPO index of recent listings is down 45%, double the S&P 500 fall. The IPO winter stalled the ‘re-equitisation’ of US markets that was reversing the two decade fall in listed stocks. But it does provide some needed market support today. By curbing new stock supply even as the largest share buybacks source of demand continues near records. The IPO winter is now thawing a little. We saw the biggest US listing of the year this week, and Porsche is attempting one of Europe’s largest ever.

OUTLIERS: There have been some hardy IPO outliers. Corebridge Financial (CRBG) listed Wednesday, as the carve out of AIG’s (AIG) retirement and life insurance business. Its $1.7 billion raise was the largest of the year and biggest since the TPG (TPG) IPO back in January. There have also been pockets of IPO craziness. The July US IPO of loss-making AMTD Digital (HKD) saw it briefly hit a peak market cap of $450 billion, the size of a top-10 S&P 500 stock.

PORSCHE: Auto giant Volkswagen (VOW3.DE) imminent listing of luxury maker Porsche hopes to buck the IPO drought. To emulate the success of Ferrari’s (RACE) spinout from Fiat, which quadrupled in price in six years. And avoid fate of Aston Martin (AML.L), down 95% since listing. A $85 billion value would make one of five largest carmakers, and give funds for its parent’s EV investments and a big dividend. It could be Germany’s largest IPO, ahead of Deutsche Telekom’ (DTE.DE) $13 billion in 2013, and near Europe’s record $17 billion by Enel (ENEL.MI) in 1999.

All data, figures & charts are valid as of 15/09/2022