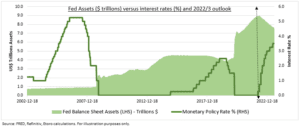

EXPECTATIONS: Markets are braced for the first 0.5% Fed rate hike in over two decades. Investors are pricing a hawkish interest rate peak of 3.50% mid next year, and a $95 billion/mo run-down of the Fed’s massive $9 trillion balance sheet (see chart) as it catches up the inflation surge. This is a double-barrelled tightening, with higher policy interest rates and also the balance sheet shrinkage pushing up long term bond yields. We see markets as sensitive to any ‘less bad’ signs in coming weeks from peak inflation or Fed tightening, with much already priced in. This would ease the Fed vice on markets, with its pressure on valuations and rising recession fears.

REACTION: These financial conditions have tightened in the US and abroad, doing some of the Fed’s work for it already. Equity markets are in ‘correction’ territory, real yields are positive, 30-yr mortgage rates over 5%. Whilst inflation expectations tentatively easing from high levels above the Fed 2% target, and inflation rates topping out at near 8.5%. We think we are close to peak inflation rates and peak fear of the Fed, though we have clearly been surprised so far!

MARKET: An ever tightening Fed and higher bond yields has been eating into the present value of future cash flows, and pressuring valuations. These have fallen sharply to below 5-year average levels but our ‘fair value’ indicator shows more risk. A focus on Value stocks versus Growth remains the main defence here. Earnings growth has been a key, but insufficient, offset to this. We also focus on ‘defensives’ with the most robust outlook to market recession fears.

All data, figures & charts are valid as of 04/05/2022