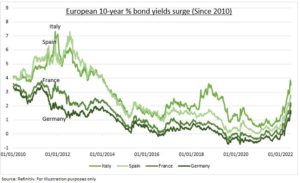

FRAGMENTATION: The ECB is ready to hike interest rates but faces much greater risks than the Fed. One of the biggest is ‘fragmentation’. By raising interest rates to combat 8.1% inflation it risks triggering financial instability driven by tension of EU’s one-size-fits all interest rate, and currency, vs distinct country situations. Government funding costs, proxied by 10-yr bond yields (chart), have soared, forcing ECB to accelerate ‘anti-fragmentation’ plans. This could help cut risk of a yield blowout like seen 10-yrs ago, give the ECB room to raise interest rates, underpin EUR, and give relief to hard-pressed eurozone (EZU) equity valuations. See @EuropeEconomy.

CORE vs PERIPHERY: The differing realities are seen in divide between so-called ‘core’ north economies like Germany, France and ‘peripheral’ southern economies like Italy and Spain. The Eurozone’s largest, Germany, has a government debt/GDP of 70%, unemployment at 5%, and a per capita GDP of $50,000. Its 3rd largest economy, Italy, debt at 150%/GDP, unemployment of 8.4%, and GDP per person 30% lower. These differing risks drive the sensitivity to higher rates.

IMPLICATIONS: Italian equities have borne the recent brunt of rising fragmentation fears, falling sharply. This is despite already being among Europe’s cheapest at under 9x forecast earnings, from utility Enel (ENEL.MI) to oil ENI (ENI.MI) and bank Intesa (ISP.MI). But economies are not stock markets. German equities (EWG) has performed as poorly as in Italy this year, given its large overseas and Russia-Ukraine exposure. Whilst ‘peripheral’ market Spain (ESP35) is one of global best performers, benefitting from its reopening tourist economy and LatAm exposure.

All data, figures & charts are valid as of 28/06/2022